Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeCommercial real estate focused on the life science sector is booming on the Gold Coast as the Queensland government announces the city as a major investment site.

Development is expected to contribute a projected 80,000 new jobs and a $11-billion-per-annum economic windfall for Queensland over the next decade.

Lumina is the Gold Coast Health and Knowledge Precinct’s final development stage, and the only opportunity left to secure premium, development-ready commercial land, or lease space, at the heart of this thriving life-science community.

Dr Chris Davis is general manager of the Institute for Glycomics at Griffith University, and an established member of the Lumina community.

He said he see big benefits in the development for life sciences organisations, and spoke of his passion for seeing pioneering research translate into new medicines, vaccines and diagnostic technologies that are changing lives across the world.

“Lumina is growing the precinct sustainably by progressing new public and private developments. We've got great science, outstanding clinical expertise, and all the facilities and resources to keep nurturing entrepreneurship,” Davis said.

It's an exciting time as the Lumina community welcomes new entrants, curating the ideal collaborative community for life sciences.

Here are four reasons investors are securing the remaining opportunities in Lumina.

The life science industry encompasses the pharmaceutical, biotechnology, medical equipment, food science, and healthcare sectors.

The federal government is actively encouraging growth across the sectors, launching a range of policy measures and incentives to support life sciences organisations.

These have included the $206-million Patent Box Scheme, the $2.6-billion Medical Research Futures Fund, and Research and Development Tax Incentives of 43.5 per cent refundable offset for eligible entities.

The Queensland government is also focussed on driving innovation, with an Advance Queensland program of $755-million investment in the innovation economy the past six years.

In addition, Queensland’s Biomedical 10-year Roadmap and Action Plan is a $5.7-billion investment in science, research, development, and innovation, along with fostering key international alliances that position Queensland as a globally competitive APAC biomedical hub.

Properties of interest for life sciences companies typically include sophisticated laboratories for research and development (R&D) activities, research hospitals, universities, corporate offices, logistics and storage, IT, and manufacturing facilities.

With booming growth in the sector under way, those who are investing in developments to house these organisations are set for excellent occupancy rates.

Australia’s life sciences real estate industry is expected to nearly double in value to $24 billion over the next decade, according to CBRE’s recent A New Era of Growth in Life Sciences report.

While commercial property deals were previously dominated by owner-occupier companies like global pharmaceutical giants, there are now large investment groups driving competition for commercial spaces.

Australian property trust Charter Hall earlier this year finalised the $106-million purchase of Melbourne’s GlaxoSmithKline campus, and Dexus Property acquired a large-scale life science asset in Melbourne’s premier Biomedical Precinct for just under $140 million in May.

In July, Home Consortium (HomeCo) purchased the unbuilt eight-storey Proxima building from developer Evans Long in an acquisition worth $80 million.

Proxima, which is set to become a paediatric centre within the 9.5ha Lumina science, health and technology development, will include in-house and be in close proximity to paediatric R&D in progress at Gold Coast University Hospital, Griffith University, and other allied paediatric health services tenants.

Investors are banking on the growth in value, and the return on investment from buy and lease-back or leasing of specialised life sciences spaces in a competitive market.

Around the world and across Australia, innovation hubs are bringing government, research and industry closer together to attract talent, capital, and deliver new business, jobs, and export opportunities.

The recently released Queensland Innovation Places Strategy discussion paper identifiesd the Gold Coast Health and Knowledge Precinct as one of its ‘engines’ for economic growth.

The establishment of the Gold Coast Health and Knowledge Precinct itself was a $5-billion state government infrastructure investment.

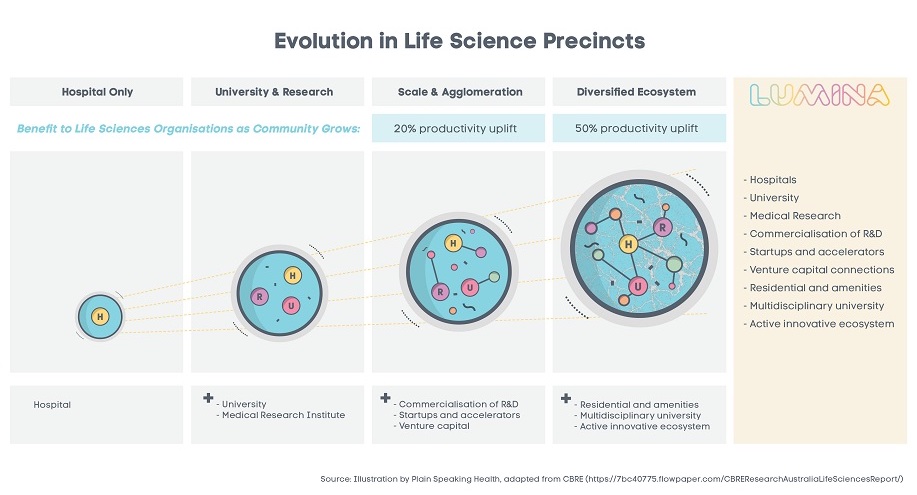

The concept of the Precinct, and particularly Lumina, was to bring together a connected community of life sciences organisations, including hospitals, a university, sophisticated laboratories for R&D activities, corporate offices, innovation acceleration spaces, commercialisation support and links with venture capital.

New light rail connections to the Gold Coast transport network, along with road upgrades and Gold Coast Airport expansion, further improve access to the precinct for local, national and international stakeholders.

The recent CBRE report has linked this type of co-located community with a significant uplift in overall productivity, up to 50 per cent greater productivity as the hub reaches maturity.

This is great news for the organisations residing there and a key advantage for those wanting to promote their commercial spaces.

A potential barrier to growth in life sciences is the limited supply of greenfield sites.

However, even if there is space, it’s not an easy process, according to CBRE’s James Jorgensen.

“To analogise with the kinds of constraints we see in the traditional industrial real estate sector, two of the major hurdles are planning and zoning issues,” James said.

“We’ve still got land supply in Melbourne, but zoned land is fast running out. For anyone, developers or occupiers, wanting to convert unzoned land into zoned land for life sciences facilities, it is a fairly protracted and risky process, which further complicates the issue.”

As an alternative, some investors considered refitting older industrial properties, however, these types of developments can lack the technological sophistication of the new purpose-built facilities, particularly in precinct developments.

Lumina offers life sciences investors and organisations the last development-ready land opportunities within the Gold Coast Health and Knowledge Precinct, along with other opportunities, from purchase or leasing purpose-built spaces for R&D, innovation laboratories, all the way down to co-working desks for start-ups.

The Urban Developer is proud to partner with Lumina to deliver this article to you. In doing so, we can continue to publish our daily news, information, insights and opinion to you, our valued readers.