Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Australia’s property market has continued to prove its resilience with profitable sales and transaction numbers rising to the end of last year.

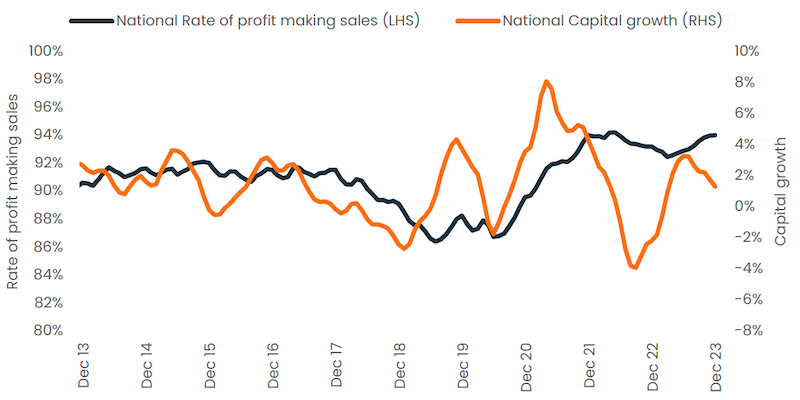

According to CoreLogic’s latest Pain & Gain report, which analysed about 90,000 resales across the last quarter of 2023, 94 per cent of transactions recorded a nominal gain.

The median gross profit rose to $310,000, marking an increase across all three metrics compared to the previous quarter’s results.

CoreLogic head of research Eliza Owen said the upward trajectory aligned with the sustained growth in home values throughout the year.

Loss-making resales declined to 6 per cent of resales in the three months to December, to a median of $40,000, as the volume of loss-making sales also fell by 5.1 per cent on the previous quarter.

Rolling quarterly rate of profit making sales versus rolling quarterly change in Home Value Index

The total nominal profit from resales in the December quarter reached $29.9 billion, an increase from the $28.7 billion of the previous quarter.

“The improvement in the key metrics of this report really highlight the improving profitability in the housing market since the recovery trend began in early 2023,” Owen said.

“We’ve observed a decline in the number of loss-making sales, which fell to just 5500 during the December quarter, even as overall transaction volumes increased.

“The broad-based increase in profitability and value across the Australian housing market helps to shore up financial stability at a time of stark increases in mortgage costs for some households.”

The December data also indicated a slight easing in short-term, loss-making resale conditions.

The portion of resales within a two-year hold period reduced from 7.9 per cent in the September quarter to 7.5 per cent.

However, there was an uptick of resales with a hold period of two to four years, from 13.3 per cent in the September quarter to 14 per cent.

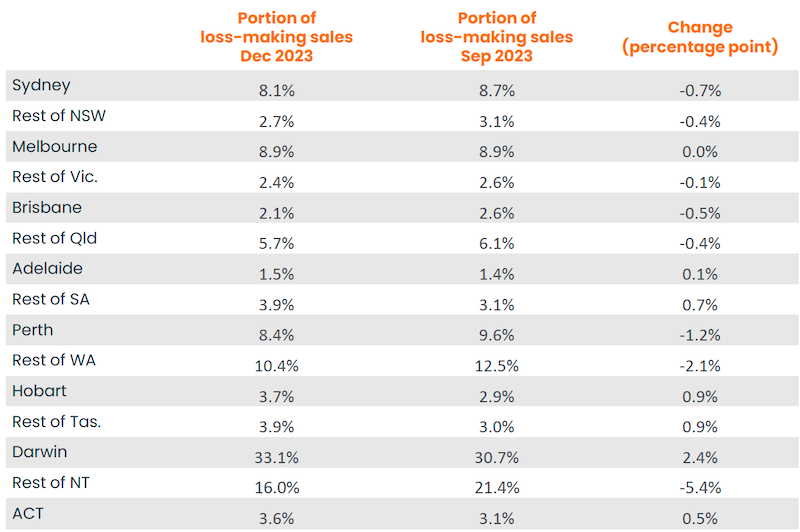

Loss-making sales rates by greater capital city and regional market

“This change reflects homes that were bought in 2020 and 2021, and it turned out to be the most popular timeframe for reselling properties in the quarter,” Owen said.

