Queensland on Cusp of Property Boom

Queensland is booming according to Westpac’s Housing Pulse Report.

Senior economist Matthew Hassan said the state’s markets were now very tight with “sales running well ahead of listings and extremely tight rental vacancy rates in most areas” tipping the market into a boom.

“Market turnover has continued to hold well above pre–pandemic levels and prices are pushing new historic highs,” Hassan said.

“While there are some soft patches—Brisbane’s inner city and tourism exposed areas—the state’s wider fundamentals remain very constructive.”

Domestic migration to the Sunshine Coast, Gold Coast and Cairns has bolstered a double digit price growth in the past six months. Westpac reported sales were running “well ahead of listings” down to just 3.4 months of sales in Brisbane, where the long run average was five months.

“The Queensland Consumer Housing Sentiment index points to more turnover gains ahead suggesting the market will become tighter still as 2021 unfolds,” Hassan said.

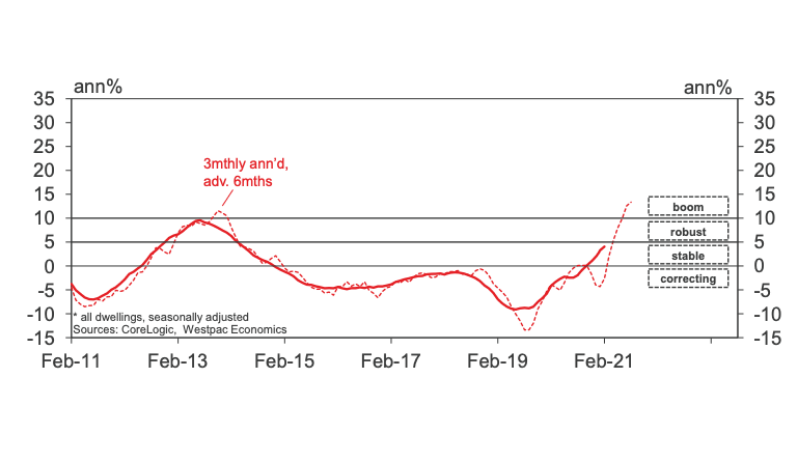

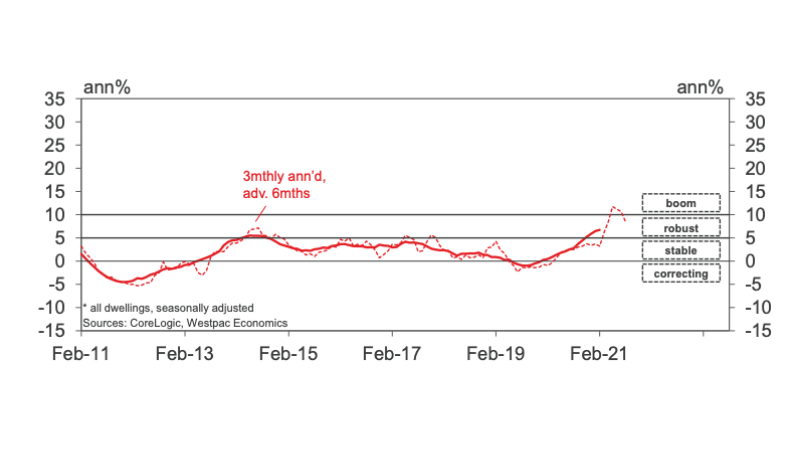

Brisbane house prices

^Source: Westpac Housing Pulse - February 21

Nationally Hassan said price expectations had continued to soar. The Westpac-MI Consumer House Price Expectations Index has increased 17.8 per cent since November, to a seven-year high of 154.7.

In light of a strong housing upswing Westpac economists are now tipping a return of prudential policy measures in the second half of 2022, to cause a flattening in 2023.

The meteoric rise of property prices over the next two years is not unique on the world stage according to Oxford Economics.

