Queensland Population Growth Fuels Property Boom

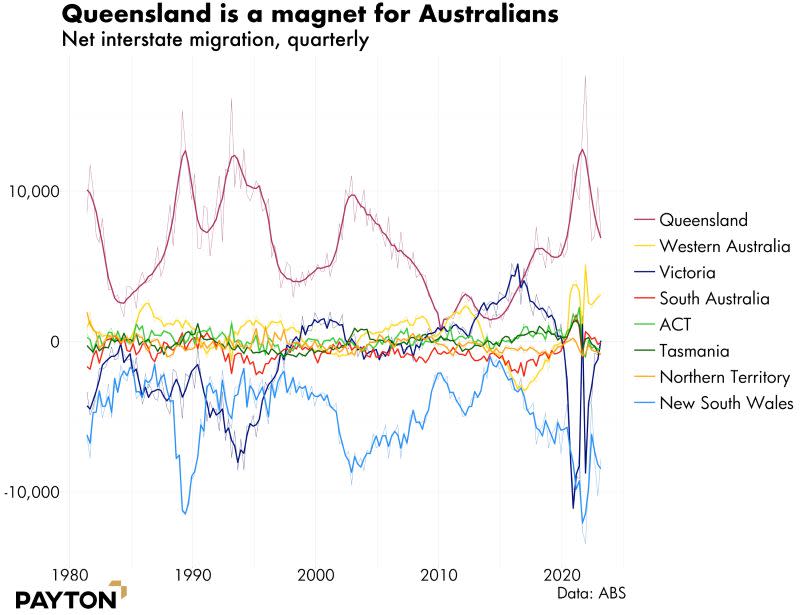

Queensland is experiencing a notable surge in population. While the state has long been a favoured destination for international migrants, the recent upswing is predominantly attributed to interstate migration, with Australians seeking a change in lifestyle choosing to relocate northward.

This influx of residents presents a significant opportunity for property developers, especially given that these newcomers rank among the wealthiest globally.

Australians, boasting the third-highest mean household net worth worldwide, bring heightened expectations for housing standards to Queensland. Seizing this opportunity, Payton Capital is playing a pivotal role in supporting property developers to capitalise on the increasing demand in the state.

Jeremy Townend, head of lending at Payton Capital, highlights the company’s commitment to this opportunity, stating, “Our new Queensland office is now operational, ensuring our team is on the ground and actively collaborating with property developers in the region to maximise the potential in the residential housing market”.

Payton Capital offers agile and bespoke lending solutions, providing developers with the capital needed to move swiftly and meet the housing needs of the new arrivals in the state.

The substantial influx of financially resourced migrants is injecting significant momentum into Queensland’s property sector.

The state’s property market remains robust, with a notable dwelling price growth of 7.8 per cent over the year to November 2023, according to CoreLogic.

Despite the positive momentum, building approvals in the state trail those in NSW and Victoria, creating a prime opportunity for property developers with the backing of Payton Capital to expedite projects and meet the rising demand.

Beyond Brisbane, Queensland’s decentralised nature sets it apart from other Australian states, with diverse markets and ample opportunities for development.

With at least nine towns boasting populations exceeding 50,000 along the coast, from the Gold Coast to Cairns, property developers have a varied landscape to explore.

The Sunshine Coast, just north of Brisbane, stands out as the preferred destination for those leaving other capital cities, as per analysis by Commonwealth Bank.

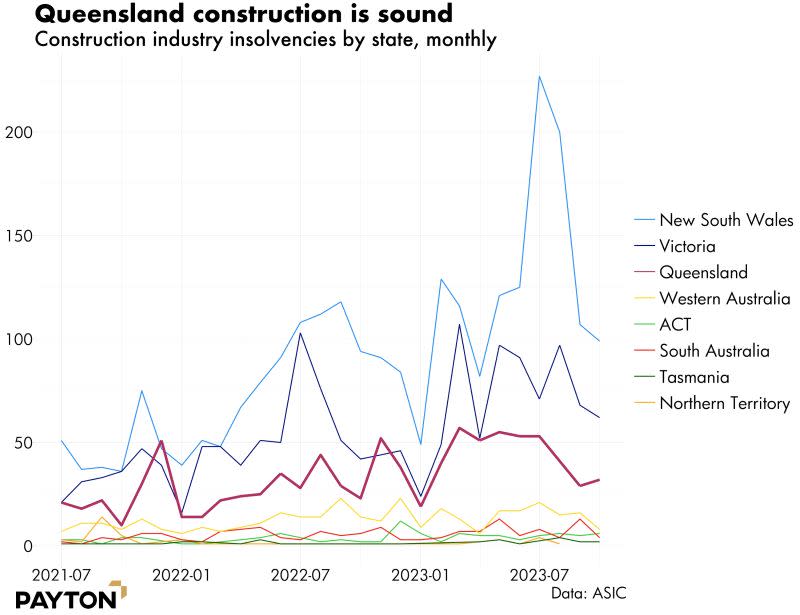

The construction sector in Queensland reflects the straightforward nature of the market. High prices and moderate pipelines of supply have created a stable level of risk.

The minimal rise in insolvencies from the lows of 2021 further underscores favourable conditions for property developers, especially with the tailored lending solutions offered by Payton Capital.

As Australia’s population continues to grow rapidly, the ongoing trend of internal migration to Queensland is expected to persist.

Retirees, remote workers and families seeking relief from soaring property prices in Melbourne and Sydney are contributing to sustained strong demand for homes in the region.

With Payton Capital’s support, property developers are well-positioned to play a crucial role in shaping Queensland’s evolving real estate landscape and meeting the housing needs of the expanding population.

For more information on how Payton Capital could assist you with lending for your next project, visit www.payton.com.au or email borrow@payton.com.au.

The Urban Developer is proud to partner with Payton Capital to deliver this article to you. In doing so, we can continue to publish our daily news, information, insights and opinion to you, our valued readers.