Property Market to Temporarily Plummet

While the trend in Australia’s house prices remained positive through March, recording a 0.7 per cent rise, housing market activity is expected to plunge as increased uncertainty spreads across the property market, and wider economy.

Recent market trends have become less relevant as we move into a period of unprecedented uncertainty—Corelogic’s Tim Lawless says this is likely to further erode household confidence—dragging Australia’s economy into a recession for the first time in almost 30 years.

“If we are correct in our expectation that housing market activity is set to temporarily plunge, we could see increased volatility and a reduction in certainty creep into housing market measurements until activity picks up,” Lawless said.

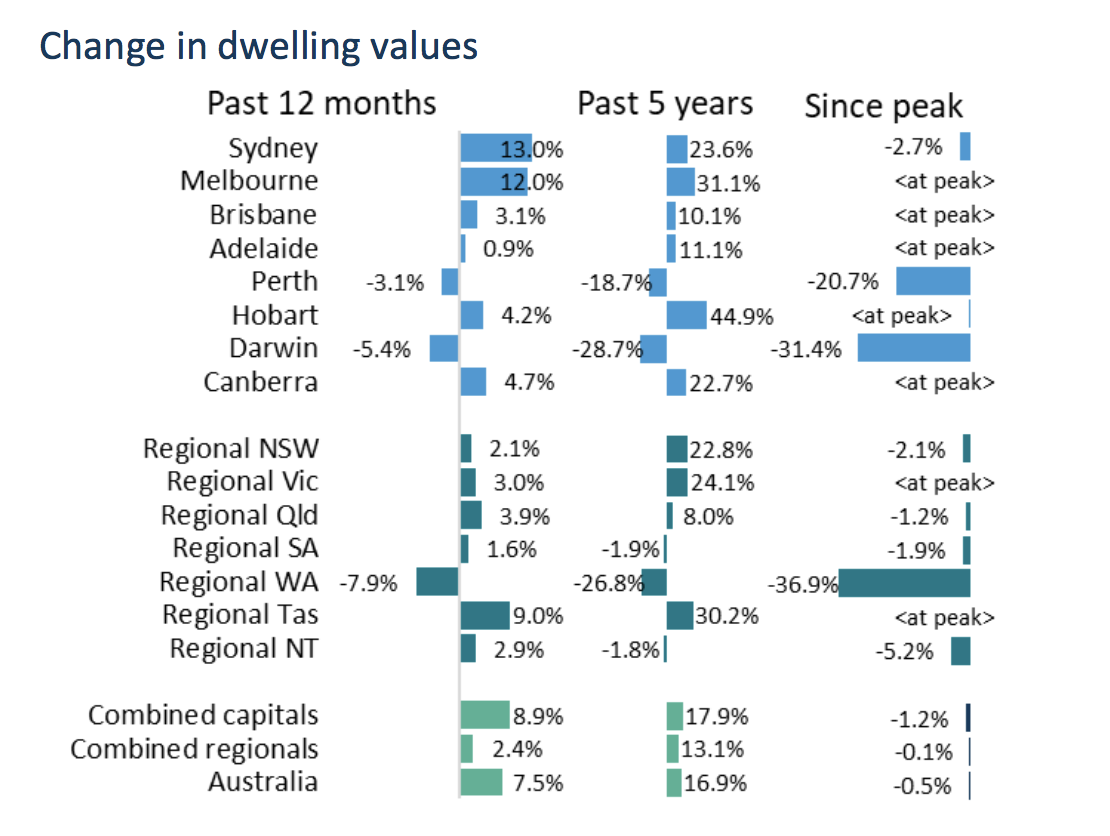

CoreLogic index results as at March 31, 2020

| MONTH | ANNUAL | MEDIAN VALUE | |

|---|---|---|---|

| Sydney | 1.1% | 13% | $882,849 |

| Melbourne | 0.4% | 12% | $695,299 |

| Brisbane | 0.6% | 3.1% | $506,553 |

| Adelaide | 0.3% | 0.9% | $437,296 |

| Perth | 0.5% | -3.1% | $445,614 |

| Hobart | -0.2% | 4.2% | $483,032 |

| DarwinDarwin | 2% | -5.4% | $392,348 |

| Canberra | 0.6% | 4.7% | $626,932 |

| National | 0.7% | 7.5% | $554,229 |

Forty per cent of the nation's auction's were withdrawn over the weekend, with social distancing measures resulting in open homes and public auctions banned.

Looking at mortgage rates, consumer sentiment, new lending and auction clearance rates, CBA senior economist Belinda Allen describes these as the best indicators of the direction of housing prices.

“But with volumes now so thin previous relationships may not hold,” Allen said.

“Based on the current movement of all but mortgage rates there does suggest there is downside risk to dwelling prices forthcoming.”

Last week, AMP economist Shane Oliver said that if the recession should last more than six months – with unemployment up to 10 per cent or more, house prices could collapse by up to 20 per cent.

Up until recently, Australia's unemployment has sat above 5 per cent.

As Covid-19 continues to roil the economy, NAB's chief economist Alan Oster expects unemployment in the order of 12 per cent.

“Which is awful,” Oster said.

“The magnitude and speed of the economic impact dwarfs anything we’ve seen in the post-war period in Australia.

“Hopefully the good news is, it’s very short, but that will all depend on the virus.”

Lawless adds that the extent of the impact on Australia's property values is “highly uncertain”.

“Capital growth trends will be contingent on how long it takes to contain the virus, and whether additional constraints on business or personal activity are introduced,” Lawless said.

“Once the virus is contained, we expect economic conditions to quickly improve, driving a turnaround in consumer spirits which should flow through to housing market activity.

“When that will be, remains highly uncertain.”

Housing values

The federal and state government stimulus packages aim to help support job retention and incomes amid Covid-19, in a move to reduce casualties.

As an increasing number of Australians face unemployment, Lawless says leniency from the banks for borrowers “should help to stymie” the number of properties hitting the market.

The data house expects the number of residential transactions to fall in the coming months.

“A consequence of tanking consumer confidence, a rising jobless rate, and more cautious lending practices,” Lawless said.

A major reduction in listing activity is also expected, with real estate reports noting they have more than halved in recent weeks, implying a “substantial drop in property listings in the coming weeks”.

“Measures of housing values and prices rely on timely updates of recently sold properties, a material slowdown in turnover is likely to create some challenges over the coming months in how we report on market conditions,” Lawless said.