Rental Growth Accelerates over 2017, Will Likely Soften in 2018: Report

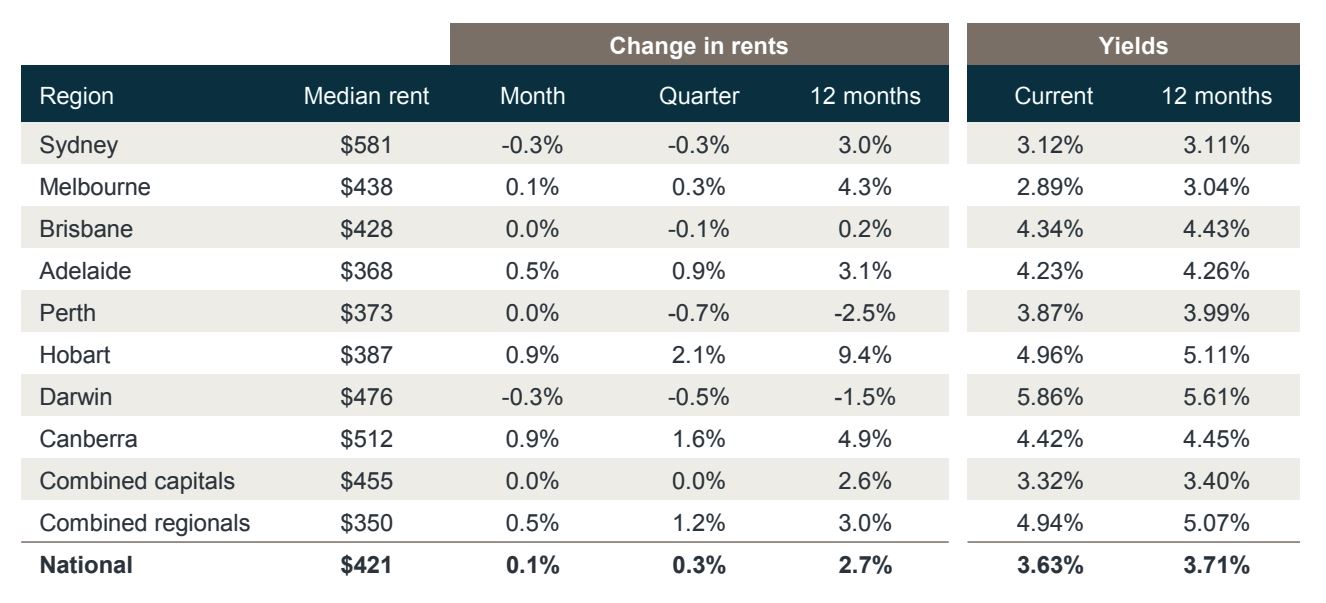

Australian capital cities have experienced a stronger annual change in rents over 2017, growing 2.7 per cent across the nation – a significant increase on the 1.1 per cent change over the 2016 calendar year.

Over the final quarter of 2017, rents rose by 0.3 per cent, although rental yields remain flat. The result is the weakest fourth quarter since 2014. Combined capital city rents remained unchanged while combined regional markets recorded growth of 1.2 per cent.

Hobart produced the highest rental growth over the quarter at 2.1 per cent, which is unsurprising given the capital was the only city to reach double-digit annual growth in house and unit rental prices in the final quarter of 2017.

"Hobart has led both value and rental growth over 2017 highlighting strong demand for housing. While Hobart remains the most affordable capital city in which to purchase a home, the cost of renting is now higher in Hobart than both Adelaide and Perth."

--CoreLogic research analyst Cameron Kusher

Across the individual capital cities, rental rates were higher in Melbourne, Adelaide and Canberra, while rents fell over the quarter in Sydney, Brisbane, Perth and Darwin. The quarterly change in rents was lower than the previous quarter in Sydney, Melbourne and Darwin while it remained unchanged elsewhere.

Although rental growth has accelerated over the past 12 months, the quarterly data is pointing to softer growth. According to the report, the first quarter of each year typically shows strong positive seasonality, so it will be interesting to see how growth over the first quarter of 2018 compares to 2017. The final quarter of 2017 was relatively weaker for rental growth compared to the previous year.

CoreLogic research analyst Cameron Kusher says that with rental growth outpacing dwelling value growth, there may be some moderate improvement in gross rental yields over the coming 12 months.

Median weekly rents nationally are $420 for houses and $425 for units.