Office Market Showing No Signs of Slowing: Dexus

Strong employment growth and positive business confidence continue to support office investments across the major capital markets, with no sign of office occupier demand slowing according to a Dexus report.

The Australian Real Estate Quarterly Review, released this week, shows office investments are continuing to perform well in Australia’s relatively steady growth environment.

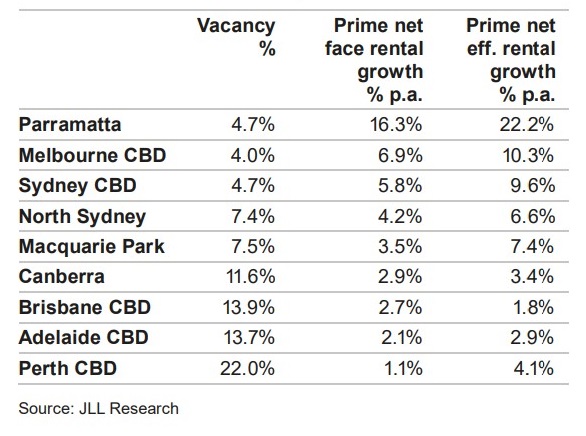

“The office vacancy rate for Melbourne CBD is four per cent, the lowest in 30 years, while the Sydney CBD (4.7 per cent) recorded its lowest in 18 years,” Dexus general manager Peter Studley said.

Related: Dexus Affirms Guidance After Strong Leasing Across ‘Solid’ Office Markets

“Melbourne is benefiting from a boost in Victorian population growth.

“While a lack of availability of large continuous office space is limiting absorption in Sydney's CBD, office enquiry levels are up substantially from last year,” Studley said.

This week property giant Mirvac reported solid returns underpinned by the company’s strong yielding office portfolio, in which Mirvac’s chief executive Susan Lloyd-Hurwitz described it as “the growth engine of the business over the next stage of the real estate cycle”.

Mirvac maintained 97.2 per cent occupancy across its office pipeline during the quarter while completing 11,000sq m of leasing activity.

The Dexus report shows Sydney recorded negative net absorption of -12,000sq m, largely due to the withdrawal of 66 King Street for refurbishment and smaller tenants leaving the market.

While Melbourne continued its solid run recording net absorption of +79,800sq m in the third quarter, “its strongest quarter in more than a decade”.

Q3 2018 Office Snapshot

Brisbane bounced back following a subdued second quarter to record net absorption of +15,400sq m in the third quarter, and a slightly reduced vacancy rate of 13.9 per cent.

While Perth's vacancy rate increased to 22 per cent, Perth continued its steady improvement recording +17,600sq m of net absorption.