Over the past six months new house approvals and prices have also lifted in the United States, Canada and New Zealand, despite vastly different impacts from Covid-19.

In each instance very low interest rates, elevated household savings and shifts in preferences were fuelling the resurgence in housing investment, Oxford Economics reports.

NEW SOUTH WALES

Sydney dwelling prices were picking up, lifting 1.1 per cent over December and January, and February figures were showing a 1.6 per cent gain.

Hassan said units were still under-performing and restraining price gains in broader measures. Geography is still having a bearing on market performances, inner-city suburbs including Parramatta and Ryde were “sluggish” while regional areas including the Central Coast and Northern Beaches were rebounding strongly, as was regional NSW.

“Demand has run well ahead of listings in recent months, especially for houses [and] rental vacancy rates are showing tentative signs of levelling out,” Hassan said.

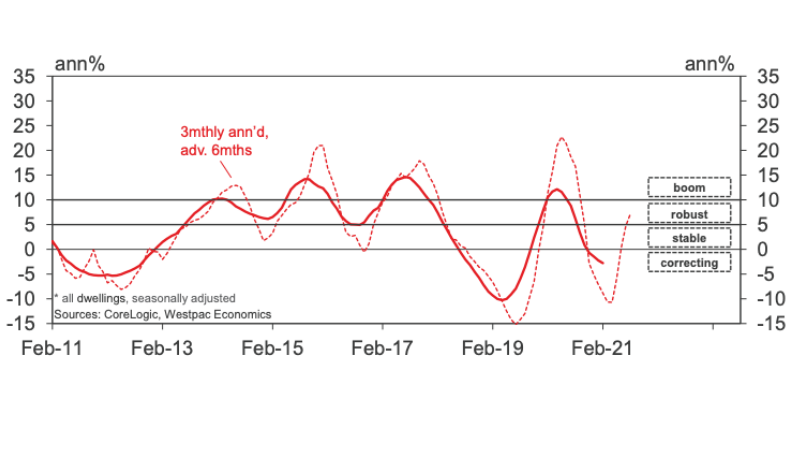

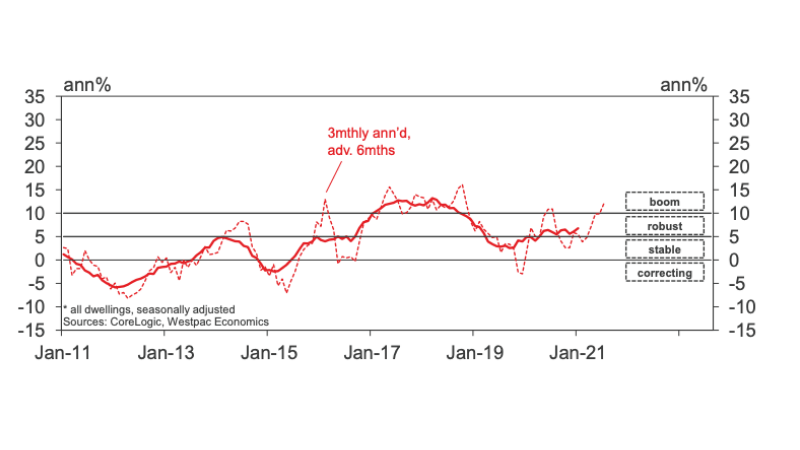

Sydney house prices

^Source: Westpac Housing Pulse - February 21

VICTORIA

Prices have started to recover in Victoria with a 1.5 per cent gain in the fourth quarter last year and a similar gain expected in this quarter. Hassan warned, however, while other states were nudging into boom territory, Victoria was just ticking into “robust gains”.

“By regions, Melbourne’s inner and inner East are still considerably weaker than the rest. In contrast, the Mornington Peninsula and regional areas are powering ahead,” Hassan said.

“While sales have run ahead of listings, the pace has been slower for units where unsold inventory is still running above long run averages. Rental vacancy rates are also blowing out with a worrying surge to what are very high levels by historical standards, pushing 6 per cent.”

