Sluggish Property Lending Market Rife with ‘Liar Loans’

The banking royal commission has not increased the factual accuracy of mortgage applications, with so-called “liar loans” rising to record levels despite the banks significantly increasing their verification requirements.

A survey from investment bank UBS has found that Australia’s mortgage market is rife with inaccurate loans, with record numbers of applicants overstating their income and understating their debt burden and living costs.

UBS analyst Jonathan Mott said that the expectation that tougher lending standards would lead to an increase in the accuracy of mortgage applications was not the case.

The number of applicants who reported their application was not “completely factual and accurate” rose to a record 37 per cent from 32 per cent in 2018, with 20 per cent overstating their income and 34 per cent understating living costs.

In a speech at the Financial Review’s property summit in Sydney last week, Treasurer Josh Frydenberg said that if responsible lending laws are applied too stringently they could adversely affect property markets.

The treasurer called for a “sensible balance” in the application of responsible lending obligations by the banks.

The survey’s findings comes as new data from the central bank released on Monday shows the pace of lending to property buyers has recorded its slowest growth on record.

The financial aggregates data showed that housing credit growth slowed to 0.17 per cent despite the turnaround in the housing market and improving mortgage approvals, which have risen 10 per cent from record lows.

Mott explains that to add 1 per cent to housing credit growth, mortgage approvals would need to grow by around 10 per cent.

“Even if mortgage approvals re-accelerate to levels seen at the height of the housing bubble, system housing credit growth would only grow to [about] 5.5 per cent,” Mott said.

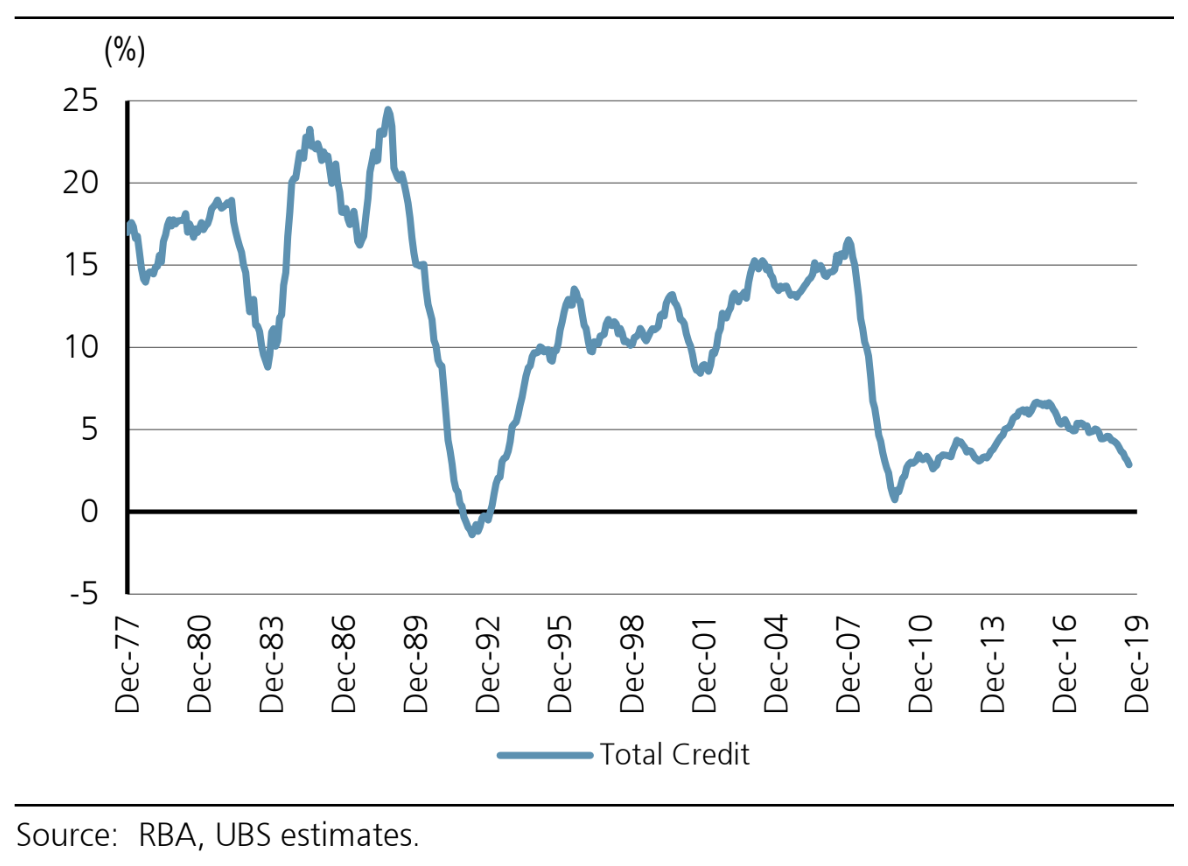

Credit growth in Australia

^ Credit growth in Australia (year-on-year basis) Source: UBS

UBS analysts expect housing credit growth to bottom out over the next two months, as bank fundamentals are increasingly challenged by ultra-low interest rates.

Mott estimates that the banks will only pass on 30bps of Tuesday’s 50bps cash rate cut.

“The major banks continue to lose share in the housing market with CBA the only major to grow its mortgage book in August (0.3 per cent).

“APRA data showed credit card outstanding balances shrunk -3.3 per cent [over the quarter] which suggests much of the tax refunds may be being used to pay down debts,” Mott said.