Queensland Leads Approvals Slump

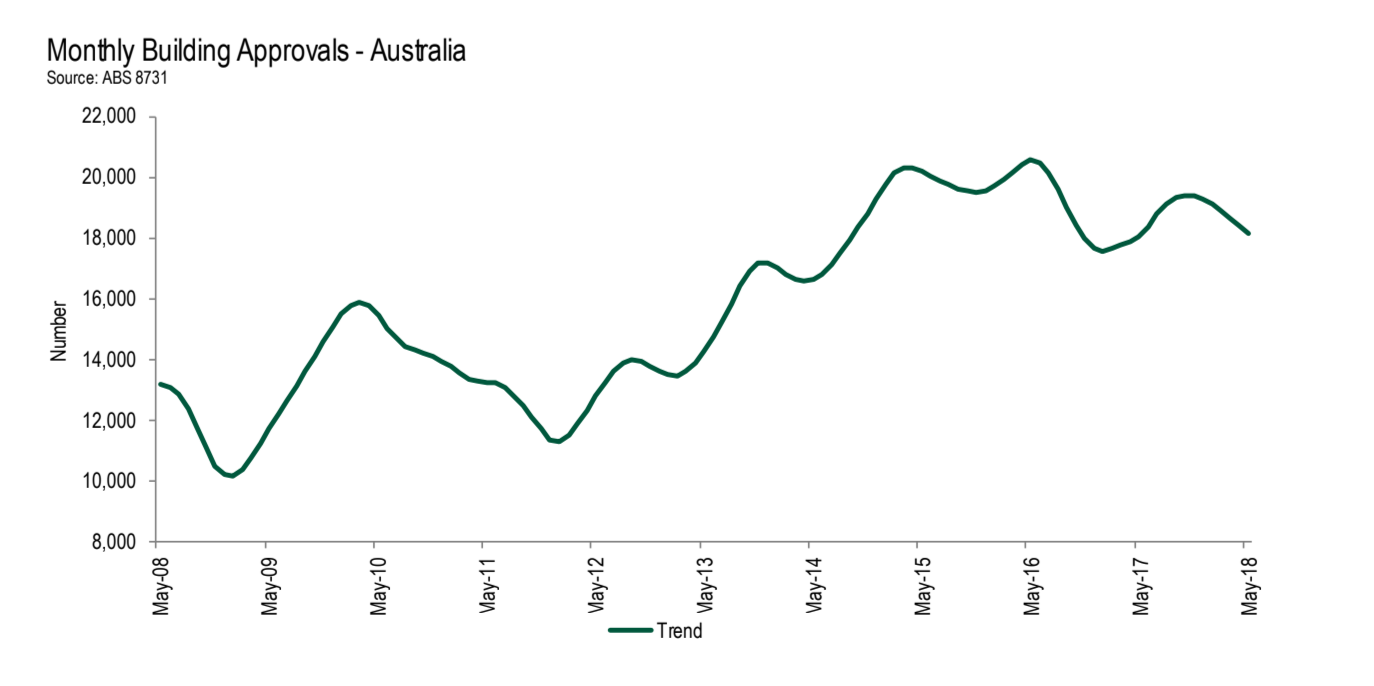

The volume of new home approvals has cooled in the first half of 2018, with the latest ABS data revealing yet another fall in May.

Last month’s 3.2 per cent slump for new building approvals was less marked than April’s, with apartments and townhouses picking up to post a 4.3 per cent gain, in seasonally-adjusted terms.

The reduction in approvals was modest, despite forecasts of little to no change for May.

Queensland suffered the biggest housing approval setback, falling a massive 26.7 per cent.

“This modest reduction in approvals is consistent with other data showing that the housing market is cooling from a record high volume,” Housing Industry Australia principal economist Tim Reardon said.

Related: Sydney Home to Nine of the Top 10 Worst Performing Regions

Despite a tougher lending environment, the detached house building market remains resilient, with the volume of house approvals 3.1 per cent higher in May than a year earlier.

HIA’s monthly home sales figures reported sales declining in May – continuing the downward trend in the first half of the year.

“The market is cooling for a number of reasons including a slowdown in inward migration since July 2017, constraints on investor finance imposed by state and federal governments and falling house prices.

Slowing population growth and difficulty accessing finance hasn't helped, Reardon says.

“Falling house prices in metropolitan areas have also contributed to banks tightening their lending conditions which have further constrained the availability of finance.

“We expect the trend – of slowing building approvals – to be modest throughout 2018 as employment and economic growth remain solid,” Reardon said.

RBA keeps rates on hold at 1.5pc

Meanwhile, the RBA announced on Tuesday that it will keep its official interest rates unchanged at 1.5 per cent in July – for a record 23 months in a row.

The widely-anticipated decision to leave the cash rate unchanged was made despite a stronger economic outlook.

Reserve Bank governor Philip Lowe was more optimistic this month, noting that the “rate of wages growth appears to have troughed and there are increasing reports of skills shortages in some areas.”