Office Markets Outperform as Vacancies Hit Record Low

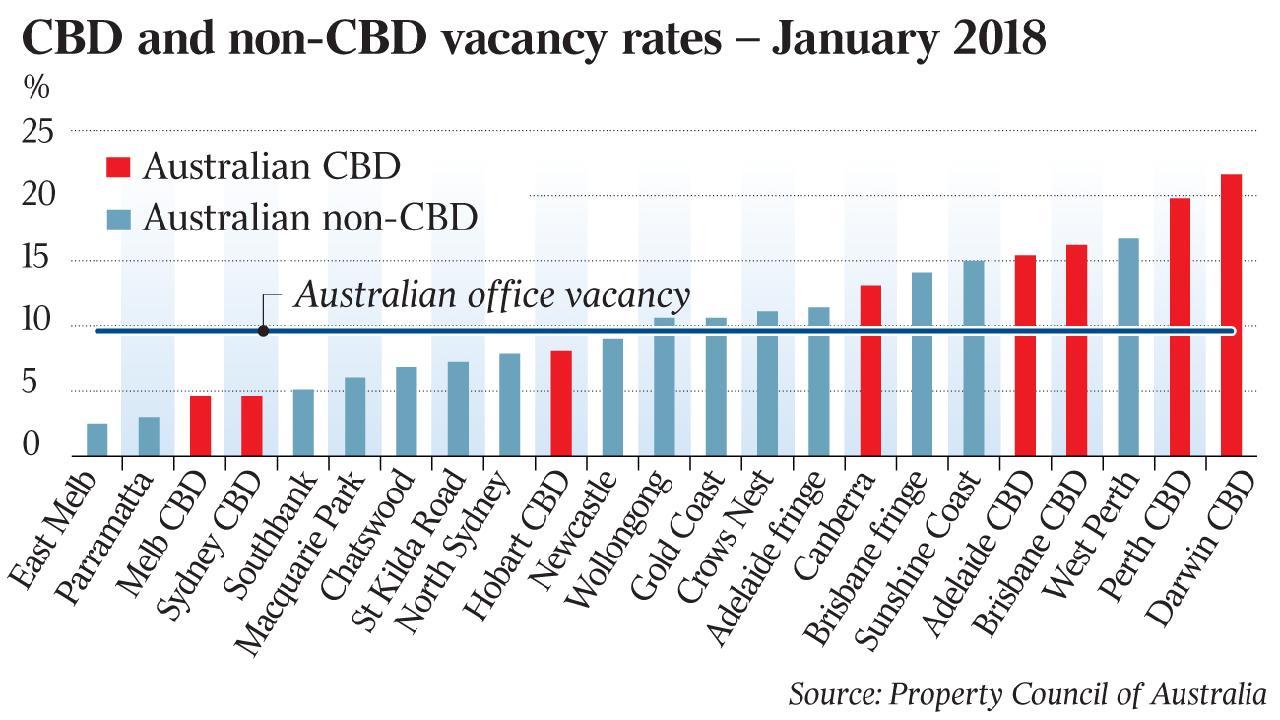

Australia’s office markets continue to strengthen with vacancy rates dropping below 5 per cent in Sydney and Melbourne.

