Lack of Brisbane Office Supply ‘Opportunity’ for Landlords

Despite the historically strong demand for new office space in Brisbane, vacancy rates in Brisbane’s CBD increased from 11.9 per cent to 12.7 per cent during the last six months, according to the latest Property Council office market report.

The completion of Shayher Group's 300 George Street building added 47,700sq m—about 2.4 per cent of current stock—to the CBD market in late 2019.

Property Council Queensland director Chris Mountford said that the underlying demand in Brisbane is a positive sign for the city’s economy.

“High tenant demand has seen 23,581sq m absorbed over the past six months—a great indicator of healthy activity in the office sector,” Mountford said.

“With an additional 55,000sqm of space due to come online over the next two years, the market will be hoping for a continuation of this strong tenant demand for quality Brisbane CBD properties.”

CBRE office leasing state director Chris Butters said despite patchy demand, Brisbane’s prime office market is tightening.

“We’ve certainly seen some improvement from the resource sector, with the co-working sector also emerging as a significant net absorber of space last year,” Butters said.

A lack of new supply under construction is also set to present an opportunity for landlords on completion of The Annex, a 7000sq m boutique building at 12 Creek Street later this month.

“Following this, there will be no new supply until the completion of the Midtown Centre in mid-2021 and this 18-month hiatus will help put downward pressure on vacancy rates,” Butters said.

As anticipated at the end of last year, 2020 is expected to continue the positive net absorption trend experienced in Brisbane, according to Savills office leasing state director David Howson.

“The prime sector continues to be the shining light with A-grade vacancy expected to continue to tighten for the foreseeable future,” Howson said.

“The continued investment in south-east Queensland infrastructure by the state government, is likely to provide significant impetus to the local market with the State Government themselves tipped to add significantly to net take-up.”

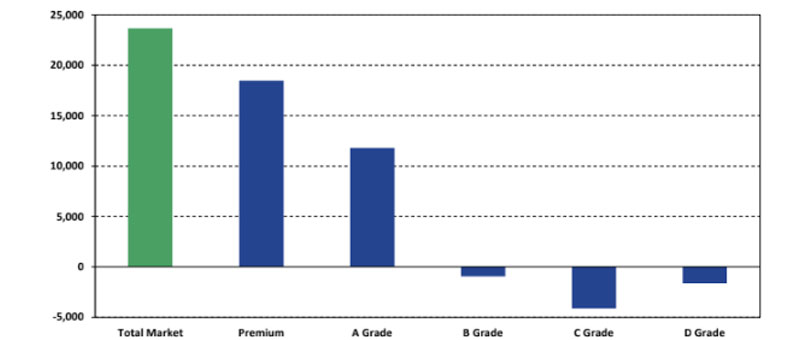

Brisbane CBD Net Absorption by Grade

^ Six months to January 2020: 'Flight to quality' evident with prime stock recording strong net absorption and secondary stock recording negative net absorption (Source: Property Council of Australia 2020 OMR).

The Property Council’s report shows the Brisbane fringe market’s vacancy decreased marginally over the last six months of 2019, falling from 13.8 per cent to 13.7 per cent.

Withdrawal of space in Brisbane’s fringe for redevelopment has been the primary cause of this vacancy reduction, with tenant demand negative in all grades except for A-grade stock.

“Almost 80,000sq m of new office space is expected to come online in the Brisbane fringe over the next few years,” Mountford said.

“We’re seeing a definite ‘flight to quality’ both in the Brisbane CBD and Brisbane Fringe markets, this will open up great redevelopment and repositioning opportunities in 2020 for older assets.”