Scentre Shores Up Balance Sheet With $4.1bn Raising

Scentre Group has priced a US$3.0 billion (A$4.1 billion) subordinated hybrid note issue as a new way to prop up its balance sheet as it moves out of the testing Covid period.

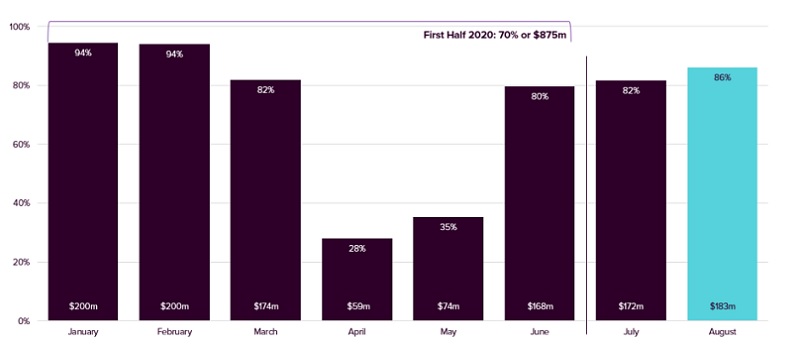

The owner of Westfield shopping centres has reported improved rent collections—86 per cent of gross rent was collected for August—and announced its intention to make a distribution in early 2021.

The ASX-listed company will put the notes on the United States market with a mix of non-call 6-year subordinated notes with a coupon of 4.75 per cent and 10-year at 5.125 per cent.

The notes, with a 60-year maturity date, are part of Scentre’s long-term funding plans, with this inaugural issuance of hybrid notes created to diversify its sources of capital.

This follows the group posting an AU$3.6 billion loss in August after the pandemic ravaged the retail sector.

In late August, Scentre also gave share buy-back notice of 126.6 million units.

Meanwhile rent collection for August has increased to $183 million or 86 per cent, this compares to the April low of 28 per cent and pre-Covid rate around 94 per cent.

Scentre Group rent collection

^ Source: Scentre Group, January to August

These results were also reflected in Australian Bureau of Statistics data which showed household spending dropped 12.1 per cent in the June quarter and 2.6 per cent in the financial year—the largest quarterly fall in household spending, and the first annual fall, recorded in the national accounts.

The Reserve Bank of Australia also noted the drop in June, and predicts consumption will continue to increase in the September quarter, but not enough to outweigh June.

“Since then, consumption had started to recover, but was still well below pre-pandemic levels,” the RBA board noted.

“Restrictions on activity had constrained spending in Victoria, with retail spending there much weaker than in the rest of the country.

“Overall, household consumption in Australia was still expected to increase in the September quarter, but this would only partly reverse the contraction that had been experienced earlier in the year.”