Retail Sales to Bounce Back by 5pc: Deloitte

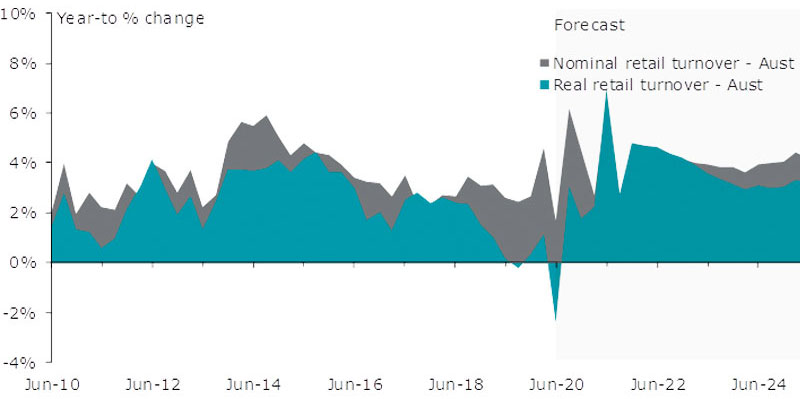

Retail sales are tipped for a stronger-than-expected recovery after a 3.4 per cent drop in the June quarter that contributed to Australia’s first recession in more than three decades, Deloitte says.

According to Deloitte’s quarterly retail forecast, retail volumes are tipped to surge back by 5.4 per cent across the September quarter after slumping during the previous three months.

Deloitte said retail trade was more buoyant in the latter stages of the June quarter and into July, pointing to strong momentum in the September quarter.

Economists pointed to high levels of government stimulus working their way into the economy for the continued recovery across retail sales.

So far, the government has spent $41.8 billion in JobKeeper payments and has also disbursed $9.2 billion worth of $750 special payments to welfare recipients and another $8.5 billion in supplement payments to those on JobSeeker.

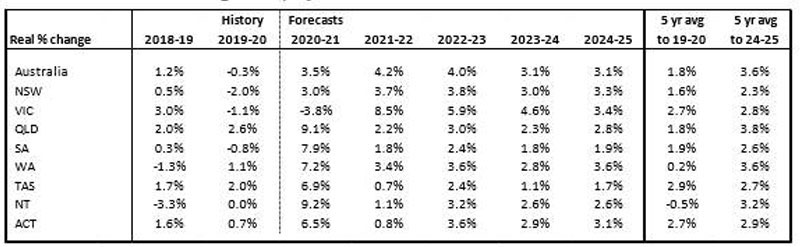

Retail turnover growth, by state

^ Source: Deloitte Economics

But the retail recovery is far from uniform, either by sector or jurisdiction across the country, as Australians deal with the coronavirus pandemic.

“There is an enormous gulf in retail performance by sector,” Deloitte partner David Rumbens said.

“Restrictions have sent cafes, restaurants and catering services into a tailspin, with spending remaining over 20 per cent lower than pre-Covid levels in the month of July.”

Social categories, including fashion and dining, have led the charge in recent months, with fashion growing 7.1 per cent month on month and dining up 4.9 per cent from the lows in March and April.

On a year-on-year basis, dining remains the weakest retail category down 12.1 per cent while fashion is up marginally by 3.5 per cent.

Victorian retail growth remains the weakest of all states, while New South Wales has led state growth on a monthly basis.

Australian retail turnover

^ Source: ABS Cat 8501.0, Deloitte Access Economics

The report also found the pandemic has accelerated Australia’s shift to online spending, although the country remains a laggard in this type of shopping.

Between February and April of this year, the share of online spending nearly doubled from 6.6 per cent to 11.1 per cent, a gain in market share that had taken over four years to achieve previously.

Online sales have almost doubled year-on-year in Victoria in July as consumers facing the prospect of stage four lockdown restrictions forked out on games, toys, fashion, takeaway food, groceries and liquor.

Deloitte said if the rise in online spending were to continue the trend experienced over the past four years from June’s 9.7 per cent share, it could reach around 12 per cent of retail sales by the end of 2023, compared to the pre-Covid trajectory of around 9 per cent.

Savings rate surges on fiscal support

Australia’s Covid-induced employment crisis has hurt take home incomes and eroded consumer willingness to spend.

“The level of cash washing through the economy from fiscal stimulus is also unprecedented,” Rumbens said.

“Employee earnings might have dropped over the quarter, but household disposable income actually rose 2.2 per cent.

“Unfortunately, we weren’t willing to go out and spend this extra cash, with the savings rate skyrocketing to 19.8 per cent as households prepare for what they expect to be further difficult and uncertain times ahead.

Looking forward, Deloitte said some parts of retail are expected to take longer than others to recover.

Supermarkets, specialty food and liquor, household goods, and other retailing have already exceeded December’s pre-Covid spending levels for spending over a whole quarter.

However, it is expected to take longer for department stores, catered food, and apparel to reach the same benchmark.