First Home Buyers Fade From the Market: Corelogic

First home buyers are potentially driving the market down by holding deposits and waiting for prices to decline according to Corelogic’s recent property pulse.

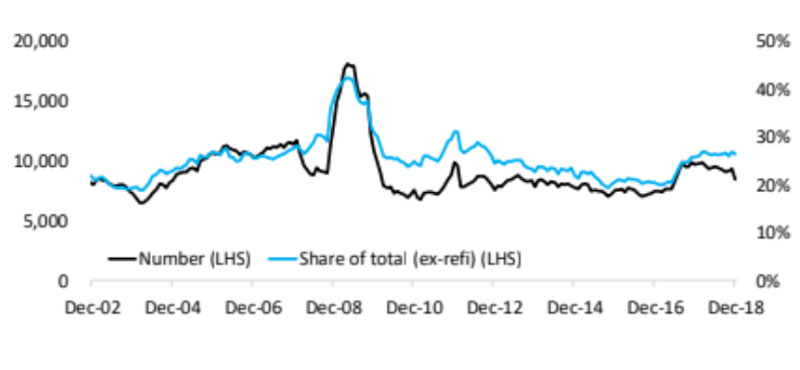

Financial commitments by occupying first home buyers fell to 18-month lows in December 2018, hitting the lowest figure since June 2017.

Credit to owner-occupiers is also down, dropping 6.4 per cent month over the month to a three-and-a-half-year low, a 15 per cent fall over the year.

While some commentators suggest the trend is centralised to Sydney and Melbourne, the reality is the number of people taking out home loan mortgages has been falling over the year, especially those in the market for their first home.

The 8,476 commitments made by first home buyers in December was down 9.6 per cent on commitments made the previous month and down 12.6 per cent year-on-year highlighting an overall weakening in the demand for mortgages.

Related: Property Market Woes No Boon for Affordability

Owner occupier FHB number and share of total

NSW and Victoria reported the fewest financial commitments by owner-occupier first home buyers since mid 2017.

In NSW, the 2,232 commitments made were 5.2 per cent lower over the month and 3.0 per cent lower year-on-year while in Victoria first home buyer commitments were down 7.7 per cent lower over the month and 14.8 per cent year-on-year.

In Queensland, the share of first home buyers compared to new lending fell in December with 1,586 commitments made, down 11.1 per cent over the month and 23.2 per cent year-on-year.

First home buyers in Queensland, as a share of total new owner-occupier lending, represented 24.3 per cent of lending, the lowest overall share since February 2017.

“Although the weakness has only been apparent for a few months, it will be important to watch going forward,” Corelogic said.

“If first homebuyer activity drops it could lead to a further leg down in value declines across the market.”

“The more pragmatic potential first home buyers are probably seeing values decline and despite incentives, they realise that if they remain on the sidelines the properties they are targeting could be becoming even more obtainable over the coming months.”

Surprisingly, Tasmania saw an increase in first home buyer commitments, up 8.5 per cent year-on-year.