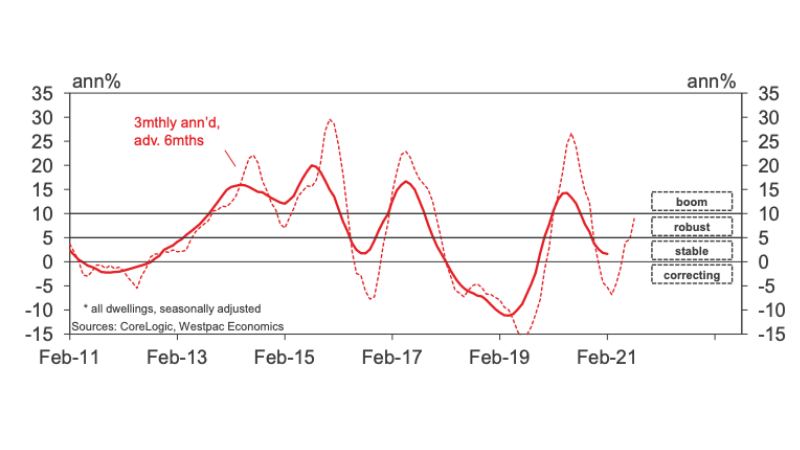

Melbourne house prices

^Source: Westpac Housing Pulse - February 21

WESTERN AUSTRALIA

Perth dwelling prices have risen at a robust double–digit annual pace over the past three months across all property segments. Gains have also been similar across all parts of Perth with strong rises in regional areas too.

Supply–demand fundamentals remain supportive with listings below their long run average in terms of months of sales and rental vacancy rates around 1 per cent.

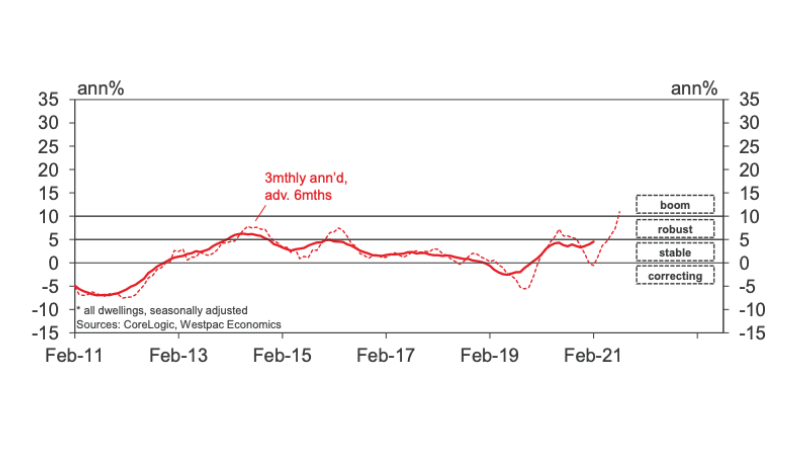

Perth house prices

^Source: Westpac Housing Pulse report - Feb 21

SOUTH AUSTRALIA

While the property market in South Australia has largely been unaffected by Covid-19, Westpac reported a sustained lift in dwelling prices.

Hassan said momentum was now about 10 per cent per annum across all property segments in both Adelaide and regional areas.

Adelaide house prices

^Source: Westpac Housing Pulse report - Feb 21

TASMANIA

Tasmania has had a lacklustre response according to the Westpac Housing Pulse report, signalling affordability was a constraint.

Prior to Covid-19 dwelling prices in Hobart had surged 40 per cent over four years, outperforming all other cities. The latest recovery is seeing prices tracking toward 10 per cent gains, with a subdued momentum in the middle and top-tier properties.

Regionally the gains are also outstripping the capital city, but Westpac senior economist Matthew Hassan said they were forecasting a sustained positive momentum for prices.

Hobart house prices

^Source: Westpac Housing Pulse report - Feb 21