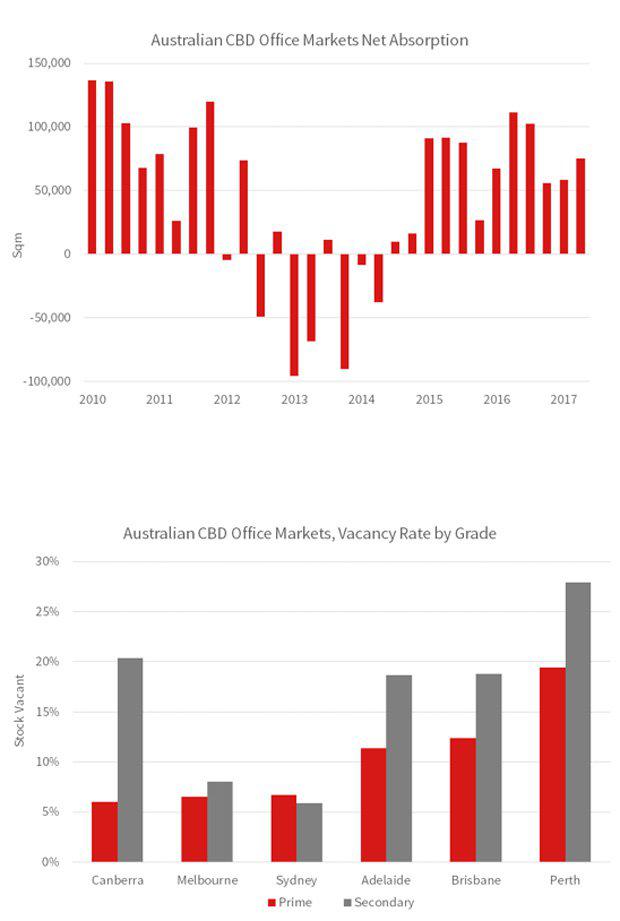

JLL Research has released its second-quarter '17 statistics on national office markets. The figures showed positive net absorption of 75,100 sq m over the quarter across CBD office markets and 291,500 sq m over the 2016/17 financial year.

The national CBD office market vacancy rate fell to 10.9% in the '17 second-quarter – the lowest rate since March 2013.

JLL Head of Research Australia, Andrew Ballantyne said, “Business confidence is at healthy levels across Australia and we have started to see positive sentiment in leasing market activity across all CBD office markets. Q2 was the first time that all six monitored CBD office markets recorded positive net absorption in the same quarter since September 2011.”

Leasing enquiry and activity has remained strong in Melbourne with the convergence between markets led by a sustained improvement in Brisbane and Perth. Net absorption is constrained in Sydney by a lack of contiguous stock and owners are experiencing high tenant retention rates and positive rental growth.

Ballantyne said, “Our closely watched measure of sub-lease availability points towards improving sentiment in the Perth CBD office market. A willingness of multi-nationals and Perth based organisations to remove sub-lease availability in anticipation of medium-term revenue and headcount growth is a positive sign for the office leasing market.

“A flight to quality is already evident in the Perth CBD with Premium Grade vacancy compressing to 7.8%. A Grade will be the next beneficiary of this trend with proactive owners allocating capex to assets to differentiate their product in the leasing market,” Ballantyne said.

Brisbane

The recovery in Brisbane is more advanced than Perth with the Brisbane CBD recording a tenth successive quarter of positive net absorption in the '17 second-quarter. Brisbane CBD net absorption was 22,500 sq m in Q2 and 52,700 sq m over the 2016/17 financial year. Vacancy tightened by 0.8 percentage points over the quarter to 15.5%.

Ballantyne said, “The sustained recovery in the Brisbane CBD office market has captured investors’ attention. Positive leasing is normally a precursor for rents and we expect to see an upturn in effective rents in early 2018.”

Melbourne

Melbourne recorded the strongest net absorption in Q2 (24,600 sq m) and over the 2016/17 financial year (162,700 sq m). Vacancy tightened to 7.1% in Q2 – the lowest rate since 1Q12.

Tim O’Connor, Head of Office Leasing Australia for JLL said, “Multiple industry sectors are contributing to positive leasing enquiry and activity in the Melbourne CBD. Technology firms and co-working operators are growth sectors of the Melbourne CBD with take-up from RocketSpace and Melbourne IT, while Dentsu Aegis Network leased expansion space at 643 Collins Street.”

A shortage of contiguous space options in the Melbourne CBD is exerting upward pressure on rents with prime gross effective rents increasing by 2.9% in Q2 and by 16.2% over the 2016/17 financial year.

Sydney

Sydney CBD net absorption was constrained by a shortage of contiguous space in Q2 (1,900 sqm). Nevertheless, vacancy tightened to 6.4% – the lowest level since the 2008 second-quarter.

O’Connor said, “Only a limited number of assets can provide contiguous space in the Sydney CBD, resulting in higher tenant retention rates. Owners are capitalising on positive market sentiment and prime gross effective rental growth which is the strongest in the world.”

Sydney CBD prime gross effective rents increased by 5.1% in Q2 and by 25.3% over the 2016/17 financial year. The rate of growth was even stronger for secondary grade assets with prime gross effective rents increasing by 29.7% over the past 12 months.

Canberra

Canberra recorded positive net absorption of 5,300 sq m in Q2, while vacancy was largely unchanged at 11.8%. Prime gross effective rents increased by 2.7% over the 2016/17 financial year.

Adelaide

Adelaide recorded its highest quarterly positive net absorption figure since the '08 fourth-quarter in 2Q '17 (10,200 sq m). Leasing activity was concentrated in the secondary grade market and the headline vacancy rate tightened to 16.0%.

O’Connor said, “The 2017/18 financial year will be positive for CBD office leasing markets. Organisations are in expansion mode, development activity is limited and vacancy will trend lower. Rental growth will no longer be solely a Sydney/ Melbourne story with a recovery in effective rents projected for Brisbane and Canberra.”