Regions Still Reeling from Rates Rises, Shifting Migration

While regional housing values have risen during the past five months, a new analysis of year-on-year performance shows many markets are still reeling from high interest rates and a shift in migration patterns back to pre-Covid levels.

CoreLogic’s quarterly Regional Market Update, which looks at Australia’s 25 largest non-capital city regions, found 18 areas recorded an annual decline in house values for the year to July, 2023.

Houses

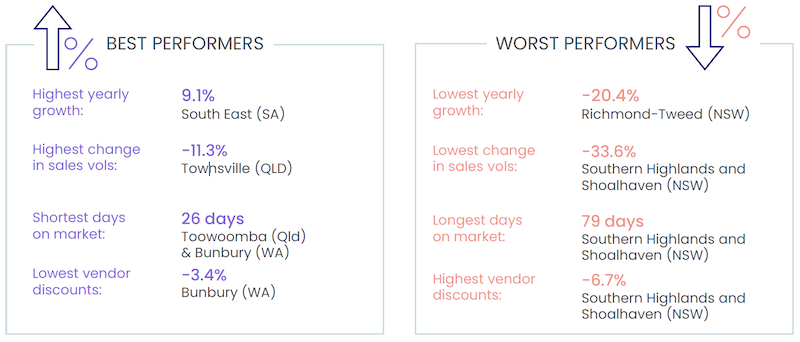

Of the seven markets where values rose, houses in the south-east region of South Australia, which includes tourism hotspots Kangaroo Island, the Fleurieu Peninsula and the Limestone Coast, had the largest annual growth for the fourth consecutive report.

Values lifted 9.1 per cent in the year to July, a small dip from 10.8 per cent three months ago.

Queensland was a big winner for regional market capital growth, including Central Queensland (2.7 per cent), neighbouring Mackay-Isaac-Whitsunday (1.2 per cent), Toowoomba (0.7 per cent), and Cairns (0.5 per cent), with Bunbury, WA (3.7 per cent) and New England and North West, NSW (1.6 per cent) rounding out the top seven.

In contrast, the weakest conditions during the past year persisted in NSW lifestyle markets Richmond-Tweed (-20.4 per cent) and Southern Highlands and Shoalhaven (-15.0 per cent), although the annual pace of declines is easing.

Victoria’s Ballarat (-11.2 per cent) and Geelong (-10.4 per cent) were the only other regions included in the report to record a double digit decline in house values during the past year.

Regional housing values to July 2023: House

CoreLogic Australia head of research Eliza Owen said despite regional Australian home values rising for the past five months, values remain -5.6 per cent below this time last year, and sales volumes are down -21.3 per cent.

“While the market is starting to recover, value growth is largely being led by capital city markets, reflecting milder housing demand across regional Australia as demographic patterns normalise,” she said.

“Year-on-year growth was hard to find across regional Australia in the past 12 months.

“The markets that had an increase were largely more affordable and more rural. Presumably, lower value assets have been more resilient to increases in interest costs because they require lower indebtedness.

“Additionally, targeted migration programs also tend to focus on parts of regional Australia as a pathway to permanent residence, so some of the more rural, regional parts of the country may have seen sustained housing demand as international travel restrictions have lifted through 2022."

Every region recorded a decline in house sales volumes over the 12 months to May.

Townsville recorded the smallest decline at 11.3 per cent, followed by Central Queensland (-12.7 per cent). Six regions recorded a decline of at least 30 per cent, with five of these in NSW.

The Southern Highlands and Shoalhaven region recorded the largest drop in sales (-33.6 per cent), largest vendor discounting rate (-6.7 per cent), and longest time on market (79 days), which Owen said was almost twice as long to sell than a year ago.

Unit markets

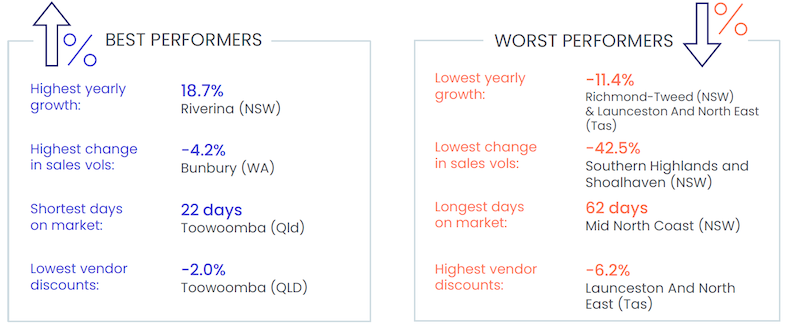

Five of Australia’s regional unit markets recorded positive annual growth for the period, led by NSW’s Riverina region for the second consecutive time.

Unit values rose 18.7 per cent, more than double the second and third strongest markets Cairns (9.2 per cent) and Hume, Victoria (9.1 per cent).

At the other end of the scale, Launceston and North-East Tasmania and Richmond-Tweed recorded the equal largest decline in unit values with 11.4 per cent.

Regional housing values to July 2023: Units

Unit sales volumes declined in all regions over the year to May. Bunbury recorded the smallest decline (4.2 per cent) while Southern Highlands and Shoalhaven recorded the largest (42.5 per cent).

Toowoomba recorded the shortest time on market at just 22 days and lowest vendor discounting rate of -2.0 per cent. Units across NSW’s Mid North Coast were the slowest to be sold at 62 days while vendors across the Launceston and North East region were offering the largest discounts at -6.2 per cent.

Regional outlook

Owen said the easiest way to characterise the markets most impacted by rate rises was the price point.

“The higher the value of the market, the more likely it’s had poorer performance in the past year. But the good news for sellers is that these markets appear to have passed through the depths of the downswing,” she said.

“Using Richmond-Tweed houses as an example, while the asset has seen an annual decline of 20.4 per cent, this is up from a year-on-year fall of 24.2 per cent in the 12 months to April.

“In two of the past three months, houses in this market have actually increased.

“While there’s still a few headwinds on the horizon for housing market performance more broadly, popular high-end markets could start to stabilise as mortgage rates move closer to a peak, and capital city markets become more expensive.”