A State-By-State Of Australia's Current Commercial Climate

Office vacancy rates appear to have peaked in all of Australia’s capital city markets. Landlords can also expect to see less of a divergence between the performance of the major markets – but the shift will be gradual, according to CBRE’s Australian Head of Research, Stephen McNabb.

Mr McNabb’s comments followed the release of the latest Property Council of Australia office vacancy statistics.

“We expect the divergence between market performance may narrow somewhat, but this will be very gradual and the south east markets still stand out as the tightest in the country,” Mr McNabb said.

CBRE’s head of office leasing for Pacific, Andrew Tracey, noted that businesses in both Melbourne and Sydney were growing again and the battle for talent was heating up.

“Overlaid against this is the roll-out of new technology, meaning that the workplace is changing and it’s changing at a more rapid rate than ever before,” Mr Tracey said.

“The battle for talent, particularly in the Technology, Media and Telecom (TMT) sector, has seen the race for amenity and better working environments become red hot and this will be a key driver of tenant decision making in the future.”

Mr Tracey noted that scarcity of stock would be a key issue in Sydney and forecast that this would impact the cost base of businesses significantly in the next few years.

“The development cycle is the pressure valve for this, but the length of the planning and development cycle means the market will remain tight for years - and it will be tighter than people expect,” Mr Tracey said.

“This will mean alternate east coast markets such as Melbourne and Brisbane will look relatively cheap when national decision makers are making a call on where to expand, so expect growth in these markets.”

City by City Commentary

Sydney CBD

Jenine Cranston, Senior Director, Advisory & Transaction Services

The Sydney market will continue to be acutely effected by a lack of stock. Sydney is now feeling the combined effect of stock withdrawals for office development, the Sydney Metro project and both residential and hotel conversions. Add to this particularly low additions of supply in 2017-2019 and we are in unprecedented territory with respect to low long term vacancy. And while other markets have, in the past, provided a release valve of sorts, right now, the suburban markets provide no such relief.

On the back of these fundamentals, larger tenants face a critical shortage of options.

Tenants seeking 5,000sqm of contiguous space in 2017 have fewer than 10 assets to choose from. This is in the context of the city being a 5,000,000sqm market. At the other end of the spectrum, if you are a B Grade tenant seeking 200sqm to 500sqm, there’s no surprise that the options are somewhat more plentiful, but rents for B Grade stock have pushed through the $1,000 /sqm gross mark on a number of assets – and they’re being achieved.

Trading terms will continue to tighten and we’re anticipating a combination of rental growth and incentive contraction to continue in the year/s ahead.

CBD rental growth will continue in 2017, but we’re not likely to see the heady heights of 20% + in 2016. This year, our forecasts are more tempered at circa 10%. That said, we’ll not be entirely surprised to see this shift northward if competition for good space hots up in a market with limited options.

Our advice is to ensure good advice and early action to avoid costly disappointments.

Melbourne

Marc Mengoni, Director, Advisory & Transaction Services

2017 is poised to see a flurry of leasing activity across the Melbourne CBD as vacancy tightens significantly and tenants scramble to secure the last remaining major vacancies.

Typically, the Melbourne market trends six months behind that of Sydney, and - following a successful 2016 in the Sydney CBD - we should see a strong year across the Melbourne market. Over the next 12-18 months, the CBD should see vacancy drop to levels not seen since right before the GFC when it hit a record low of 3.1%.

The tightening conditions occurred quite quickly and will see strong competition return for quality space available for lease. Within the CBD, we can already see this competitive tension within the Eastern core where vacancy has dropped to an estimated 1.5%. This trend will continue for the next 18-24 months, with new development supply coming on line from the likes of 447 Collins and 477 Collins not hitting the market until late 2019 onwards.

Brisbane

Chris Butters, State Director, Advisory & Transaction Services

The Brisbane office market performed well above expectations in 2016, although this was largely due to State Government growth (with public sector employment now at record levels) and the impacts of the Government’s move to 75,000sqm of space at 1 William Street, which resulted in a shuffle from/between more than 20 assets. It appears that the resultant backfilling of space by the government and supplementary requirements has boosted the second half year absorption numbers significantly.

In light of the surprisingly strong levels of net absorption, vacancy has tightened to 15.3%, well below the anticipated 17% level forecast mid last year.

Beyond the government, however, the lower AUD has supported tenant demand from the education and training sector as well as benefitting industries including tourism and agriculture.

Throughout 2016, a significant quantity of sub-lease space transacted in Brisbane with tenants housed in secondary assets taking the opportunity to upgrade into fitted premium accommodation at discounted rentals. With the majority of development led lease tails now absorbed, and the contractionary phase of the cycle well and truly past, Brisbane has trended back to a predominantly direct vacancy market.

Despite the record level of net absorption recorded, it really does appear to have been a result out of kilter with underlying occupier demand and driven by the State Government. While private sector demand is slowly improving, there remains a strong focus on efficiency and cost containment. We expect this trend to continue in 2017, although with the State government shuffle now largely through the system, net absorption will likely still be positive although more modest. Given the minimal supply pipeline for the next couple of years, vacancy should continue to trend down.

Gold Coast

Nick Selbie, Associate Director, Advisory & Transaction Services

Total vacancy on the Gold Coast fell significantly during the last six months of 2016, reducing the vacancy to 12.2% (from 14.3% at July 2016). Net absorption over the year to December 2016 totalled 4,860sqm. This will be the 7th consecutive year of positive absorption on the Gold Coast since the latter half of 2009. Direct vacancy sits at 11.8% with the sub-lease market at 0.4%.

