Covid Keeps City Rental Vacancy Rates Up

The national residential rental vacancy rate declined again in July in all capital cities except Melbourne, which recorded yet another increase.

National vacancy tightened slightly to 2.1 per cent in July from 2.2 last month according to the SQM Research.

Despite the national drop, Melbourne had a 0.1 per cent increase to 3.1 per cent for July and Sydney recorded the highest rental vacancy rate in the nation.

The SQM Research also showed capital city average asking rents decreased 0.6 per cent for houses and 0.9 per cent for units for the week ending 4 August to $534 and $419 per week respectively.

Sydney, Melbourne and Brisbane all recorded declines in asking rents for both houses and units over the month.

Melbourne had the largest decrease of 1.4 per cent for both houses and units.

Australian capital city vacancy rates

| City | July 2020 vacancies | July 2020 vacancy rate | June 2020 vacancy rate | July 2019 vacancy rate |

|---|---|---|---|---|

| Sydney | 26,506 | 3.6% | 3.8% | 3.5% |

| Melbourne | 18,746 | 3.1% | 3.0% | 2.0% |

| Brisbane | 7,593 | 2.2% | 2.4% | 2.4% |

| Perth | 2,803 | 1.3% | 1.5% | 3.0% |

| Adelaide | 1,809 | 0.9% | 1.0% | 1.1% |

| Canberra | 653 | 1.0% | 1.1% | 1.1% |

| Darwin | 453 | 1.4% | 1.8% | 2.9% |

| Hobart | 212 | 0.7% | 0.9% | 0.5% |

| National | 71,760 | 2.1% | 2.2% | 2.3% |

^Source: SQM Research, July 2020 for online listings, advertised three or more weeks

SQM managing director Louis Christopher said the rental vacancies were worse in places dealing with Covid-19, particularly Melbourne.

“We are now observing a clear trend of reduced rental vacancies in outer suburban locations and regional locations around Australia,” Christopher said.

“However, when looking into the numbers it is clear there are still very elevated levels of rental vacancies in the inner-city locations.

“We believe there has been a move towards outer regional living and away from high density areas. This very likely has been as a result of fears surrounding coronavirus and the ability for many employees to work remotely.”

House prices have also remained stronger in regional areas during the pandemic than their metropolitan counterparts as more people move to the area.

Related: Airbnb Spurs Surprise Fall in Vacancy Rates

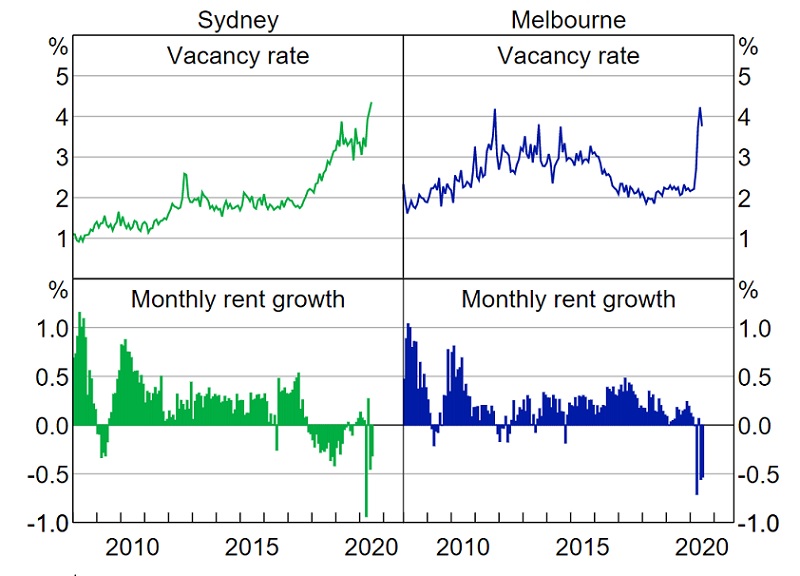

Advertised rents and vacancy rates

^Source: CoreLogic, RBA, REINSW, REIV; seasonally adjusted

In its quarterly monetary statement, the Reserve Bank of Australia noted that the rental market was not faring as well in Melbourne or Sydney as the rest of the country.

“One important factor affecting rental market conditions has been the decline in international visitors and domestic business travel because of travel restrictions,” the RBA said.

“This has encouraged some landlords to offer their short-term rental accommodation on the long-term market, increasing the available rental stock. ”

Although new residential bond lodgements rose sharply in May, some tenants entered into new lease agreements with lower rates.

“Nationally, around 5 per cent of residential tenants have obtained rental discounts over recent months,” the RBA said.

“Instances of rent deferrals remain much higher than usual. Lower rental income could present cash flow challenges for some property investors if these conditions persist, and is also likely to weigh on investor demand for new properties.”