Sluggish Housing Construction Continues to Drag on Economy

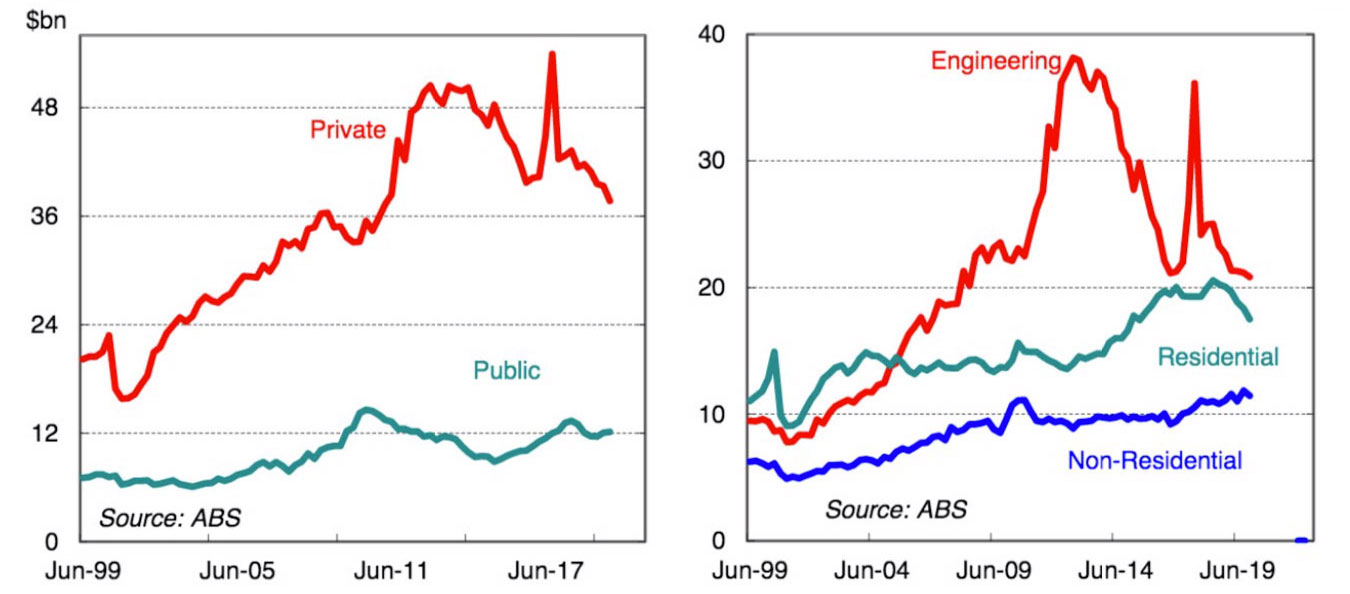

The residential construction market continues to drag on the economy, with housing construction work falling again in the final quarter of 2019.

The ABS construction statistics, which provide data on the value of construction work done in Australia, reveal that residential building construction rates fell by 4.6 per cent over the December quarter.

Non-residential construction activity also fell by 3.4 per cent during the period, a fall of 12.8 per cent seasonally-adjusted over the year.

Engineering construction also fell 1.5 per cent over the December quarter, dragged down by a 3.1 per cent seasonally adjusted fall in privately funded construction activity.

Overall, the value of construction work done is down by 7.4 per cent on a year ago, with the seasonally-adjusted estimate for construction work down 3 per cent in the period.

Commbank senior economist Belinda Allen said that although residential construction had fallen, there were signs of a stabilisation.

“With dwelling prices now rising and building approvals flattening out we expect residential construction work done to stabilise in the second half of 2020,” Allen said.

The ABS stats, which cover all states, recorded falls in new residential building in Queensland, (‑14.2 per cent), New South Wales (‑5.4 per cent) and Western Australia (‑4.5 per cent).

“Victoria also fell by 2.1 per cent but there are signs approvals are lifting in this state given the strong population growth and a low rental vacancy rate,” said Allen.

There were gains in South Australia (2.3 per cent), Tasmania (2.4 per cent) and the ACT (9.0 per cent).

Commsec’s chief economist Craig James said that with residential work down 15 per cent from the highs of around 18 months ago, work flows are now adjusting to more balanced supply-demand metrics.

On the upside, according to James, there is still plenty of construction work to go around.

“Some firms like Monadelphous continue to highlight the difficulty in attracting and retaining good skilled workers for engineering projects,” James said.

Likewise, in terms of the outlook for home building, Diwa Hopkins, senior economist with the Housing Industry Association said that although international factors may impact on the volume of home building in the medium term, the home building contraction had just about run its course.

“Confidence returned to the overall housing market at the end 2019, buoyed by interest rate cuts and house prices returning to growth,” Hopkins said, adding that the HIA anticipated the improved conditions would flow through to the new home building side of the market this year.