'Perfect Storm' in Brisbane's Misunderstood Apartment Market

Brisbane’s apartment market is segmented and running at different speeds, according to the weight of opinion “on the ground”.

While the investor grade market has experienced some oversupply, Brisbane apartment projects with architectural merit aimed at the higher-end are consistently sought after and preserving their value.

Treating the decline in prices in pockets of the Brisbane apartment market as characteristic of what’s happening in the larger market is entirely misdirected, according to DFP’s Matthew Royal.

Where is the Pain? The Investor Grade Market

On the one hand, established and new investment-grade apartments and townhouses in over-supplied areas of Brisbane are seeing a reduction in rents and capital values.

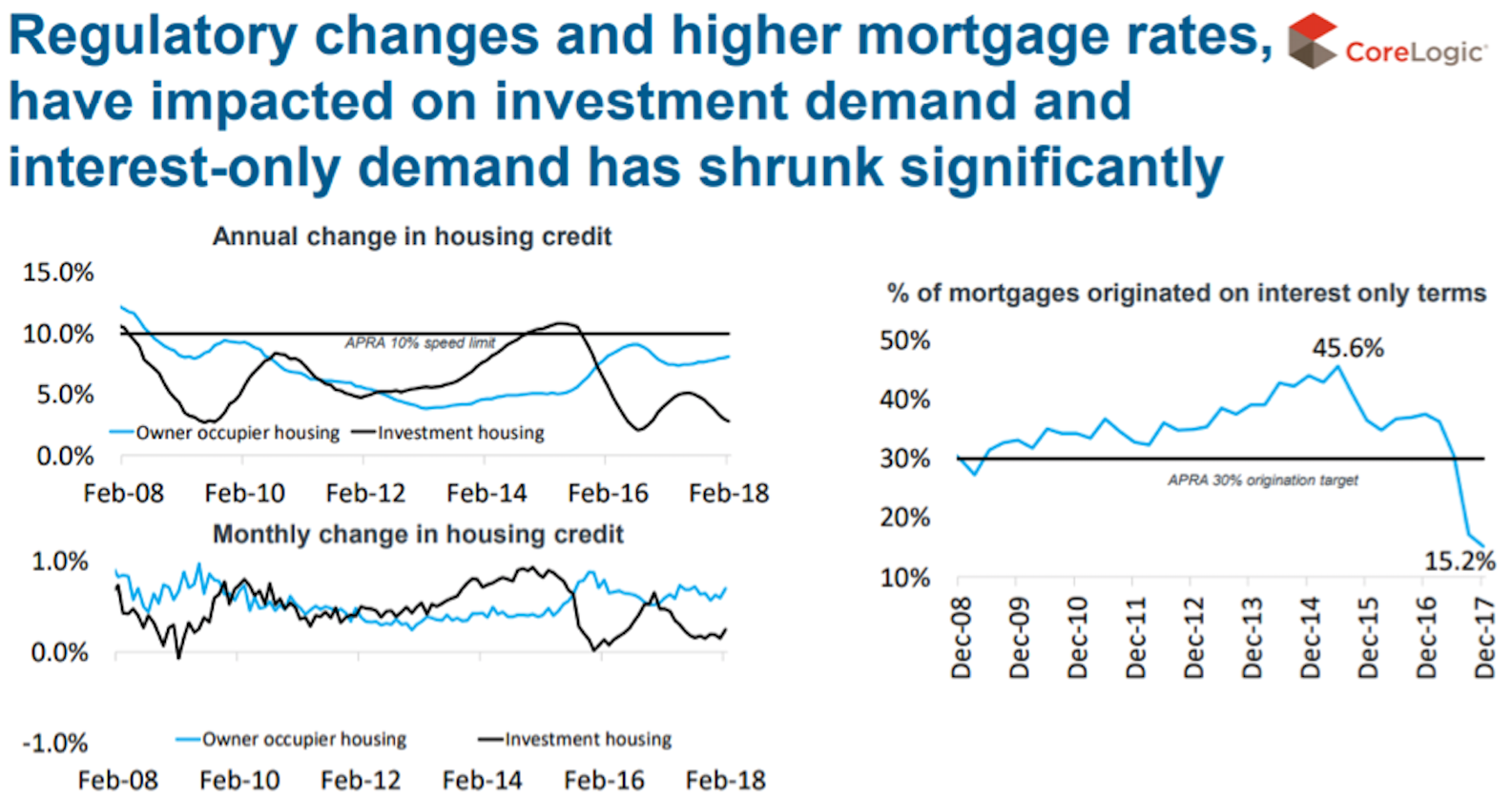

According to Matthew Royal, principal of property advisory firm Development Finance Partners (DFP), this is being compounded by lenders requiring investors to commit to principal and interest repayments rather than simply interest-only payment.

Related reading: 10,000 Apartments Abandoned in Saturated Brisbane Market: BIS

“Some apartments and townhouses built five to ten years ago are getting valuations for their properties which are up to 20 to 30 per cent below expectations,” said Royal.

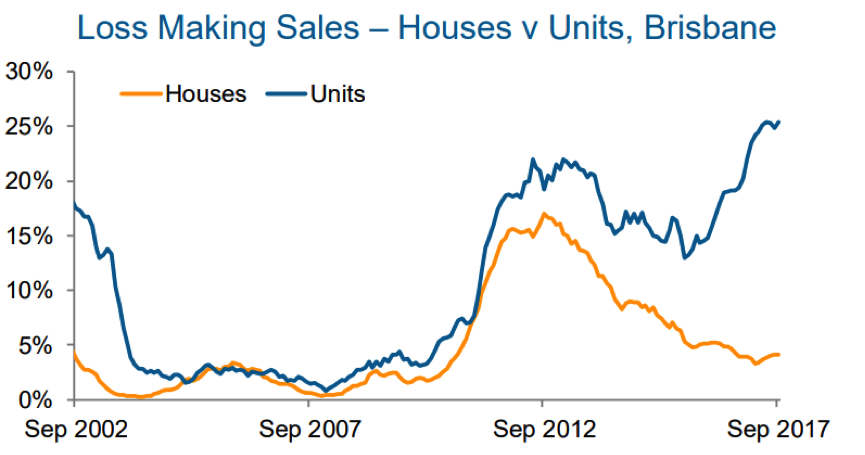

“Sections of the market are dire at present, in particular when considering that in the one in four sellers of Brisbane apartment sold at a loss,” he added.

Research from Corelogic supports this hypothesis by showing that the gap between loss-making resales of houses and apartments is continuing to widen, with the average loss realised on the sale of an apartment about $30,000.

Most at risk will be smaller, investment-grade stock which has been marketed and sold heavily to offshore purchasers on high commissions.

Where is the Gain? – The Owner-Occupier Market

On the other hand, the owner-occupier market is starting to build momentum as a lack of quality apartments for locals combine with growing demand from downsizers and interstate migrants.

“Owner-occupiers will be the drivers of change in the local market in 2018,” writes Lachlan Walker of Brisbane-based research firm Place Projects in the December Brisbane Quarterly Apartment Report.

“We expect this market to continue to solidify and absorb demand in 2018…with A-grade property continue to portray value,” he added.

Royal believes the characteristics of the Brisbane apartment market are currently a classic case of the temporary imbalance between and demand and supply correcting itself over the short to medium term in some our local markets.

“It’s not in the realm of a catastrophe – Brisbane for the most part is still reflecting a healthy property market but there are pockets where the market is unwinding,” he says.

We also believe that there are markets within markets. For example, well-designed apartments which are larger in size, close to amenity and infrastructure in well sought-after suburbs are likely to fare best as is consistently the case.”

The Urban Developer is proud to partner with Development Finance Partners to deliver this article to you. In doing so, we can continue to publish our free daily news, information, insights and opinion to you, our valued readers.