New Home Loans, Approvals Hit High

The value of new home loan commitments for housing increased by 5.9 per cent in September, according to the latest Australian Bureau of Statistics figures.

This is due to low-interest rates and government initiatives putting the value of owner-occupier loans up 6 per cent to $17.3 billion, as the upward trend continues, for now.

“Approximately half of the rise in September’s owner-occupier housing loan commitments was for the construction of new dwellings, which rose 25.3 per cent,” ABS head of Finance and Wealth, Amanda Seneviratne said.

“Owner-occupier housing loan commitments are at historically high levels.”

Seneviratne said the value of owner-occupier home loan commitments rose in all states except Victoria and Tasmania.

“The fall in commitments for existing dwellings in Victoria was partly offset by a rise in commitments for construction of new dwellings.”

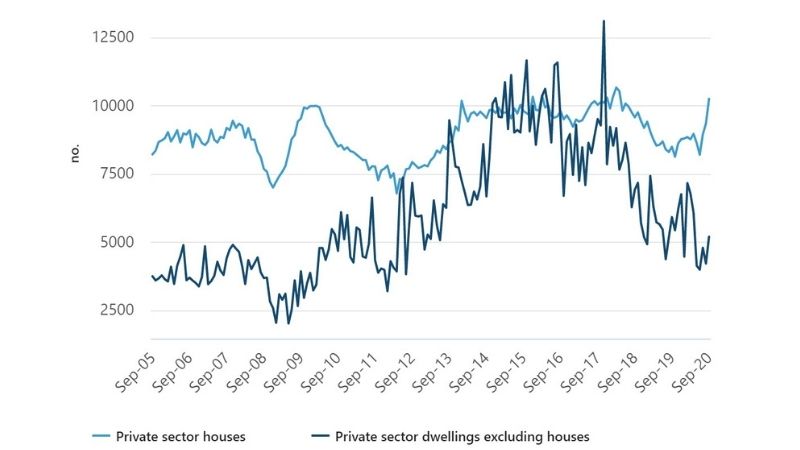

Meanwhile, building approval figures strengthened in September with national total dwellings rebounding 15.4 per cent in seasonally adjusted terms, with 15,827 approvals.

Unit approvals are up 23.4 per cent and private sector homes 9.7 per cent in the September ABS results.

Across the states and territories dwelling approvals rose in Western Australia (42.6 per cent), South Australia (28.3 per cent), Queensland (19.3 per cent), Tasmania (18.8 per cent), Victoria (12.4 per cent) and New South Wales (4.6 per cent).

House, unit dwelling approvals

^ Source: Australian Bureau of Statistics, Sept 2020 seasonally adjusted

HIA chief economist Tim Reardon said the result was the highest for new home construction since the ABS commenced collection of this data in 2002.

“The ABS also released its building approvals data—a more lagged indicator of future building work—which shows the third-strongest month of approvals for detached houses in the past 16 years,” Reardon said.

“We do not expect this to be the peak of the cycle.

“Based on the strength of new home sales in September, we expect finance approvals and building approvals to continue to be strong next month, before the positive impact of HomeBuilder starts to slow.”

Property Council of Australia chief executive Ken Morrison said the data shows the stimulus works, is supporting jobs and should be extended.

“As successful as this measure has been, housing construction is still facing a second cliff in 2021 as flat population growth kicks in.

“It would make a lot of sense to extend HomeBuilder to the end of the financial year to keep this momentum going until net overseas migration can return as a traditional driver of activity,” Morrison said.

Meanwhile, non-residential approvals are down 36.7 per cent and business construction loans are down -47.3 per cent on last year.

However, activity looks to be changing in this area, with $2.06 billion in new business construction loans or a 57.2 per cent increase for September.