New Online Marketplace Offers Real Estate Funding Alternative

Changes in Australia's banking sector has led to a rise in demand for alternative funding sources.

This has led to a fragmentation of the marketplace for commercial real estate funding with borrowers typically unaware of these alternative funding solutions.

The availability of project funding is one of the most crucial factors driving activity in new development, particularly for private developers.

APRA's restrictions, coupled with the recent Banking Royal Commission, led to a rush of non-bank financiers filling the void and provided a much-needed injection of liquidity into the sector.

However, transactions are often undertaken inefficiently and lack transparency, which leads to increased lead times and further uncertainty.

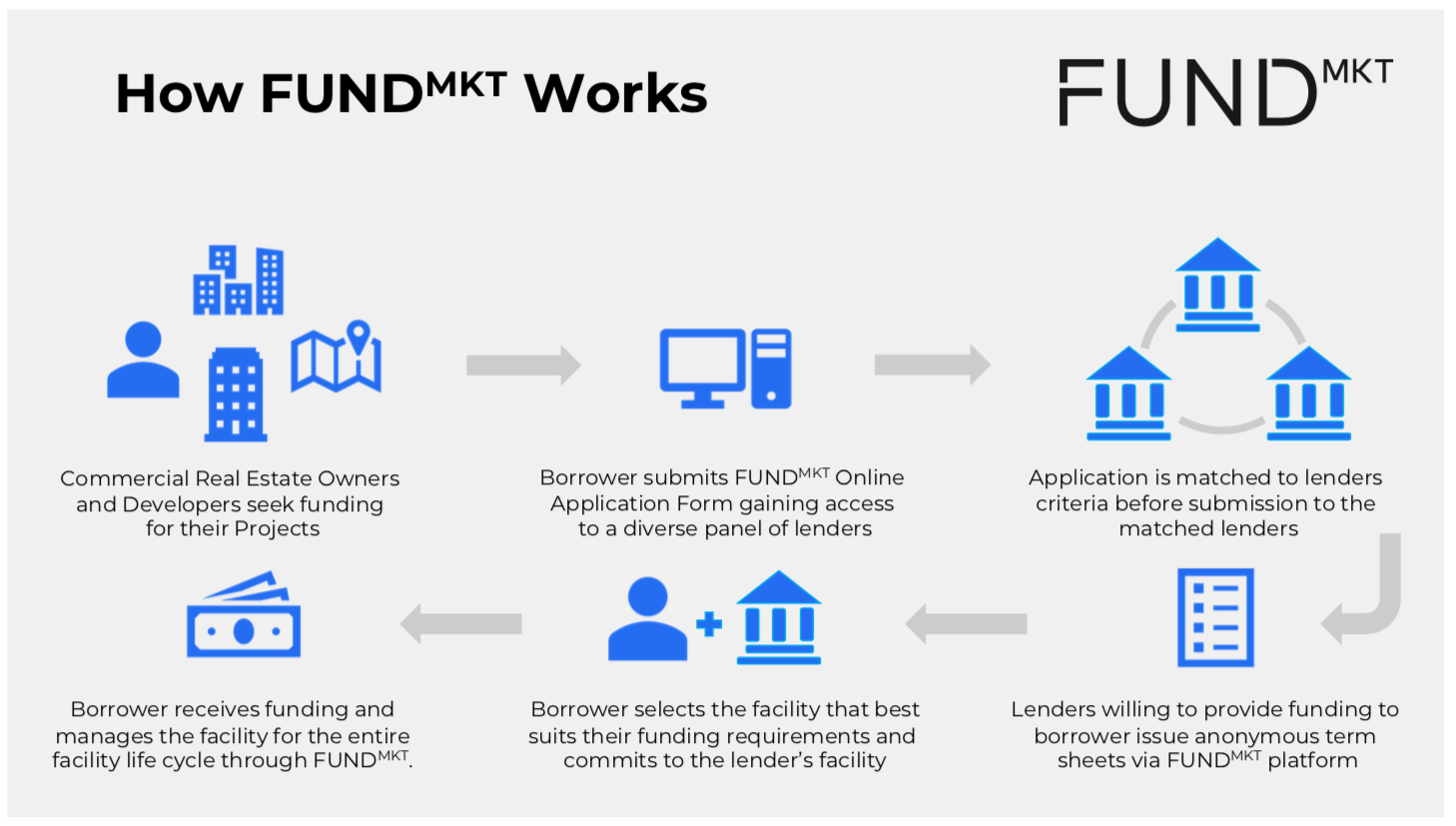

FundMKT is redefining the way in which funding is sourced in the commercial real estate industry.

“Coming from a development and funds management background, FundMKT was established in direct response to the credit squeeze in order to increase access to commercial real estate funding,” FundMKT co-founder Rowan Pollard said.

By leveraging technology FundMKT has created an online marketplace where borrowers and lenders can procure and manage their funding requirements in a secure, transparent and efficient platform.

The first end-to-end marketplace of its kind in Australia, FundMKT provides access to the full capital stack including equity, mezzanine, construction funding and commercial real estate investment loans.

“We provide access to a diverse panel of over 160 commercial real estate financiers which, in turn, provides the best opportunity to borrowers to obtain funding for their projects in a timely and cost efficient manner,” Pollard said.

Through a single online application, FundMKT

provides borrowers access to a network of bank,

non-bank and alternative lenders helping to

reduce repetitive and time consuming processes.

“FundMKT really allows the borrower to retain control of the funding process and assess all opportunities side-by-side to select the best outcome,” Pollard said.

The platform provides accountability throughout the facility management process all while giving the borrower transparency throughout the whole process.

“All commercial real estate funding requirements are unique and therefore require a tailored funding solution.

“FundMKT's algorithms match the borrowers key requirements with each financiers funding criteria thereby ensuring that applications are only submitted to matched financiers that are willing to assess the opportunity, providing borrowers with the best ability to secure funding,” Pollard said.

Register now to find the right funding solution for your next project.

The Urban Developer is proud to partner with FundMKT to deliver this article to you. In doing so, we can continue to publish our free daily news, information, insights and opinion to you, our valued readers.