Record Rental Listings Flood Sydney, Melbourne

An oversupply of properties is making it cheaper to rent in Australia’s biggest cities as landlords struggle to fill empty properties or retain existing tenants.

According to the latest ANZ Corelogic housing affordability report, loss of income and travel restrictions have contributed to excess stock levels across Sydney and Melbourne, while all other capital cities saw a drop in total rental listings.

Between March and June, inner Melbourne recorded a 57 per cent increase in advertised rental properties while Sydney’s city and inner south both recorded a 53 per cent jump.

New rent listings across the combined capital cities increased 2.2 per cent between the 28 days ending 28 June, and the 28 days ending 31st of May.

Analysts pointed to a number of determining factors that were increasing supply levels, particularly in inner-city areas of Melbourne and Sydney, where there was a greater exposure to overseas migration.

Provisional estimates from the ABS revealed there was a 98.8 per cent decline in overseas arrivals to Australia in May 2020 compared with May 2019.

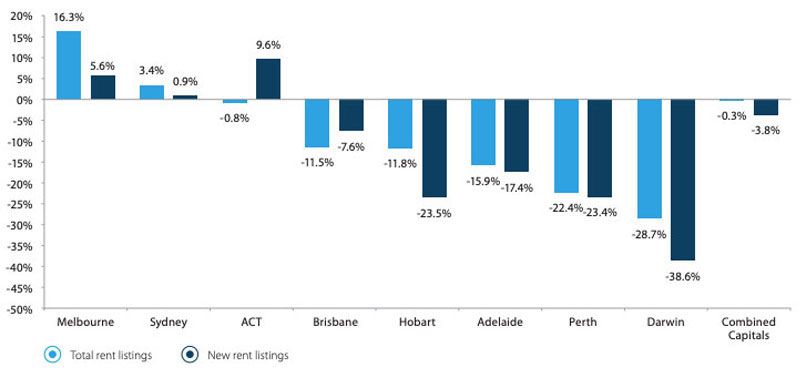

Change in total and new rent listings

^ Mar 15-June 28. Source: Corelogic

Overlaying the slowdown in migration, significant job losses—driven by lockdown measures in response to the pandemic—had also inflated rental listings.

“While there has been a formal program to defer mortgage payments, relief for renters has been much less defined,” ANZ economist Felicity Emmett said.

“The financial impact has not been evenly felt, and the stimulus measures designed to offset it, will have varying impacts of their own.”

Emmett highlighted Melbourne and Sydney for their “service economies”, noting people working in industries hardest hit by Covid-19 were also most likely to rent.

“Nearly 40 per cent of people who work in the accommodation and food services sectors rent,” Emmett said.

“Between the weeks ending 14 March and 27 June, 21 per cent of hospitality workers lost their jobs, compared to an average of 6 per cent across all industries.”

Another factor contributing to increased rental supply is the conversion of short-term accommodation—namely Airbnb—to the long-term rental market.

Researchers from the University of Queensland estimate that 4 per cent of the country’s housing stock had been used as Airbnb rentals between July 2016 and February 2019.

Rent listings

| SA4 Region Name | Total Listings Count - 28 days to 15 March | Total Listings Count - 28 days to 28 June | Change in Total Listings |

|---|---|---|---|

| Melbourne - Inner | 7,011 | 11,019 | 57.2% |

| Sydney - City and Inner South | 3,611 | 5,530 | 53.1% |

| Sydney - Eastern Suburbs | 2,189 | 3,094 | 41.3% |

| Melbourne - Inner East | 1,990 | 2,382 | 19.7% |

| Melbourne - Inner South | 2,218 | 2,654 | 19.7% |

| Sydney - Inner West | 2,421 | 2,729 | 12.7% |

| Brisbane Inner City | 2,426 | 2,665 | 9.9% |

| Sydney - North Sydney and Hornsby | 3,104 | 3,293 | 6.1% |

| Adelaide - Central and Hills | 1,060 | 1,116 | 5.3% |

| Gold Coast | 2,832 | 2,977 | 5.1% |

^ Source: Corelogic

“Before the onset of the pandemic in Australia, investor participation in the housing market was at its lowest since 2001,” Corelogic head of research Eliza Owen said.

“Investor finance fell sharply over April and May due to high levels of uncertainty.

“If sustained, this suggests that the decline in demand for rentals could be partially offset by a decline in the supply of rental property.”

Owen noted Sydney regions with the steepest decline in rental values between March and June are the City and Inner South down 4.1 per cent, followed by Sydney’s Eastern Suburbs with a loss of -3.7 per cent.

Melbourne rents have slipped 1.0 per cent, driven by a 2.0 per cent decline in unit rents, while house rents declined by a smaller 0.3 per cent.

The Brisbane rent market has had the weakest growth in rent values outside of Sydney, Perth and Darwin, with annualised rental value growth of 0.6 per cent over the past 5 years.

Rent values across Hobart have seen the steepest rate of decline of the capital markets from March to June, falling 2.3 per cent over the period.

“Rental affordability already showed signs of worsening in four of the eight capital city markets over the year to March 2020,” Emmett said.

“Affordability may deteriorate further in the coming quarters due to job and income loss.

“For renters who are less affected, or unaffected by the Covid-19 downturn, affordability may improve markedly, depending on the region in which they are located.”