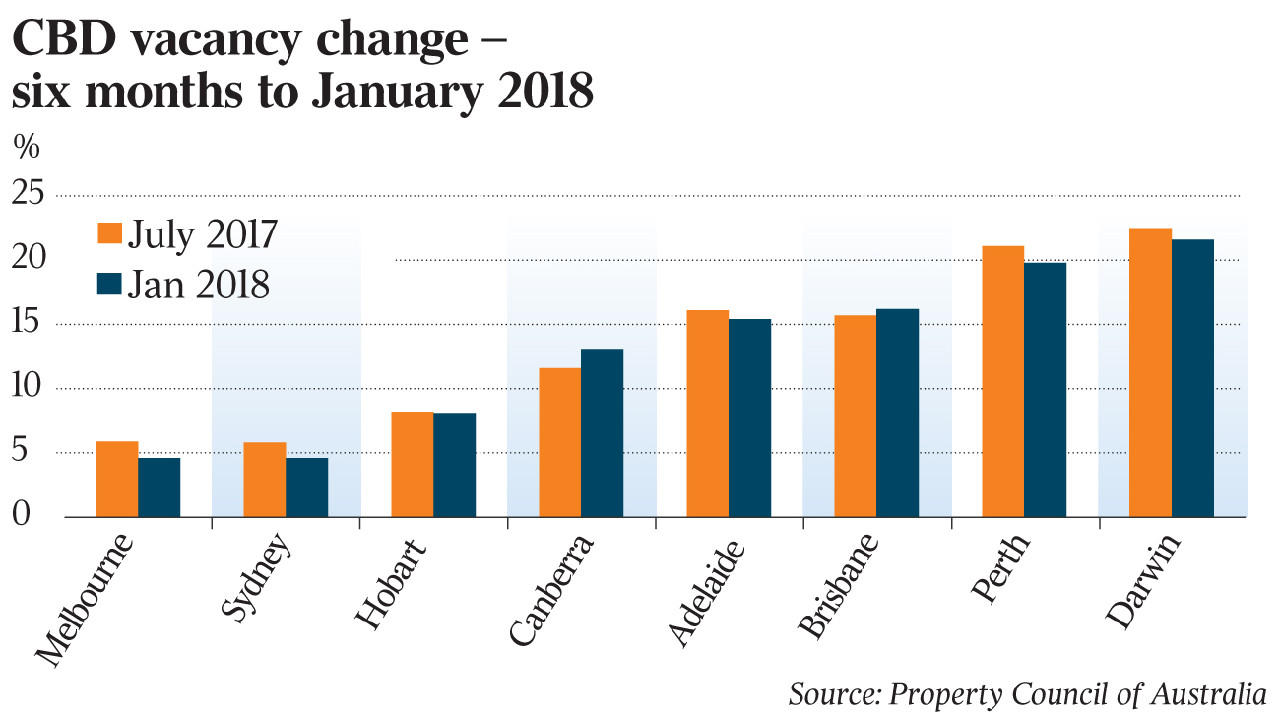

Demand has been the strongest it’s ever been in the past decade for office space in the Sydney CBD, with vacancy rates dropping from 5.8 per cent to 4.6 per cent in the six months to January 2018.

The office vacancy rate fell by 0.6 per cent nationally. Eastern seaboard office markets remained the highest performers, while vacancies in Perth and Brisbane’s resource-affected office markets showed signs of tightening.

Vacancy dropped in 75 per cent of the 26 individual markets covered in the Property Council’s Office Market Report.

"Australia's tightening office markets provide a window into a strengthening economy, and these results are certainly encouraging," Property Council chief executive Ken Morrison said.

[Related reading: Brisbane’s Office Market a Viable Alternative]

Morrison said that Melbourne’s strong result was driven by a surge in tenant demand while the Sydney office market “squeeze” as buildings are withdrawn for future redevelopment and infrastructure investment like the new metro line stimulated the Sydney CBD office market.

“We continue to see very strong results for [Sydney’s] CBD office market,” Property Council NSW executive director Jane Fitzgerald said.

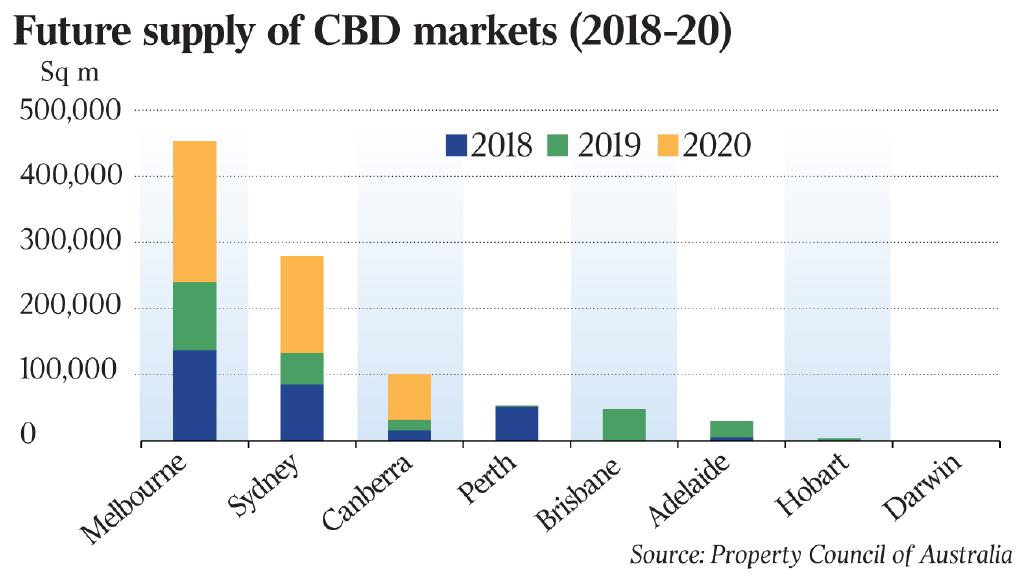

“There is a significant amount of supply coming into the market over the next few

years with 85,712 square metres entering the market in 2018 and 147,248 square metres is due to come online from 2020 onwards.”

Office leasing inquiries also picked up, with a 19 per cent increase in the final quarter of 2017, according to Colliers International’s latest Office Demand Index report.

State-by-state, increases in office demand in the fourth quarter of 2017 were experienced in almost every region including Brisbane (173 per cent), Perth (257 per cent), Sydney (6 per cent) and Canberra (25 per cent).

[Related reading: Positive Outlook as Vacancy Declines in Australia’s Office Markets]

New South Wales was a higher performer in the country when came to commercial performance, with a number of key regions tracking strong numbers.

Parramatta’s overall vacancy rate reduced form 4.3 per cent to 3 per cent due to 7,751 square metres of net absorption and 2,052 square metres of withdrawals, with a bare zero for vacancy when it came to A Grade office space.

The Property Council also revealed Macquarie Park’s vacancy rate dropped from 8.4 to 6.0 per cent.

North Sydney, amongst all of this scrabbling for prime office space in the six months to January, had no such demand, recording an increase in vacancy from 7.9 to 8.4 per cent in the Property Council’s report.

Fitzgerald anticipated a change in the winds as investment in Sydney Metro Northwest could improve connectivity for the North Shore markets.