Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

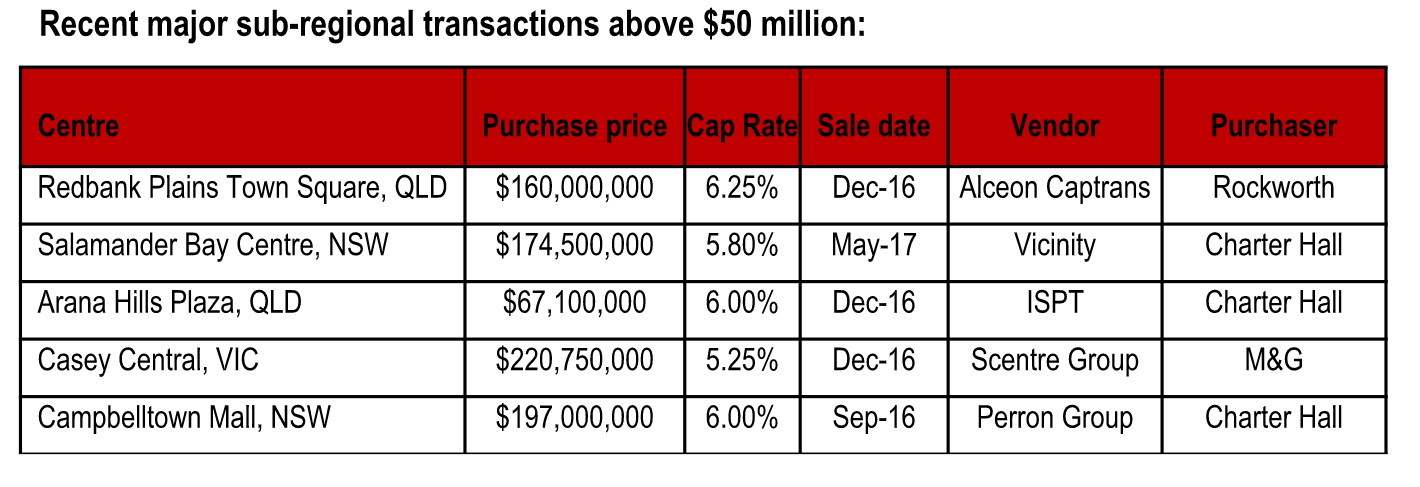

SubscribeSingapore’s Rockworth Capital Partners outbid domestic players to acquire Town Square Redbank Plains in Brisbane for $160 million.

After negotiating the sale on behalf of the Alceon Captrans JV, JLL Head of Retail Investments for Australasia Simon Rooney said the sale represented a growing trend towards offshore investors snapping up quality Australian sub-regional assets.

“Sub-regional retail is the preferred asset class for many offshore groups seeking quality retail exposure, given the defensive and resilient characteristics and positive in-built growth outlook," he said.

"Assets which are predominately food, service and convenience-based, with a high proportion of non-discretionary retail and limited fashion, offer enhanced and consistent returns and limit trading volatility.

"The lower rental profile of sub-regional centres also provide attractive opportunities for income and capital growth, via asset repositioning and tenancy re mixing.

“The comparative attractive yield profile available in the Australian retail sector, continues to offer strong relative value for offshore investors as evidenced by the recent transactions of Town Square Redbank Plains to Rockworth Capital and Casey Central,” Mr Rooney said.

Mr Rooney said domestic institutions are also keenly pursuing sub-regional centres to secure above-benchmark total returns through active management and asset repositioning.

He said the current series of transactions, such as the Charter Hall acquisition for around $175 million or the current Blackstone retail portfolio sale process currently valued at around $3.5 billion, would be expected to drive retail investment activity in Australia to a new record high in 2017.

Town Square Redbank Plains is strategically positioned within Brisbane’s residential south-west growth corridor, serving a significant residential trade area estimated to be in excess of 50,600 residents and expected to experience robust population growth of 2.3% per annum over the next decade.

The completion of the recent redevelopment incorporated the expansion of the existing 5,900 square metre neighbourhood centre known as Redbank Plains Shopping Village, anchored by a 3,200 square metres Woolworths supermarket, into a major sub-regional shopping centre.

The newly completed centre comprises approximately 26,945 square metres of GLA and includes Woolworths, Coles, and ALDI supermarkets, a Target DDS, together with two drive-through tenancies, a large format tenant precinct, specialty tenancies and at grade and basement car parking for over 1,200 cars.