Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

National residential property listings fell again in July as the trend of the past 12 months rolled on.

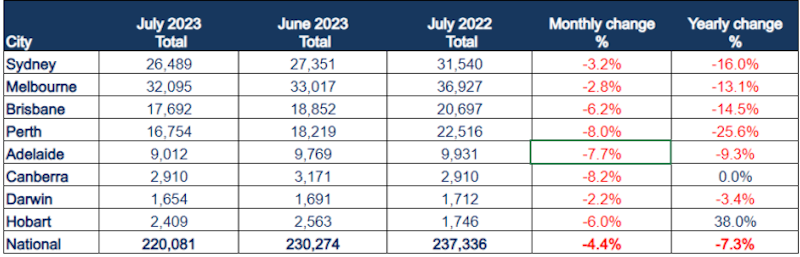

Figures released by SQM Research revealed that listings last month dropped by 4.4 per cent to 220,081 properties from 230,274 recorded in June, 2023.

The decrease was primarily influenced by falls in listings for Canberra (-8.2 per cent), Perth (-8.0 per cent) and Adelaide (-7.7 per cent).

Brisbane and Hobart also recorded sharp decreases of 6.2 per cent and 6.0 per cent respectively.

Sydney, Melbourne and Darwin were also down, by 3.2 per cent, 2.8 per cent and 2.2 per cent respectively.

Historically, July listings have fallen (month on month) five times out of the past 10 years, SQM said.

The average historical change (July over June) has been -0.5 per cent, which makes the falls reported for July, far greater than the seasonal average.

Over the 12-month period, residential property listings across the country decreased by 7.3 per cent, with most cities experiencing a decline in total listings for the year with Hobart, up a remarkable 38 per cent, the outlier.

Nationally, new listings less than 30 days rose by 0.4 per cent in July, adding 63,504 new property listings to the market.

Melbourne, Brisbane, and Darwin increased 4.8 per cent, 2.7 per cent, and 2.5 per cent respectively.

However, new listing numbers for Perth and Canberra experienced a decline of 0.3 per cent and 3.5 per cent respectively. There was also a significant drops in Hobart, down 5.6 per cent.

Total property listings

Older listings—properties that have been on the market for more than 180 days—had a significant fall of 6.9 per cent in July but have risen by 20.2 per cent over the past 12 months. Most cities recorded decreases in older stock except for Hobart.

SQM Research’s release found that as of July 2023, the number of residential properties selling under distressed conditions in Australia decreased to 5277, a drop of 1.1 per cent from the previous month’s 5335 distressed listings.

The decrease in distressed selling activity was mainly driven by falls in NSW (down 3.6 per cent), Victoria (down 1.4 per cent) and Queensland (down 1.6 per cent) compared to June.

National asking prices rose in July by 1.4 per cent, driven by a number of regional increases.

However, this was offset by general asking price falls recorded across the capital cities.

Asking prices fell by 0.9 per cent in Sydney and 0.3 per cent in Melbourne. The largest fall was in Canberra, where asking prices fell by 1.2 per cent.

SQM Research managing director Louis Christopher said the greater-than-average decline in residential listings for July had been driven by a significant fall in older listings.

“The decline in older listings could be as a result of higher absorption rates and we note that the calendar year to date has actually recorded higher than expected levels of total residential property sales turnover,” he said.

“That said, our overall indicators suggest a market that is finely balanced, right now.

“We have reported a levelling out in auction clearance rates compared to earlier this year and I note the dip in asking prices over the course of the month.

“So various leading indicators of the Australian housing market are giving off mixed signals at this time.”