Suburban Office Stock Returns Hit 10-Year High

The latest findings from research into Australia’s metropolitan office market has revealed that returns from suburban office property are at their highest in more than a decade.

Colliers International Metro Office Research report revealed that over the year to March 2018, suburban markets such as North Sydney, St Leonards, Chatswood, St Kilda Road and the Melbourne City Fringe have seen strong effective rental growth of more than 15 per cent.

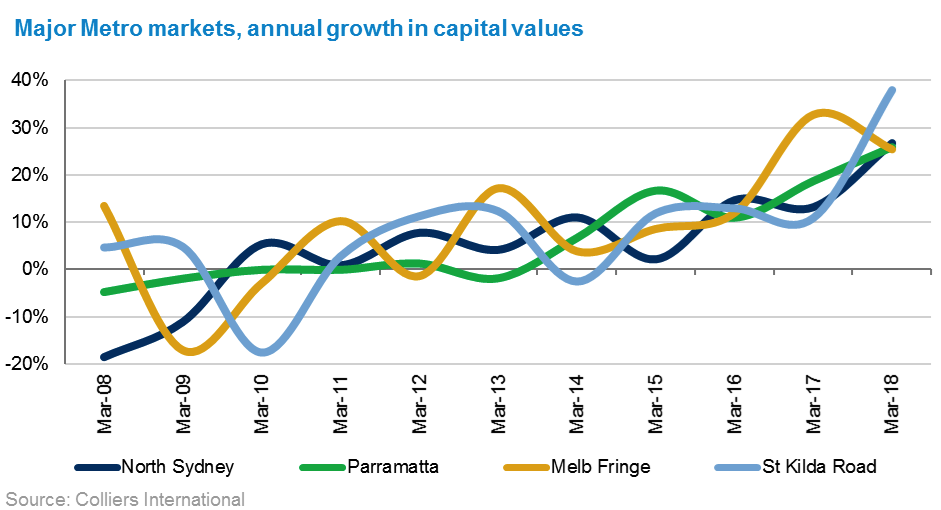

Coupled with an average of 50 basis points of yield compression over the same time period, capital value growth has been 25 per cent on average across these markets.

Related reading: Sydney North Shore Office Market Continues to Climb

The Sydney metro market reduced by 40,000sq m over the past year, and Brisbane’s contracted by 34,000sq m. In Melbourne, while the metro market grew by 30,500sq m, the key markets of St Kilda Road and the City Fringe both contracted – St Kilda Road by close to 40,000sq m.

Colliers’ national director of research Anneke Thompson said the long-term growth of these key markets will be impacted by a number of factors, including tight occupancy, withdrawal of stock, residential development upside and major metro rail upgrades.

Metro rail developments in both Sydney and Melbourne, like the NSW government's $20 billion Sydney Metro scheme, will offer significant demand uplift potential upon completion, with markets such as the Sydney North Shore and St Kilda Road in Melbourne to be significantly impacted.

In Sydney, office vacancy dropped to a decade low of 4.6 per cent, while prime gross effective rents rose 2.9 per cent over the March quarter, creating a rising battle for space which has tipped office value to produce prime net face rents past $1000.

Colliers’ managing director of capital markets and investment services John Marasco said withdrawal of stock continued to have an impact on metro markets.

“In addition to the supply and demand fundamentals contributing to rental and capital value growth, investors also see a unique exit strategy for metro office investments,” he said.

“A number of metro markets are also proving popular with residential developers, and many investors are attracted to the potential residential conversion exit strategy that these investments provide.

“The affordability factor is also playing a part. As rents in the premium end of the Sydney CBD market breach the $1000 per square metre mark, savvy occupiers are now looking to alternative markets such as North Sydney, which offers much more affordable rents and significant improvements to accessibility once the Sydney Metro Rail development is complete.”