Sydney, Melbourne Property Prices Still Reeling from Pandemic

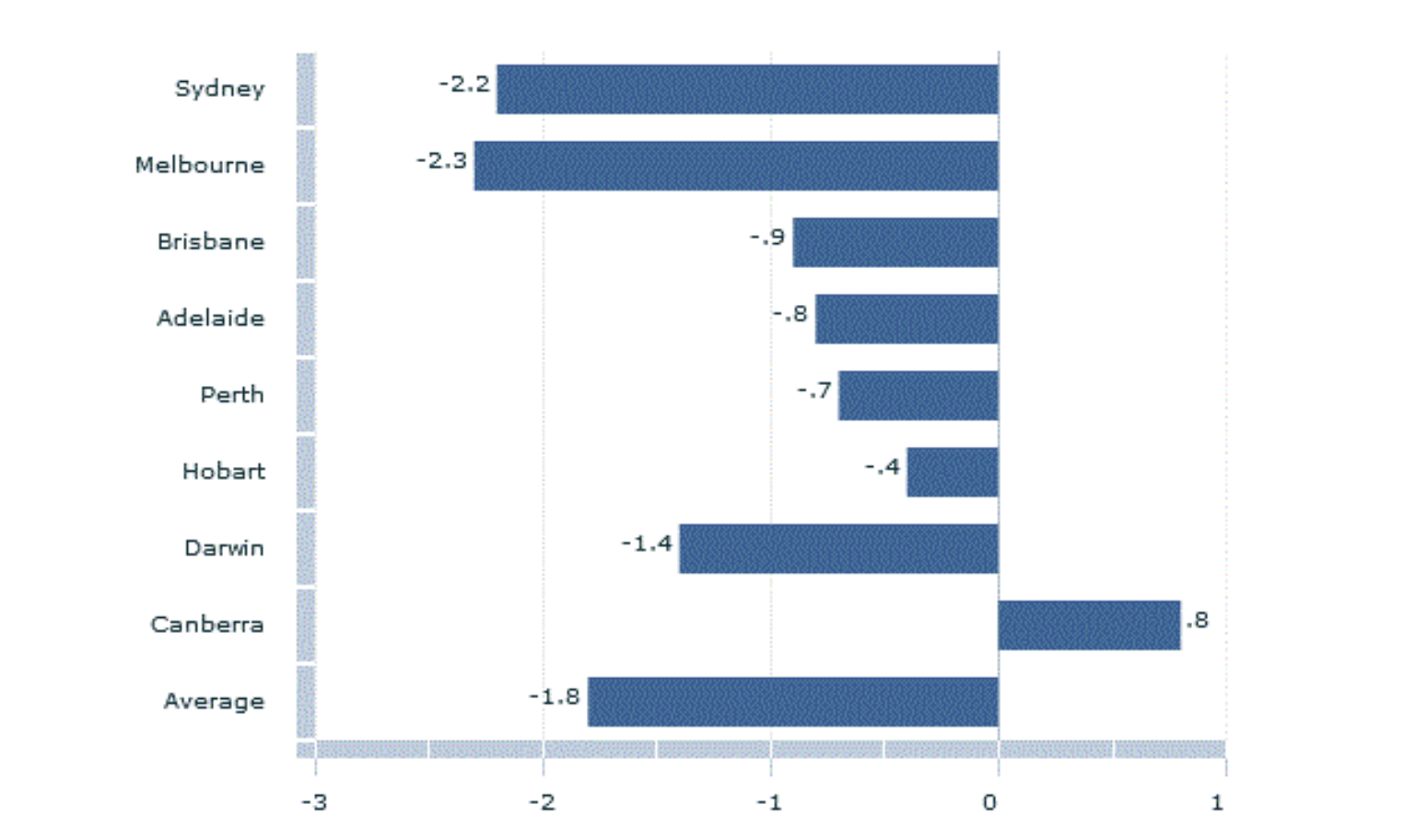

The nation’s largest housing markets Sydney and Melbourne led residential property price falls in the June quarter, with the latest official figures posting a national 1.8 per cent drop.

Melbourne’s property market recorded a 2.3 per cent decline and Sydney a 2.2 per cent drop, reveals June quarter data released on Tuesday by the Australian Bureau of Statistics.

“All capital cities apart from Canberra recorded falls in property prices in the June quarter 2020,” ABS head of prices statistics Andrew Tomadini said.

Sydney house prices fell 2.6 per cent for the period while attached dwelling prices fell 1.4 per cent.

Melbourne house prices dropped 2.8 per cent, and attached dwelling prices fell 1 per cent for the period.

Residential property prices: quarterly percentage change

^ June Quarter 2020. Source: ABS

Tomadini added that the number of residential property transactions fell substantially in the eight capital cities during the June quarter 2020, as a result of the impact of Covid-19 on the market.

Brisbane property prices recorded a slight 0.9 per cent decline for the quarter, Adelaide 0.8 per cent, Perth a 0.7 per cent fall, Hobart a 0.4 per cent fall and Darwin declined by 1.4 per cent for the quarter.

Over the year to June, property prices are up 6.2 per cent, with all capital cities up, apart from Perth and Darwin.

The total value of Australia’s 10.5 million dwellings was $7,138.2 billion with the average dwelling price at $678,500.

Residential property prices: June key statistics

| Residential property prices | Mar Qtr 20 to Jun Qtr 20 % change | Jun Qtr 2019 to Jun Qtr 2020 % change |

|---|---|---|

| Weighted average of eight capital cities | -1.8 | 6.2 |

| Sydney | -2.2 | 8.1 |

| Melbourne | -2.3 | 8.8 |

| Brisbane | -0.9 | 2.3 |

| Adelaide | -0.8 | 0.7 |

| Perth | -0.7 | -0.2 |

| Hobart | -0.4 | 6.1 |

| Darwin | -1.4 | -2.7 |

| Canberra | 0.8 | 3.6 |

The ABS figures come as the RBA also released minutes on the central bank’s September meeting.

In their discussion on the housing market, members noted that dwelling prices in Melbourne and, to a lesser extent, Sydney had declined in recent months, but price movements had been mixed elsewhere.

No new information on what else could be done to ease monetary policy is found in the latest minutes, indicating that further easing measures are “not imminent”, according to CBA senior economist Belinda Allen.

“The RBA now seems content to wait and assess both the performance of the economy in Q3 and into Q4, and perhaps, more importantly, the Federal Budget due 6 October.”

The latest monthly data from Corelogic recorded a 0.4 per cent drop in August, the fourth consecutive month of national house value falls.

Melbourne property prices recorded the biggest fall with a 1.2 per cent decline for the month, while Sydney prices declined 0.5 per cent.