Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

The Reserve Bank of Australia has moved to increase the cash rate target 50 basis points to 1.35 per cent, which could further put the brakes on an easing housing market.

Announcing the third cash rate rise in as many months, RBA Governor Philip Lowe said global inflation was high with ongoing supply chain disruptions, the war in Ukraine and strong demand derailing productive capacity.

Lowe warned inflation was forecast to peak this year before normalising to a 2 to 3 per cent range next year.

“Global factors account for much of the increase in inflation in Australia, but domestic factors are also playing a role.

“Strong demand, a tight labour market and capacity constraints in some sectors are contributing to the upward pressure on prices.

“As global supply-side problems continue to ease and commodity prices stabilise, even if at a high level, inflation is expected to moderate.”

Lowe said the tight labour market would drive wage growth as unemployment remained steady at 3.9 per cent in May, the lowest rate in almost 50 years.

But the board is holding vigil over household spending, with budgets under pressure from higher prices and interest rates.

“Housing prices have also declined in some markets over recent months after the large increases of recent years,” Lowe said.

“The household saving rate remains higher than it was before the pandemic and many households have built up large financial buffers and are benefiting from stronger income growth.”

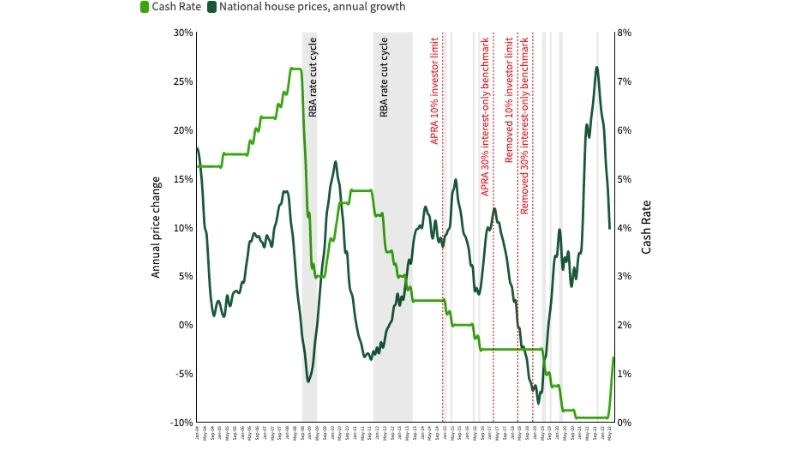

Cash rate and national house price growth

▲ Source: Domain

The board has signposted further rate hikes to ensure inflation returns to target over time.

Domain chief of research and economics Nicola Powell said the cash rate hike would add about $142 a month to repayments on a $500,000 home loan.

“This means borrowers are facing a cumulative increase of $363 since the first rate rise in May on a $500,000 home loan,” Powell said.

“Higher home loan costs will weigh on the demand for new home loans and are likely to result in fewer housing transactions.

“Sydney and Melbourne housing markets were already slowing in momentum prior to the RBA lifting rates, meaning this will add further pressure to the slowdown.”

Finsure Group chief executive Simon Bednar said interest rates would hit 2 per cent by the end of the year.

“The road to these new higher levels of official interest rates is an unpredictable one with many experts tipping the RBA to go hard every month until the end of this year,” Bednar said.

“There are also other schools of thought such as the central bank leaving the cash rate alone next month and also in October while it assesses the impact of its rate decisions on curbing inflation and on consumer sentiment.”

Bednar said despite a cooling in the housing market, lenders would still have to work hard to keep customers through incentives.