Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Demand for industrial development in south-east Queensland remains strong despite limited land supply and lengthy approval processes, according to a speculative developer.

Builder-developer Carmdev is bullish about the future of south-east Queensland’s industrial market with Australia Post moving into its Crestmead facility and a pipeline of further projects on the horizon.

Director Gabriel Reggi said the only limiting factor was the availability of land in the region.

“The approval process has got its complexities but compared to residential development it’s a smoother process, it’s streamlined,” Reggi said.

“We can build for ourselves so we usually build within six months—sometimes from start to finish can be 12 months for us, which as a developer is very appealing.”

Reggi said the fundamentals were good for ongoing growth in the market and said Carmdev would look to hold on to some of its developed assets, and recycle capital with others.

“Years ago there would be constant land subdivisions and you would buy one or two serviced blocks and do that kind of thing, but that’s really dried up,” Reggi said.

“So the last few years that’s what we’ve been doing. But there’s really not a whole lot of supply at the moment.

“We purchased two blocks in Heathwood as part of a small subdivision where there were only two or three blocks left. So we were actually very lucky to get those, they’re serviced and ready to go, but it’s very few and far between at the moment to try and get those sites.”

Reggi said key to the site acquisition strategy was selecting sites that were close to main arterials to service cities of south-east Queensland and close to residential to provide proximity to workforce.

Strong demand and tight vacancies are creating good rental growth for the industrial asset class in south-east Queensland.

“In our space that demand is really strong,” Reggi said.

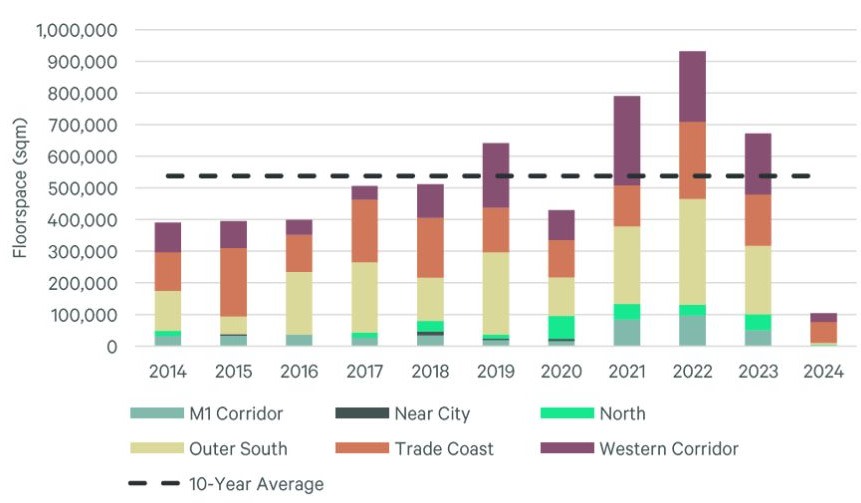

Brisbane gross take-up rate by precinct

“We typically build assets ranging from 1000sq m to 3000sq m. We’re going to be doing some smaller products, and in that level there’s a real shortage of owner-occupier product that owners can purchase.”

According to CBRE research, the gross take up of industrial space fell 34 per cent quarter-on-quarter.

New floorspace added to the market in the quarter totalled about 136,000sq m, also down on the previous quarter by 37 per cent. The pipeline for the calendar year is expected to total about 800,000sq m, with 32 per cent of this floorspace pre-committed.

Reggi said although there was more land due to enter the pipeline, it took 12 to 24 months to get it rezoned and ready to go, so the developer was keeping a watchful eye on the market while drawing up plans for Carmdev’s next two projects.

Lot 13 Hub Heathwood would comprise a single 3000sq m A-Grade freestanding industrial warehouse, while seven A-grade smaller footprint industrial units are slated for Lot 17 Hub, Heathwood.

Reggi said they would look to start construction on these projects in the third quarter of 2024.