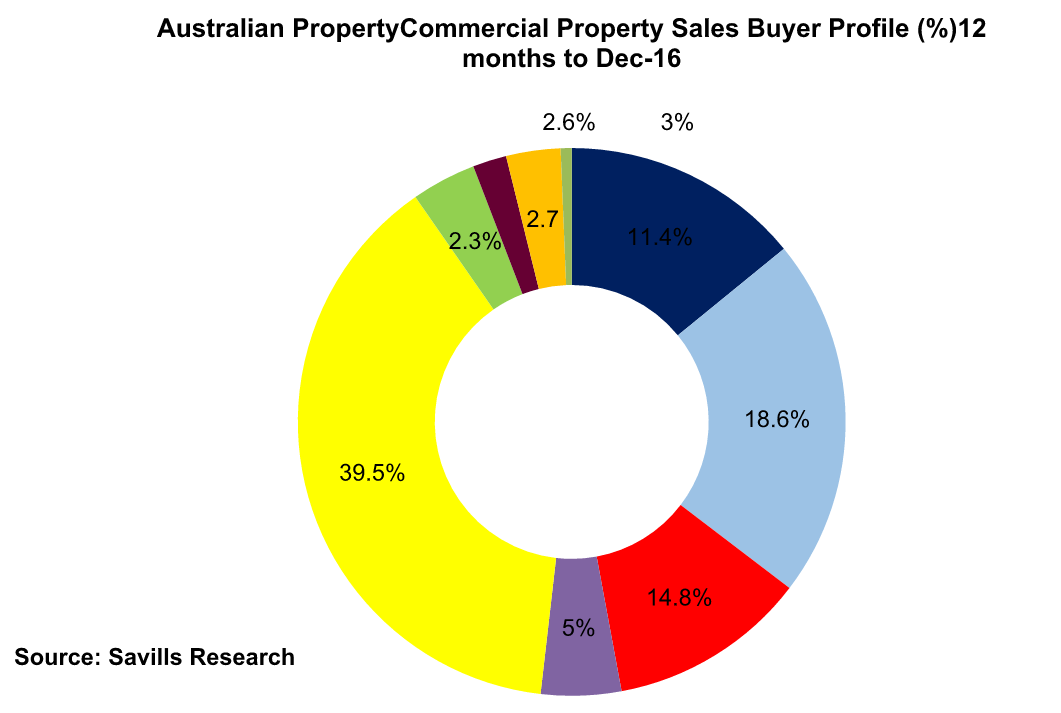

Australia’s commercial property investment market continues to power ahead with another $26.9 billion spent in the 12 months to December with Foreign Investors again dominating national investment with spending of more than $10 billion or 39.5 per cent of the market, according to Savills Australia’s latest research.

Savills National Head of Research Tony Crabb said while the 2016 total was down a significant 20 per cent on the record $33.7 billion spent in 2015 it was nevertheless a strong result at 4.7 per cent over the $25.7 billion, five year average.

"The 2015 calendar year was obviously the standout in what has been an extraordinary investment market over the last four or five years, and 2016 - up nearly 5 per cent on the longer term average - was also a strong result.

"Given all indications from Savills offices in Australia and across the globe there seems little doubt that both local and off-shore investor demand will deliver another year of outstanding growth in 2017, the only qualification being a possible lack of stock," Mr Crabb said.

He said investors spent $14 billion on office, $6.5 billion on retail and $6.4 billion on industrial property with Foreign Investors dominating all categories with 46 per cent of office, 31 per cent of retail and 36 per cent of industrial purchases.

The foreign contingent was one of four key investors who accounted for a combined 84.3 per cent of purchases including Funds (18.6%), Private Investors (14.8%) and Trusts (11.4%).

New South Wales led the national count with $6 billion in office sales - 43 per cent of the national total - including $3.5 billion in non-CBD sales (47 per cent of the national total).

In the retail sector Queensland dominated with 32 per cent of total sales ($2.1 billion), while the biggest industrial spend was in New South Wales with $2.7 billion.

Some of the bigger sales included:

Retail

David Jones (NSW) - Scentre Group/Cbus $360 million

Forest Hill Chase (Vic) - Blackstone $267 million

St Collins Lane (Vic) - JP Morgan $247 million

Toombul Shopping Centre (Qld) - Mirvac $228 million

Casey Central (Vic) – M & G Real Estate $221 million

Industrial

Goodman Portfolio (NSW/Qld) – Blackstone – circa $1.2 billion*

JPMorgan portfolio (6 assets NSW) - $250 million

Oxford Cole Store Laverton (Vic) – Logos Property Group - $205 million

Portlink Industrial Estate (Vic) – Charter Hall - $215 million

Office

Southgate Complex (Vic) - ARA $578 million

1 Shelley St (NSW) – Charter Hall/Morgan Stanley - $525 million

420 George St (NSW) - Investa (75%) $442 million

890 Grenfell St (SA) - Blackstone $400 million