NSW to Clean Up Infrastructure Taxes, Spending

The clean-up of NSW property taxes continues with 29 recommendations for change in the Review of Infrastructure Contributions final report.

The report aims to improve infrastructure while enabling more efficient development and supporting housing affordability.

The recommendations set out where infrastructure costs should be recovered from developers or landowners and where governments should rely on other sources of funding.

The priority reforms ensure charges can be properly factored into feasibility studies prior to rezoning and introducing landowners contribution when an area is rezoned—to be paid on sale or the development application of a site.

Also, developers should not have to pay council contributions until their project gets a certificate of occupation and the government needs to be more transparent on how much money is collected and where it is spent.

According to the review, these reforms could provide the state economy $12 billion over 20 years, improve services, lower house prices and create jobs.

NSW Productivity Commissioner Peter Achterstraat said the review has found the current infrastructure contributions system is not fully enabling the state and councils to provide the infrastructure required to support development.

“Previous attempts at reform have resulted in a system that is overly complex, unpredictable, and imposes undue administration costs,” Achterstraat said.

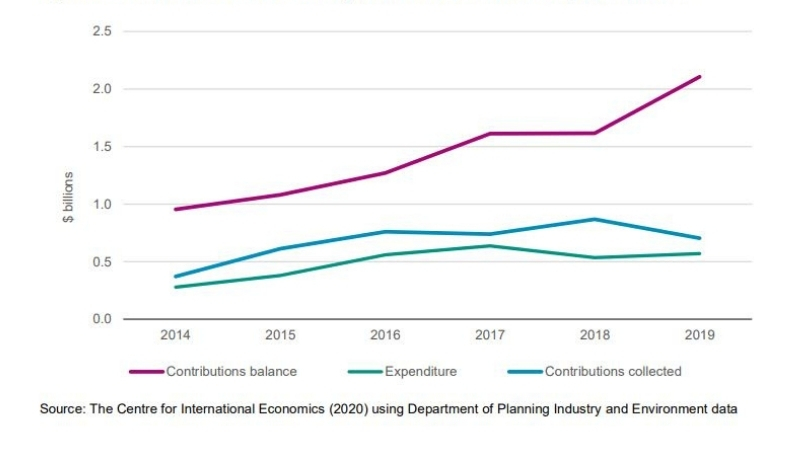

“Moreover, contributions collect only a small proportion of the required funding and fails to deliver services in a timely and coordinated way.

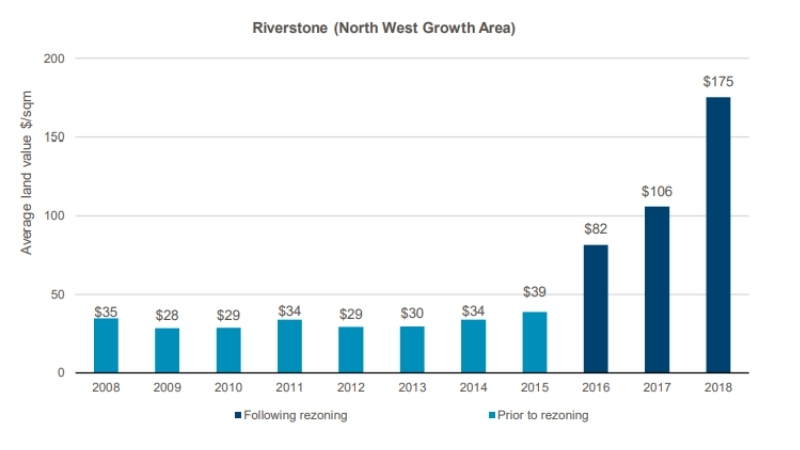

“Property prices are high and can rise substantially in the lead up to, and following, rezoning, which adds to the cost of land acquisition.”

Rural to residential rezoning: Land values per square metre

^Source: Review of Infrastructure Contributions

Urban Taskforce chief executive Tom Forrest said the government needs to play more of a role in providing space for bio-diversity, affordable housing and infrastructure.

“This should see an end to council’s stashing infrastructure contributions into a safe and letting developers cop the blame for the lack of public amenity,” Forrest said.

“Importantly, the report also acknowledges that affordable housing levies do not fit into a principles-based infrastructure contributions framework .

“Taxing new home buyers to fund broad social goals is not efficient or fair. Government should fund affordable housing, or approve more housing thus driving prices down.”

Local contributions and expenditure over time - metropolitan

^Source: Review of Infrastructure Contributions

UDIA NSW chief executive Steve Mann said they now want to see the government act swiftly on these changes.

“We need to move to implementation of key reform as soon as possible to deliver housing and jobs,” Mann said.

“UDIA strongly endorses the opportunity to deliver productivity gains and is keen to see these recommendations result in an infrastructure contributions scheme which is simple, certain and efficient.”

Mann said there are still a few concerns to be raised around the implication of a rezoning levy and station-catchment levy, transport contribution, the biodiversity measure, regional dwelling contribution as well as the exclusion of the Aerotropolis region to from the Special Infrastructure Contribution.