Sydney and Melbourne Office Markets Will Slow: Moody’s

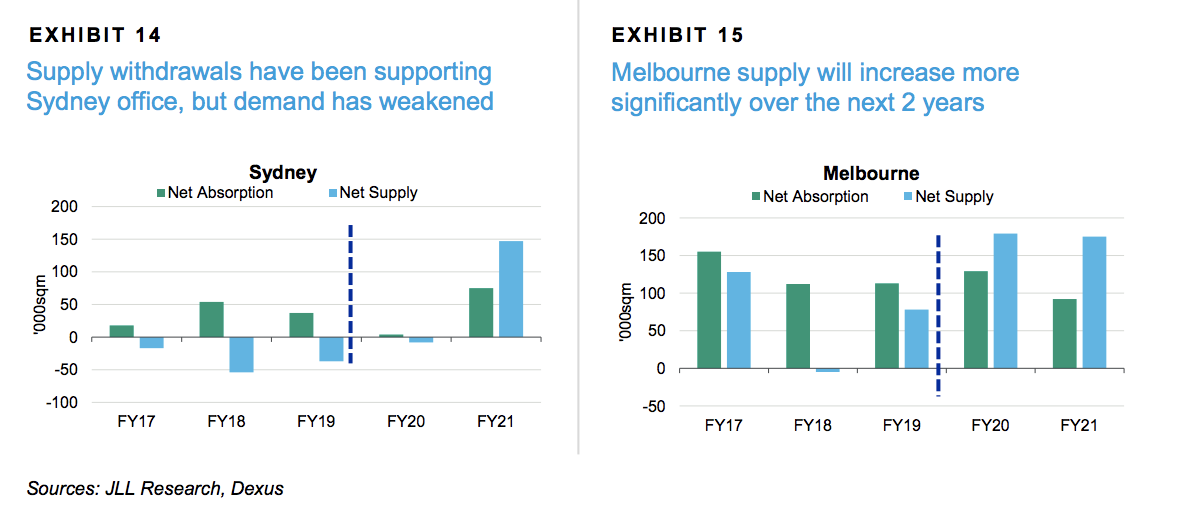

The nation’s two major capital city office markets have been running hot, but Sydney and Melbourne’s office market performance is expected to slow amid a new wave of supply, weaker macroeconomic conditions and lower business confidence after 2020, according to Moody’s Investors Service.

Demand for office space will continue to be bolstered by population growth, infrastructure spending, growth in services, Moodys says.

While demand will see Sydney and Melbourne’s office sectors outperform for the remainder of this year, Moody’s vice president Matthew Moore says the global rating firm expects “performance to slow”.

“Performance of the Sydney and Melbourne markets will slow, but remain at strong levels in fiscal 2020, reflecting still low supply levels,” Moore said.

“We expect conditions will weaken post-2020.”

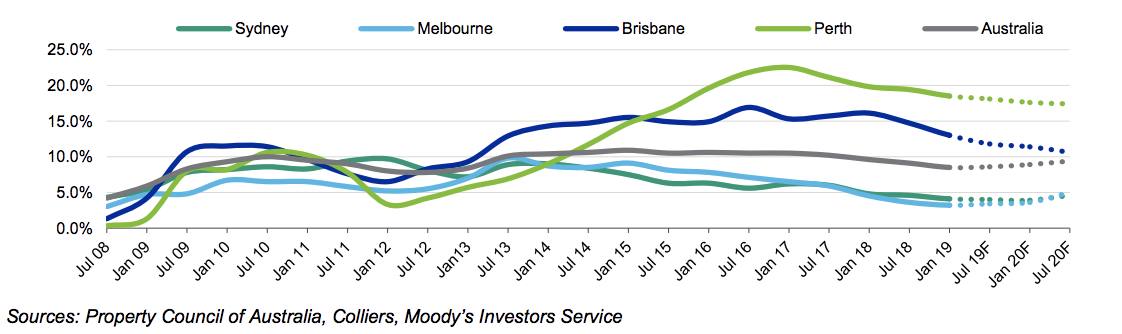

While still at record lows, vacancy rates are likely to increase.

“The historic low vacancies of 4.1 per cent and 3.8 per cent, respectively will rise on increasing supply and a slowing economy,” the report notes.

Melbourne is home to the tightest CBD office market in Australia, recording a 16 per cent increase in prime office rents over the 12 months to the second quarter of this year.

Research house BIS Oxford Economics recently forecast Melbourne's current record low CBD vacancy rate would increase briefly, rising above 5 per cent in 2020, but then pull back to 4 per cent, as take-up outstrips new supply in the following years.

Further afield, Brisbane and Perth markets are in recovery phases of the market cycle.

Vacancy rates sit around 12 per cent in Brisbane, and 18 per cent in Perth.

“But we expect them to fall with below-average levels of supply over the next 12 [to] 18 months,” the Moody’s Investors Service report notes.