Sydney and Melbourne Slow Rate of Decline in May

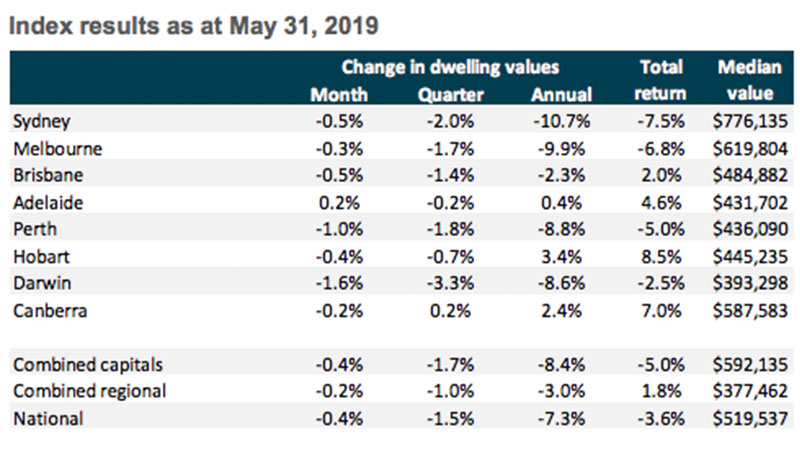

The pace of housing declines eased in May, with national dwelling values recording a 0.4 per cent decline, the smallest month-on-month drop in the past 12 months.

While dwelling values are still trending lower, Corelogic’s home value index shows the improvement is being driven by a slower rate of decline in major markets Sydney and Melbourne.

Sydney’s residential values recorded 0.5 per cent declines for the month while Melbourne values dropped 0.3 per cent. Corelogic head of research Tim Lawless says this is the smallest decline in values for both cities since March last year.

Taking in the latest housing data, macroeconomic research group Capital Economics said it expects Australia's housing price declines to reach a trough by the end of this year.

“We suspect house prices may start to rise again thereafter, by 3 per cent in 2020 and 5 per cent in 2021,” the research consultancy group said.

Although Capital Economics added that it expects the housing downturn to remain a drag on the economy throughout this year and into 2020.

While most analysts are predicting a June rate cut, Lawless says a “variety of headwinds” are still at play in the property sector.

“Especially in the credit space,” he said.

“Although interest rates and serviceability tests are set to reduce, lenders are continuing to scrutinise incomes and expenses much more intensely.”

Related: The Four Potential Scenarios For Housing Markets: UBS

Lawless says the slower rate of decline is also noticeable in higher auction clearance rates recorded through the month.

The last week of May recorded clearance rates breaking 60 per cent for the first time in a year in Sydney, while Melbourne clearance rates have maintained around the 60 per cent mark over three of the past six weeks.

“Although clearance rates remain low relative to several years ago when housing market conditions were much stronger, the improved performance at auction aligns with the easing rate of decline,” Lawless said.

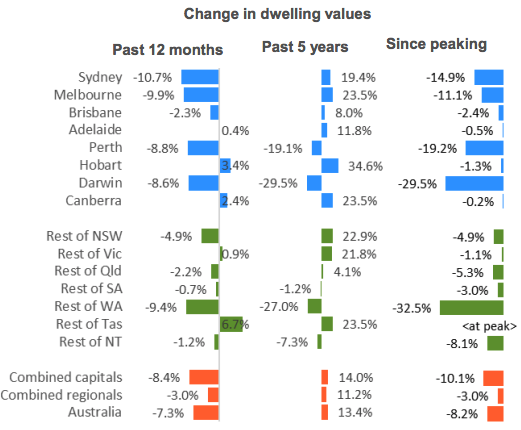

National dwelling values have recorded declines of 8.2 per cent since peaking in 2017.

Adelaide was the only city not to record a drop in dwelling values in May, rising 0.2 per cent.