Sydney housing prices will rise by as much as 9 per cent in the next 12 months and reach record highs, according to a forecast report by Domain.

The property market across Australia generally is in a strong recovery phase and prices will continue to rise throughout the next financial year, the report shows.

House prices in Sydney, Adelaide and Perth will post the biggest gains and hit record highs, with unit prices in Brisbane, Adelaide and Hobart also potentially smashing records.

Domain’s report says the markets in those cities may fully recover from the 2022 downturn by this time next year.

“We’ve already started to see prices rising this year and we’re expecting that to continue, but we’re expecting the recovery to be slow and steady,” Domain chief of research and economics Dr Nicola Powell said.

“Sydney is set to be the one outperformer with the strongest rate of growth, but there will be a lot of different dynamics going on with both push and pull factors, which can have very different impacts,” Powell said.

“The biggest factors, however, are the continuing lack of supply of homes on the market and the rise in population, especially with the boost in migrant numbers to relieve skill shortages.”

The country’s second biggest city is expected to see sluggish growth. Housing prices in Melbourne are forecast to grow by up to just two per cent, while the price of apartments will continue to fall by about the same amount.

Domain says unit prices, generally, are expected to have more modest growth than houses.

Even at the upper forecast of 2 per cent, Melbourne will recoup about one-third of the value lost during the downturn, making it the slowest recovery in the past 30 years.

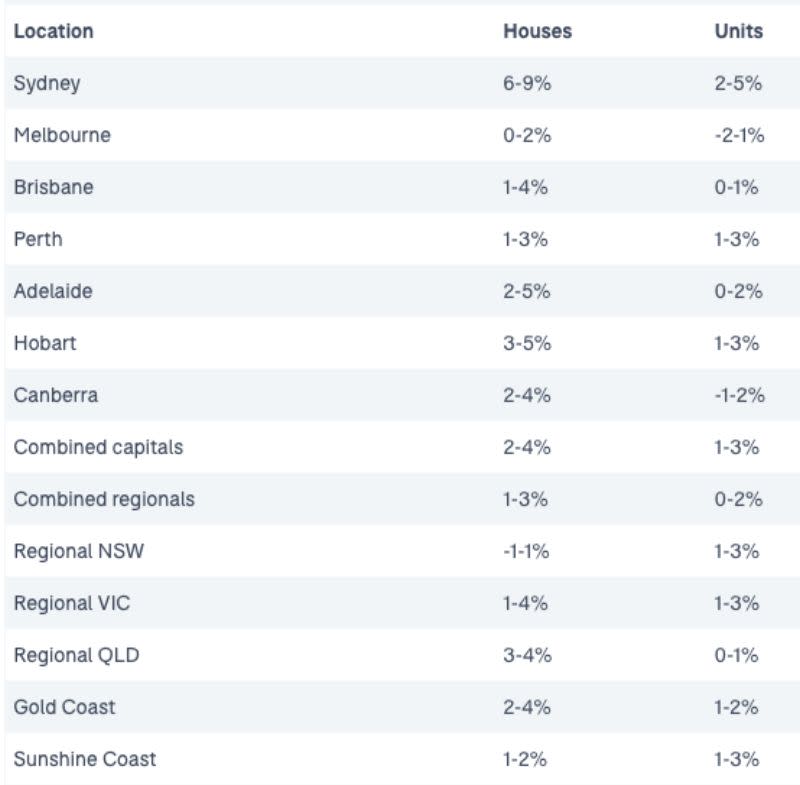

House and apartment price forecast for the next 12 months

Adelaide and Perth house prices are also forecast to rise slowly and may avoid a downturn but see a period of modest or sideways growth.

At a 6 to 9 per cent growth rate, Sydney’s median house price will sit between $1.62 million and $1.66 million, surpassing the previous $1.59-million peak set in March last year. The 2022 downturn was the steepest Sydney had ever experienced, with house prices falling 9.6 per cent from peak to trough over three consecutive quarters.

Brisbane’s forecast growth of one to four per cent by the end of the new financial year would see house prices at a near record high, just below the median price of $858,511 reached half-way through 2022.

Hobart house prices are expected to grow 3 to 5 per cent.

Regional house and unit prices will increase modestly over the coming financial year, with house prices expected to outperform units.

National president of the Real Estate Institute of Australia Hayden Groves welcomed the report, saying he remained optimistic on prices and anticipated they would continue to rise over the next 12 months.

“As completions of the ‘peak-COVID’ construction boom begin to filter through, much needed supply will come into the market which should, in turn, release rental stock because many of these newly completed homes will house people coming out of the rental pool,” he said.

“However, with supply well below what is required to house the pending influx of new Australians arriving here, underlying demand will continue to drive up home prices and rents for the immediate term, despite the current higher interest rate environment.”

Population growth—largely through increases in international migration—is likely to drive higher demand and higher prices for housing, the report says.

Further, headwinds in the construction industry over the past few years—skills shortages, supply chain disruptions, and rising construction costs—have led to an industry-wide slowdown, again fuelling potential house price rises.

“Affordability will eventually contain the rate of growth with people able to borrow less and being unnerved by higher inflation,” Powell said. “So, while it won’t be smooth sailing, the outlook is much more optimistic.”