Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeWith two major CBD buildings coming onto the market over the past six months, Brisbane’s office market vacancy has unexpectedly risen to a new record high.

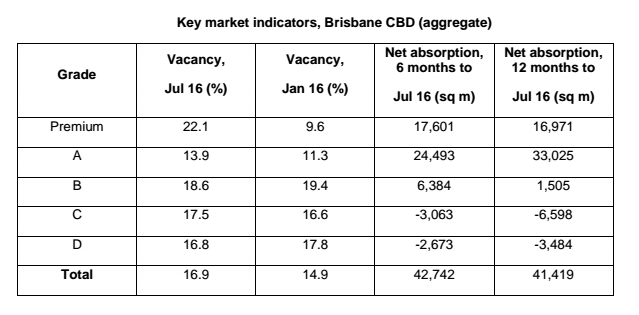

The Property Council of Australia’s latest Office Market Report, released yesterday, shows the headline vacancy rate for Brisbane’s CBD has increased from 14.9 per cent to 16.9 per cent, over the six months to July.

“Given over 115,000 square metres have come online over this time, the Brisbane market has demonstrated its resilience through being able to absorb much of the new supply,” Property Council Queensland Executive Director Chris Mountford said.

“After the Government’s 1 William Street development is completed later in the year (75,853sqm), there is little further space expected to enter the CBD market in the short to medium term.

“While the recent supply additions had a negative impact on the headline vacancy rate, there is positive news for Brisbane, with net demand for CBD space reaching five times it historical average over the same period.

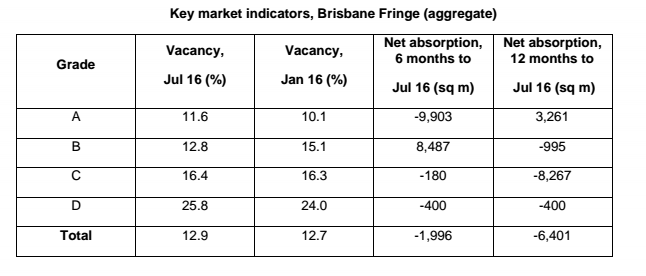

“The slight increase in the fringe office vacancy from 12.7 to 12.9 per cent is directly attributable to negative demand.

“With the ongoing ‘flight to quality’ and historically high levels of sublease vacancies, tenants are seeing an opportunity to move from the fringe into the CBD.

Mr Mountford said demand continued to be in the Prime and A-Grade with lower grades continuing to experience negative demand.

“Through its new report, An Open City, Brisbane City Council has presented an overview of the CBD revitalisation initiatives in place to stimulate activation of the city centre, including opportunities for adaptive reuse of older buildings.

“Many of these initiatives have been the catalyst for the redevelopment of underutilised office buildings into student and visitor accommodation, with incentives for retirement living and aged care currently being investigated by BCC.”

According to Knight Frank Senior Director of office leasing Campbell Tait, with the Brisbane CBD office leasing market seeing an increase in activity over the past six to 12 months, it wouldn’t be at all surprising to see an improved set of numbers resulting in a sizeable decreased figure in headlined vacancy numbers this time next year.

Analysis of the Brisbane CBD market

Headline comments:

Brisbane CBD vacancy increased in the six months to July 2016

This was due to supply additions

Demand was positive

The upper grades of space recorded positive demand, while the lower grades recorded negative demand

There is a significant amount of space due to come online over the next six months

Brisbane CBD’s vacancy rate increased from 14.9 percent to 16.9 percent

This was due to 115,134sqm of supply additions

Demand was positive with 42,742sqm of net absorption recorded

10,596sqm of space was withdrawn over the period

The upper grades of space recorded positive demand, while the lower grades recorded negative demand

Future supply:

A total of 75,853sqm is due to enter the market in the second half of 2016

18,450sqm is planned for 2017

82,700sqm of space is mooted

Analysis of the Brisbane Fringe market

Headline comments:

The Fringe market’s vacancy increased over the period

This was due to negative demand

All grades have double digit vacancy

Only the B Grade segment recorded positive demand

There is no space due to come online in the short to medium term after 2016

Brisbane Fringe’s vacancy increased from 12.7 percent to 12.9 percent

This was due to -1,996sqm of net absorption

All grades of space have double digit vacancy

Only the B Grade segment recorded positive net absorption

A total of 22,000sqm is due to enter the market in the second half of 2016

No space is in the pipeline after that in the short to medium term

40,648sqm is mooted for this market