House, Land Sales Spark REIT ‘Mini-Boom’

The residential market is going through a short “mini-boom” with house and land package sales expected to grow between 7 and 10 per cent on last year, according to UBS.

Analysts from the investment bank gave their outlook on the Australian real estate sector following “stronger than expected results” as companies continue to face the fallout from Covid-19.

During the pandemic, ASX-listed company results revealed the impact of the pandemic, with only seven real estate investment trusts (REIT)s under UBS coverage providing guidance for the next financial year: Goodman Group, Charter Hall Group, Centuria Capital Group, Centuria Industrial REIT, Centuria Office REIT, Charter Hall Long WALE REIT, Rural Funds Group and BWP Trust.

The UBS analysts, Grant McCasker, Tom Bodor and Sam Merrick, said industrial REITs performed well and looking forward they also had a positive residential forecast.

“We expect affordable residential land sales to remain elevated in the first quarter of 2021 as a result of substantial government grants and stimulus, and ultra-low interest rates.”

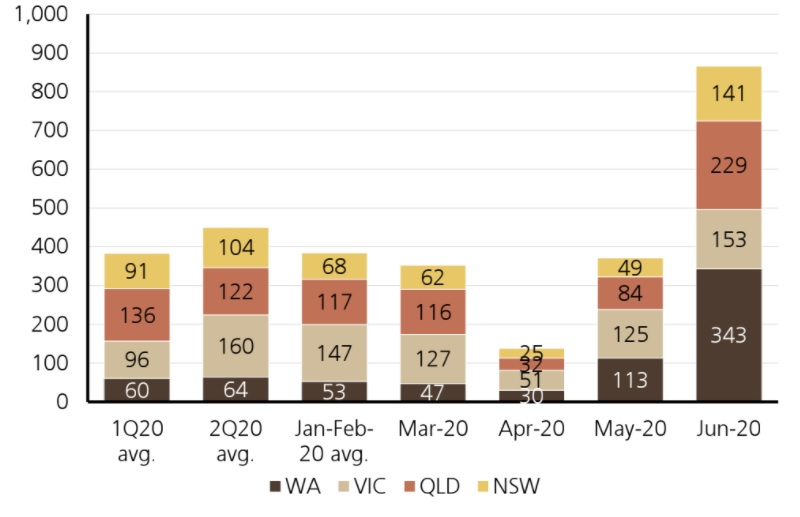

Stockland net sales by month

^ Source: UBS, Stockland

“Over the course of FY21 we expect sales to moderate towards long-term averages and while it is likely that stimulus is extended the current demand reflects a pull forward of sales,” the analysts said.

“We expect apartments to remain subdued; however land tax changes could stimulate build-to-rent—and in turn multi-res construction—without the typical requirement for pre-sales.”

Apartment sales had more challenges with a higher price points, a drop in investor demand and less people wanting to buy off-the-plan.

Building approvals for both units and apartments jumped in July and New South Wales was the first to halve tax for build-to-rent developments.

However, McCasker, Bodor and Merrick do not see the strong residential sales momentum seen in June and July continuing throughout 2021.

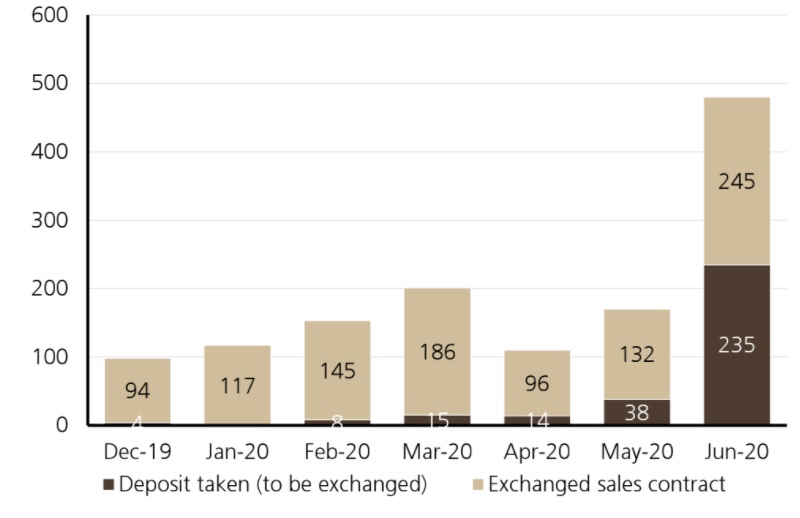

Mirvac monthly sales

^ Source: UBS, Mirvac

Office, retail in strong headwinds

The UBS analysts are in no doubt that working from home will continue, but for now, office usage is offset by social distancing.

“There was limited new evidence to settle questions over the working from home structural impact to office over the longer term.

“We see some risks that if the city remains quiet beyond Christmas, tenants may start to request abatements or rent relief despite being in a position to continue paying rent.”

Meanwhile, desk utilisation levels will hit office occupancy and retail will continue to come under scrutiny.

The analysts said substantial risks remain for the retail sub-sector, with tenants expected to reduce their footprints.

“[There will be] increased scrutiny on occupancy over the next nine months,” the analysts said.

A change in shoppers’ habits will also continue to increase the demand for logistics and industrial tenants to bolster their portfolios.