“While some of these sales might have been influenced by a rise in mortgage rates, it’s interesting to note that only 3.7 per cent of homes sold during this timeframe ended up making a nominal loss.”

Regional markets outperformed capital cities in terms of profitability, with 95.5 per cent of resales in regional Australia making a nominal gain, compared to 93.2 per cent in combined capitals, according to the report.

The increase in profitability was also more rapid across regional markets, indicating a strengthening trend outside major urban centres.

“Due to the lingering value add of the Covid-boom, regional markets are looking more profitable than capital cities,” Owen said.

“Regional markets typically have lower property prices and a different lifestyle appeal, and are outperforming capital cities in terms of profitability potentially due to sustained demand, limited housing supply, and a more favourable cost of living environment.”

Adelaide remained the most profitable capital city market for the fifth quarter straight, with more than 98 per cent of resales making a nominal gain in the three months to December.

The Perth market also had significant improvement in line with its high growth in home values, with the rate of loss-making sales reducing to 8.4 per cent, marking its most profitable period since July 2015.

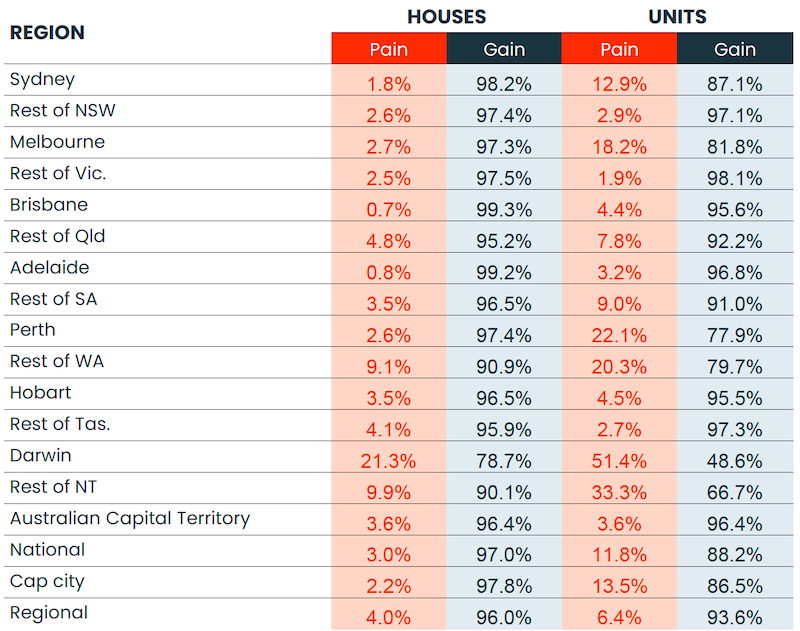

Houses continued to deliver higher rates of profit-making sales compared to units, with 97 per cent of house resales making a nominal gain, compared to 88.2 per cent of units.

However, Owen said, the gap in profitability between houses and units narrowed slightly, indicating a potential shift in market dynamics including affordability along with supply constraints.

Proportion of total resales at a loss/gain, houses v units

“Underlying land value, scarcity factor and desire for more space through the pandemic has led to a substantially larger rise in house values relative to unit values over the past four years,” she said.

“The relatively large premium on house values has put them out of reach for many, particularly first home buyers and lower-income households.

“As units become increasingly attractive to buyers, the price gap between detached housing and medium-to-high density options will close and profitability of units will improve.”

The median hold period of resales across Australia was 9 years in the December quarter, making November, 2014 the median initial purchase date for resales through the quarter. Since that date, national home values have increased 63 per cent.

At the national level, loss-making house sales had a median hold period of 5.9 years, where loss-making unit resales had a median hold period of 8.4 years.