Rural Village Tops Housing Profit-Maker List

Corelogic's latest “Pain and Gain” report has found some usual trends in the nation's housing market for the December quarter.

The report analyses the proportion of dwelling resales that made a nominal gain (or loss) relative to the previous purchase price.

The latest analysis was based on 98,000 sales through the December quarter, where CoreLogic observed the property had previously sold.

Based on the observations, 89.9 per cent of sales saw a nominal gain through the December quarter, up from a recent low of 87.4 per cent in the three months to June.

The median profit on resales across Australia through the December quarter was $230,000, up from $200,000 in the previous quarter.

The increase in the rate of profit-making sales coincides with a turn in housing market performance from the December quarter, the 112-day lockdown easing across Melbourne and national housing values rising 2.3 per cent.

The report highlights some usual trends across Australia’s housing market.

The portion of resales making a nominal gain was higher among houses (92.7 per cent) than units (81.3 per cent).

Owner occupiers generally had a higher incidence of profit (92.2 per cent) than investors (84.9 per cent).

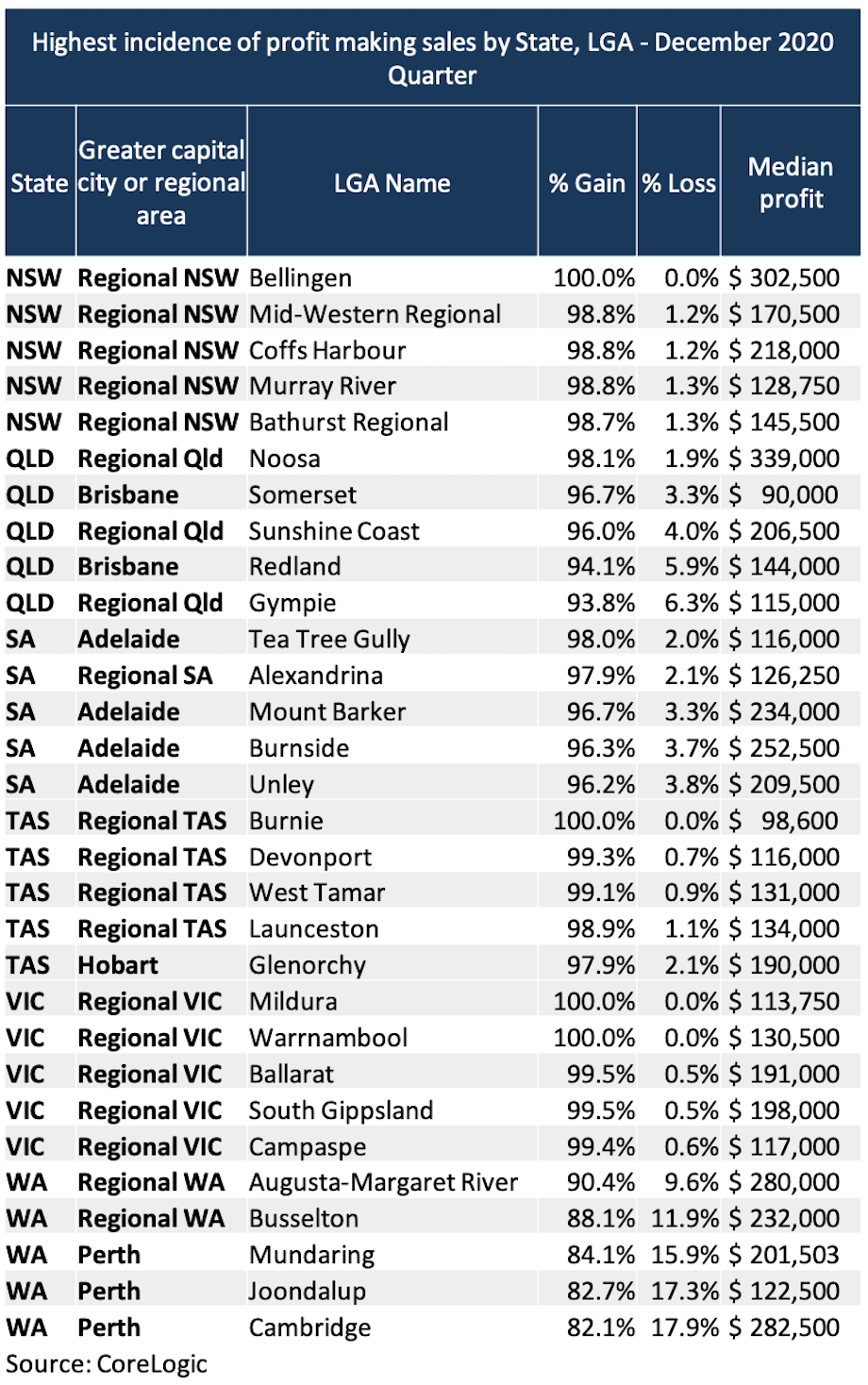

However, looking at the highest rates of profit-making sales at the LGA level highlights other recent trends in housing demand.

The table showcases the top five LGAs within each of the major states, by the portion of sales that made a profit in the December quarter. Only LGA regions with a minimum of 100 sales were analysed.

Of the 30 LGAs featured, 20 are in regional areas of Australia. The most profitable areas across NSW and Victoria were all in regional markets, including non-coastal regional centres such as Bathurst, Mildura and Ballarat.

This coincided with quarterly growth rates in the December quarter of 3.5 per cent in Bathurst, 4.5 per cent in Mildura, 3.4 per cent in Ballarat, as well as a broader uplift in affordable, regional centres of NSW and Victoria through much of 2020.

The results partly reinforce some of the trend for established, regional markets that offer space and affordable houses (as opposed to the waning unit demand in major cities) through the pandemic.

However, it is worth noting that regional lifestyle markets have shown relatively high incidence of profitability for a long time. Of the regions featured, the average quarterly proportion of profit-making resales during the past decade range from 80.7 per cent in Busselton, Western Australia, to 96.9 per cent in Ballarat, Victoria.

The most profitable areas on this list include lifestyle markets in Noosa and Bellingen.

These areas have a particularly high incidence of owner-occupier properties (above 75 per cent), which have a higher incidence of profit-making sales, and generally have a higher median profit than investor profits.

For Bellingen, the median hold period for all sales over the December quarter was more than 14 years, far higher than the national average of 8.9 years.

With most Australian housing markets experiencing price increases through the first few months of 2020, it is expected that the proportion of profit-making sales will continue to rise at the national level. It is worth noting that these results are the gross profit between the original sale price and the transaction over the December 2020 quarter, and does not take into account transaction costs, or costs incurred for maintenance or improvements to the property.

Recent weeks of flooding, if not the past 12 months of extraordinary events, have shown that housing market activity, and ownership and transaction costs, can quickly change the outlook for profitability in real estate in certain markets.