RBA Hints At Historic Interest Rate Cut

Reserve Bank of Australia governor Philip Lowe has indicated the official cash rate could be cut for the third time this year, as the board prepares to meet next week to “again take stock of the evidence”.

In a bid to tackle weak household spending and rising unemployment, Lowe said that “further monetary easing may well be required”.

Money markets are pricing an 80 per cent chance of a cut when the RBA meet on 1 October. A decision to cut could see interest rates at a fresh new low of 0.75 per cent.

The central bank lowered the cash rate in June and July to the current historic low of 1 per cent following an almost three year hold.

“It is nevertheless likely that an extended period of low-interest rates will be required in Australia to make progress in reducing unemployment and achieving more assured progress towards the inflation target,” Lowe said in his economic update address to the business chamber in Armidale on Tuesday.

“The board is prepared to ease monetary policy further if needed to support sustainable growth in the economy, make further progress towards full employment, and achieve the inflation target over time.”

Latest ABS figures reveal that the unemployment rate increased to 5.3 per cent in August, the RBA aims to have the unemployment rate at at least 4.5 per cent to put upward pressure on wage growth.

On the international front, Lowe said interest rates around the world are low and moving lower.

“There are many reasons for this, but the central reason is that the global appetite to save is elevated relative to the global appetite to use those savings to invest in new productive capital,” he said.

Inflation has been below the 2–3 per cent medium-term target range and is expected to pick up, Lowe said it’s expected to remain below the midpoint of the target range for “some time to come”.

A ‘gentle turning point’

Weak growth in household spending was partly attributed to an adjustment in the housing market, with falling house prices having a knock-on affect on the decline in housing turnover, the turnover rate has declined to the lowest level in more than 20 years.

But looking forward, the RBA says there are some signs that, following a soft patch, the economy has “reached a gentle turning point”.

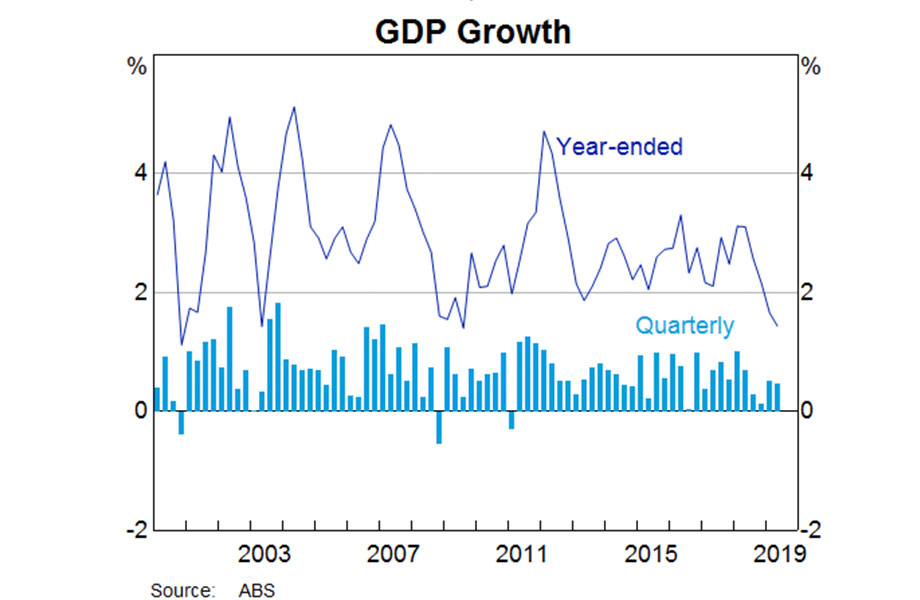

“This is evident in the fact that GDP growth over the first half of this year was stronger than it was over the second half of last year.”

“We are expecting a further modest pick-up in the quarters ahead.”

The central bank said this outlook was supported by a number of factors, including the lower interest rates, recent tax cuts, the depreciation of the Australian dollar, infrastructure spending, the stabilisation of the housing markets in some cities along with a brighter outlook in the resources sector.

“It is reasonable to expect that, together, these factors will see growth in the Australian economy return to around its trend rate next year, although there are some obvious risks to this outlook,” Lowe said.