Property Industry Lobbies to Kickstart International Migration

Developers and lobby groups are calling on the federal government to kickstart plans for international migration to help inject confidence into the inner-city markets and put the shine back on Sydney and Melbourne property.

While the trend of overselling and undervaluing properties has turned, the overheated markets have cooled over the past year with an exodus to the regions, and an exposure to international migration.

Developer Tim Gurner said he was “bullish” about the future of the eastern seaboard but the government was going to have to boost immigration as part of the economic recovery of the country.

“They’re going to have to pump immigration, and we’re building nothing. There’s nothing being built and we’re going to have a massive undersupply in a couple of years,” Gurner said.

“I think in three years time we will be looking at it going holey-moley where did this boom come from … [but] it will take immigration. We’ve got to get 60,000 students back in the CBD in Melbourne, that will change things overnight.”

The Property Council of Australia has joined the growing number of voices calling on the Australian government to do more to kickstart overseas migration post-Covid.

“We now need to pivot towards a growth agenda. Australia has amassed the expertise and has the capacity to reignite the big economic engine of population growth while simultaneously protecting Australians,” chief executive Ken Morrison said.

“This means setting concrete plans to upsize border processing and quarantining arrangements so that more people can cross the international border.”

Auction clearance rates of 90 per cent last weekend reinforced a more confident Sydney market, but more needed to be done to shore up international migration plans to bolster construction sector confidence.

Off-the-plan settlement valuations

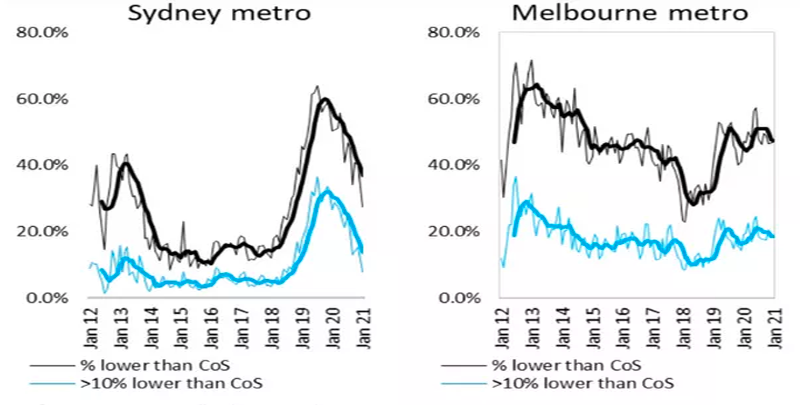

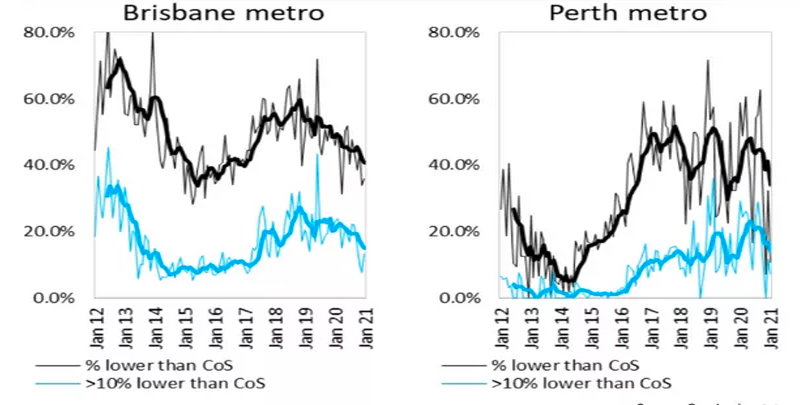

^ Off-the-plan settlement valuations lower than the contract price and at least 10 per cent lower than the contract price. Source: Corelogic

Fiducia development director Marie Doyle said while the market had taken a hit in 2020 there was a growing anticipation that could “put the shine” back on the inner-city residential sector.

“I think Sydney is still performing well … there’s certainly this anticipation of more confidence in the market for purchasers that are looking into that,” Doyle said.

“I think the key in Sydney at the moment is really about putting confidence back in the market for buyers.”