Regions ‘Streets Ahead’ as Covid-19 Curbs House Prices

Tasmania boasted the nation's best performing regional house and unit markets in April, while Western Australia's Bunbury bottomed out over the same period.

Dynamics will shift, though, as the real economic impact of Covid-19 is revealed, with regional locations "streets ahead" of capital cities for both capital growth and rental return, analysts say.

Corelogic's regional market update, which looks at capital growth over the year to April, saw Tasmania’s Launceston and north east region retain the title of top performer across both the house and unit market, also topping the list over the January 2020 quarter.

Houses continued to be the better performer, with 21 of the 25 house markets included in the analysis recording a rise in value, while units had fewer regions—16 of 25—where growth was positive over the year to April.

CoreLogic's head of research, Eliza Owen, noted that regional dynamics would begin to shift amid the Covid-19 downturn.

“Launceston and north east Tasmania have unsurprisingly seen an uplift due to a spillover of demand from Hobart, and a bullish sentiment towards Tasmanian property markets.

"However, this is annual data, and captures much of the demand prior to the onset of Covid-19.

"Monthly Corelogic data is showing rents and property values have started to slip across Hobart, which may draw local demand away from regional areas and back toward the capital city over 2020."

While Western Australia's Bunbury region saw the lowest yearly growth, with house values down -6.4 per cent over the same period, Owen predicts that parts of regional WA may fare better in terms of stability in housing values over 2020, off the back of increasing optimism in mining as China recovers from the pandemic.

"This could represent a reversal of the housing demand dynamics we’ve observed over the past few years," Owen said.

In terms of sales volumes, NSW's Southern Highlands and Shoalhaven saw the highest change in sales volumes for houses across the region, up 21.6 per cent over the year to April 2020, followed by Illawarra, where house sales increased by 18.4 per cent.

The Launceston and North East region saw a -11.3 per cent decline in house sales over the year.

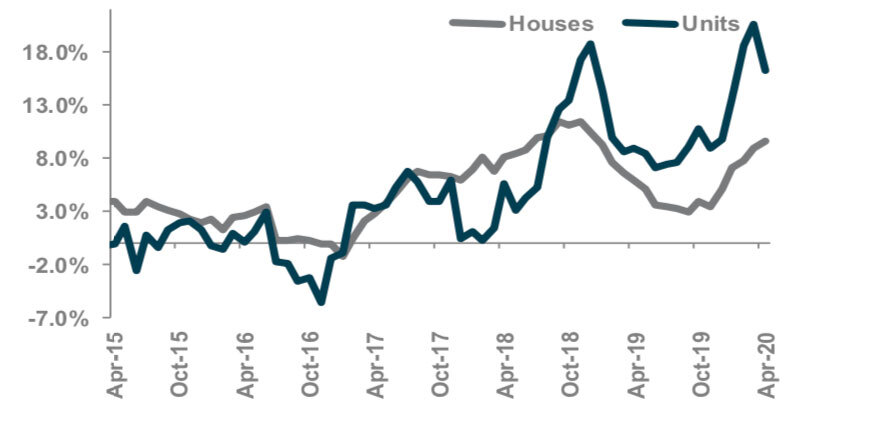

Corelogic home value index

^ Source: CoreLogic

Looking at days on market, the quickest selling region for houses over the year to April 2020 was Ballarat, in Victoria, where it's currently taking around 30 days to secure a sale.

The region with the longest days on market over the year was the New England and North West region in NSW, where houses are taking just under 100 days to sell.

The lowest discounts are being offered across NSW's Central West region, with a discount rate of -4.0 per cent, while vendors in Central Queensland are offering discounts of -6.9 per cent in order to secure a sale.

Across Australia's regional unit market, Launceston and North East region again recorded the largest annual growth rate of 16.2 per cent, while Victoria's Hume region saw the lowest yearly growth, at -10.3 per cent.

Reflecting results in housing data, units across Ballarat, in Victoria, currently sell quicker than any other region, with the average unit selling in 30 days.

Selling conditions are proving more challenging across both Queensland's Wide Bay region, along with WA's Bunbury, with units taking more than 100 days to sell.

The Mackay-Isaac-Whitsunday region in Queensland is offering the largest discounts in order to secure a sale—-8.1 per cent— while the lowest discounts are being offered across the Ballarat region in Victoria, at 2.3 per cent.

Median house price change: Five years to December 2019

^ Source: Propertyology

In terms of property rankings for capital cities, analysis based on Corelogic's data puts Brisbane in equal second place behind Canberra, a result that Propertyology's head of research Simon Pressley says confirms the regions are "streets ahead" for both capital growth and rental return.

"The facts are that Australia’s best-performed property markets over the last five years have not been the biggest cities.

"Official data confirms that various regional locations, along with Hobart, were streets ahead of all other capital cities for both capital growth and rental return," Pressley said.

Predicting that lower profile property markets will continue to be the nation's strongest performers in years to come, Pressley said that the impact of Covid-19 going forward could be seen by looking back.

Pressley believes the outlook for Canberra’s detached housing market is bright thanks to an anticipated lower economic impact from Covid-19.

"Canberra’s economy was already strong before the germ arrived, and with approximately 100,000 of its 213,000 workforce in the public sector it will be significantly shielded through the Covid-19 job lockdown period," Pressley said.

"Logic would also suggest an expansion of Canberra’s public sector workforce will be needed to help administer the federal government’s record $320 billion Covid-19 support packages."

Brisbane’s property market is in second spot, with soft private sector job growth seen as "an important missing link for otherwise solid fundamentals", Pressley said, adding that Hobart's "reasonable medium-term credentials" include this month’s commitment from the state government to embark on the biggest construction program in the state’s history.