Property Investors Rise in Every State and Territory

Consecutive rate cuts combined with an easing in lending standards has seen a sharp rise in investor lending with every state and territory recording a lift in the value of investment loans.

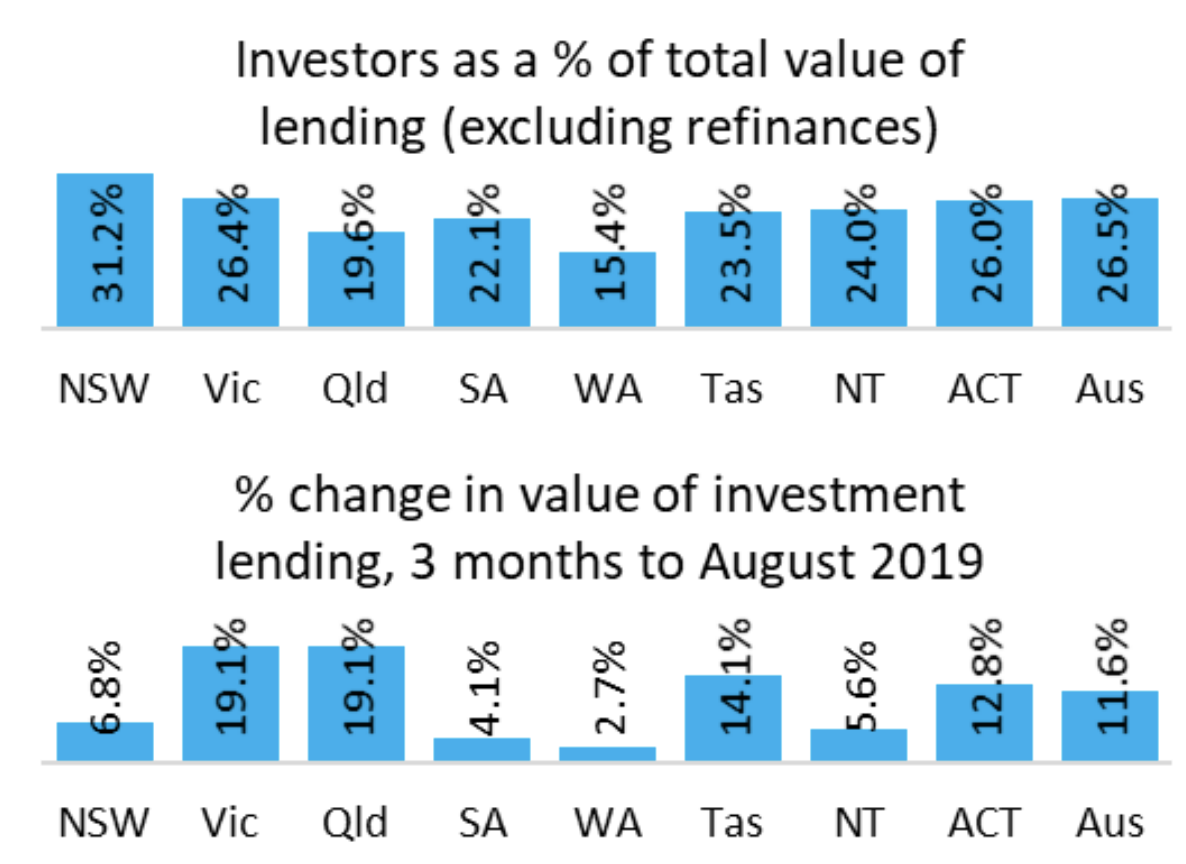

Victoria and Queensland recorded the largest rise for the three month period to August, where the value of investment home loan commitments increased by 19.1 per cent, according to Corelogic.

But proportionally, investment activity is concentrated in New South Wales where investors make up 31.2 per cent of mortgage demand based on the value of loan commitments, excluding refinances.

Victoria follows, at 26.4 per cent and Canberra at 26 per cent.

Western Australia, where housing values have declined since 2014, shows the lowest share of investors at 15.4 per cent.

Corelogic's Tim Lawless said the housing market had “turned a corner” with values rising across five of the eight capital cities over the September quarter, an attraction for investors eying capital gain opportunities.

“The value of home loans committed to by investors has recorded a sharp rise since June,” Lawless said.

“Rising a cumulative 11.6 per cent over the three months ending August, the fastest rate of growth in the value of investment loan commitments since November 2016.”

In his latest update, Reserve Bank deputy governor Guy Debell noted that investor demand had notably slowed during the recent property slow down, but that in his view it was primarily a decrease in investor demand given falling housing prices, more than the impact of tighter lending conditions.

Moving forward, Lawless says there’s a “strong likelihood” investor activity might increase further.

“The long term average shows investors are typically around one-third of mortgage demand, implying investors are currently under-represented in the market.

“As investment activity rises we could see increased price pressures as this sector of the market tends to be more competitive in setting new price benchmarks.”