We expect continued absorption to occur in both the direct and sublease markets in 2017. 3,700sqm of sub-lease space in Robina has reached agreement, while the A- grade market will also show absorption on the back of very strong leasing activity at 50 Cavill Avenue, Surfers Paradise.

CBRE expects business confidence to remain positive over the next 12 months with preparations continuing for the Commonwealth Games, stage 2 of the Light Rail progressing through its construction phase, record breaking tourism figures and sustained activity in the residential development market.

As the vacancy rates continue to trend towards 10%, the supply side of the market is beginning to activate with discussion being held on a number of speculative developments. There has been very limited supply over the past five years, which has resulted in the consistent decline in vacancy.

Perth

Andrew Denny, Senior Director, Advisory & Transaction Services

Although the latest Perth CBD vacancy rate shows an increase, at 0.7% the rise is the smallest since vacancy starting increasing in 2012.

With limited new future supply, and forecast modest demand levels, CBRE believes we are now at peak vacancy.

The other key factors leading to an improved market include significantly increased transaction levels in the last 5 months of 2016, including a strong movement of tenants from the suburbs, particularly West Perth to the CBD.

Sublease availability has also fallen in each of the past four quarters from a record 98,000 sqm in December 2015 to currently sit below 69,500sqm. This is a 29.4% decrease in availability in just 12 months. Companies withdrawing space from the market include major mining companies in a sign improved commodity prices will flow through to the office market.

Premium vacancy rates fell in the last six months of 2016. This is a strong indicator to the future where we will see further falls in premium and A grade vacancy rates.

We expect rents and incentives to now stabilise at the premium end of the market.

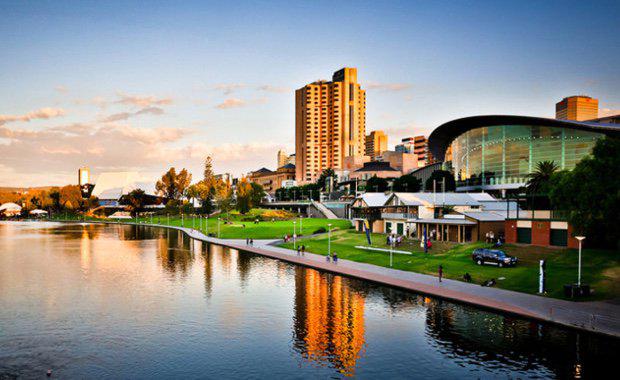

Adelaide

Andrew Bahr, Director, Advisory & Transaction Services

The fundamentals of vacancy, demand and supply remain relatively stable, however a real stalemate exists at present. 2016 was a year of low major lease expiries which led to limited demand. In saying that, Q4 2016 saw an increase from Q4 2015 and that trend has continued into Q1 2017.

The GPO Tower, which is now pre-committed, will bring some 24,000sqm of space into the market come 2019 .There is no other new supply before then so, with an increase in demand, we should see vacancy and then incentives begin to fall by the end of 2017.

Canberra

Zoe Ferrari, Associate Director, Advisory & Transaction Services

On an annualised basis, white collar employment growth was 3.3% and 3.4% respectively for the June and September quarters of 2016 – compared to -1% and - 2% in the corresponding quarters of 2015. This growth, combined with the rumoured project Tetris winding up in Canberra, we will see any future growth in the public sector result in positive net absorption in stock levels.

Our prime office vacancy rates are at sub 5% and the Civic market has not seen a new speculative built office building since 2010. This has had a significant affect in our market as tenants continue to seek prime office accommodation. Two new buildings are to be speculatively built for completion in late 2018 early 2019 – which will see in excess of 25,000sqm of space hit the market. However, we are also likely to see a % of this space taken as pre commitments once construction and marketing commences.

We are definitely starting to see the affects of a lower vacancy rate throughout Canberra with incentives declining and rentals growing. We do, however, need to be conscious that we are also likely to see some of the B and C grade stock that tenants are moving out of be refurbished and re-positioned in the market, which will undoubtedly affect our vacancy rates.

Sydney North Shore

Stefan Perkowski, Head of Office Services, North Sydney

Vacancy rates have continued to tighten with the North Sydney vacancy rate now sitting at 6.4%. Demand remains strong, particularly in the sub 500sqm range, however we do still have a number of larger tenants either still in the market - such as Arcadis from 141 Walker Street with a circa 4,000sqm requirement – in addition to new entrants such as NBN with a 20,000 North Sydney specific requirement.

New developments continue to dominate discussions, with 177 Pacific Highway achieving 100% occupancy on practical completion and construction of 100 Mount Street well underway and due for completion in Q4 2018. An announcement of an anchor tenant for 1 Denison is also rumoured to imminent, which will then trigger construction with completion due for Q1 2020. Together these projects will add circa 100,000sqm of supply to the North Sydney market.

Incentives, especially in the B grade market, have continued to tighten with deals over 20% a rarity now in the market. A grade incentives are still strong especially within 101 Miller where tenants are still achieving circa 30%.

Competition in the B Grade market continues to dry up with many building owners now enjoying 100% occupancy. Net rents in the B grade competition have continued to increase and now range from $500/sqm to $65/sqm net. A grade rents are now beginning to enter the $800 net range for smaller suites with views.

In 2017, minimal new vacancies are anticipated and, coupled with strong demand, we are predicting further tightening of incentives.