Australia’s House Prices Forecast to Grow 5pc in 2020: Moody’s

After the largest downturn in 40 years, the Australian residential property market is moving out of its correction with a forecast 5.4 per cent increase in national house prices in 2020.

Corelogic and Moody’s 2019 third quarter housing forecast report has predicted a significant uptick across the east coast capital city residential markets next year, led by a 7.7 per cent expansion in Sydney.

Melbourne’s house values will follow close behind, expected to grow 7 per cent in 2020 after a 9.2 per cent fall in 2019.

Brisbane’s market, which has fared better than most other capital cities, is still working through a moderate correction with house prices forecast to grow 2 per cent in 2020.

Moody’s economist Katrina Ell is confident that the housing correction has largely passed along the east coast.

“The national index for home values has fallen for almost two years, before house values began to rise in [Sydney and Melbourne] in the September quarter,” Ell said.

Related: Is the Downturn Over? House Prices Begin to Rise

Home Value Forecasts: Corelogic-Moody’s

| 2020 (Houses) | 2020 (Apartments) | 2019 (Houses) | 2019 (Apartments | |

|---|---|---|---|---|

| National | 5.4 | 5.1 | -7 | -3.8 |

| Sydney | 7.7 | 7.9 | -8.4 | -5.9 |

| Melbourne | 7 | 4.8 | -9.2 | -1.8 |

| Brisbane | 2 | 5.4 | -1.8 | -1.3 |

| Perth | -0.7 | -0.8 | -7.8 | -8.6 |

| Adelaide | 1.4 | 0.8 | -0.5 | 0.7 |

| Hobart | 1 | -0.4 | 4.1 | 2.7 |

| Canberra (ACT) | 5.1 | 2.6 | 2.6 | -1 |

^ % change year ago. Source: Corelogic, Moody's Analytics.

Despite record levels of household debt and the softest economic conditions in a decade, Ell said that the Reserve Bank is doing the lion’s share of the heavy lifting.

“The RBA has reduced the cash rate by 75 basis points so far this year [with] a further 25-basis point reduction expected for early 2020.

“This could trigger a pickup in the Sydney and Melbourne housing markets that is more aggressive than forecast [and] would likely lead to further household leveraging.”

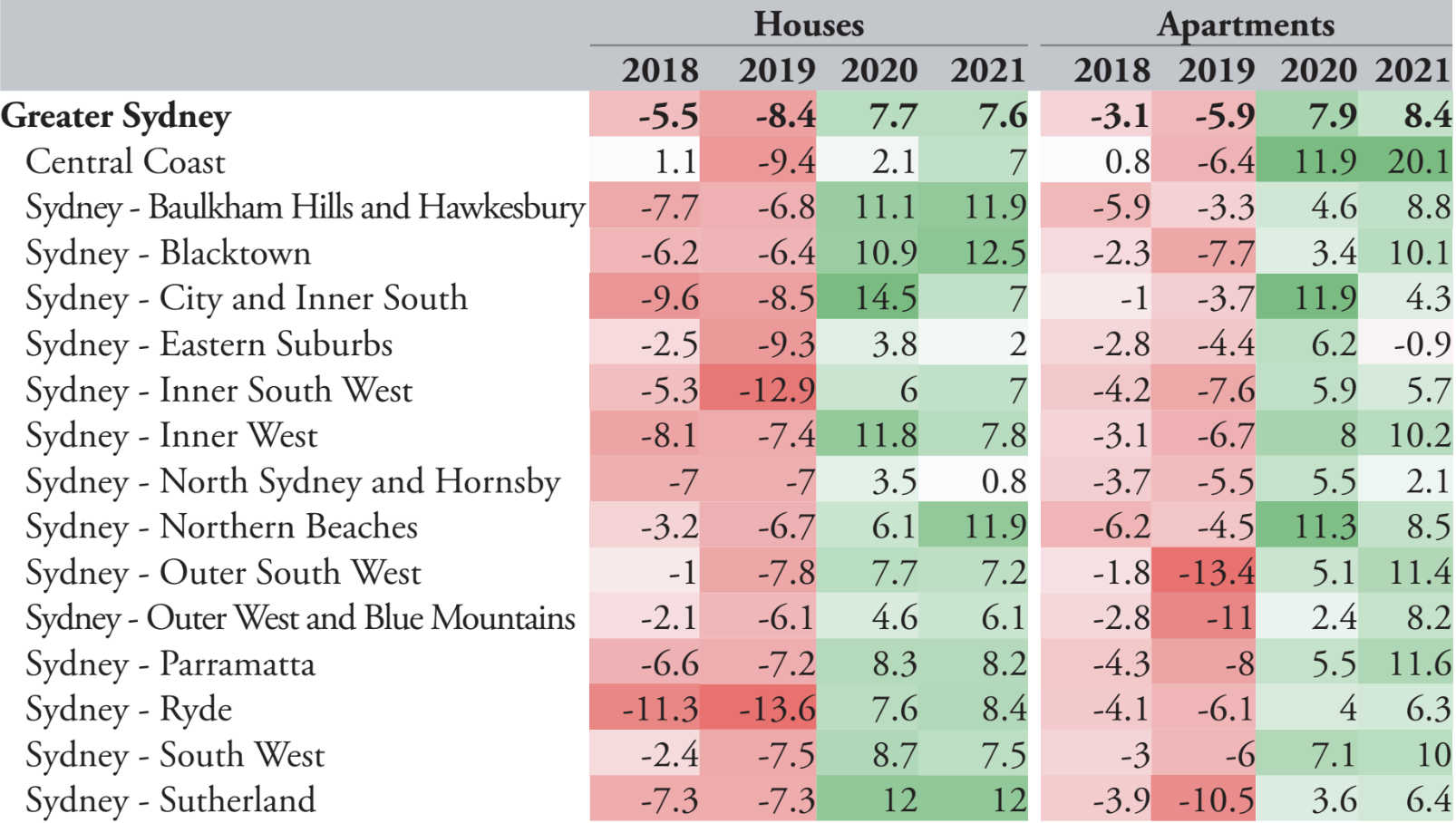

Sydney home prices set to pick up 8pc in 2020

Ell points out that it is important to keep Sydney’s correction in context.

“House prices in Sydney remain around 60 per cent higher than they were in 2012.

“Housing values have risen at a faster rate than what fundamentals—income, population and interest rates—suggest, and are overvalued relative to the equilibrium value.”

As a result, Ell predicts Sydney home value growth will be far from the lofty gains of recent years.

Housing values are predicted to rise by an average 7.7 per cent for houses and 7.9 per cent for apartments in 2020, followed by an improvement of 7.6 per cent for houses and 8.4 per cent for units in 2021.

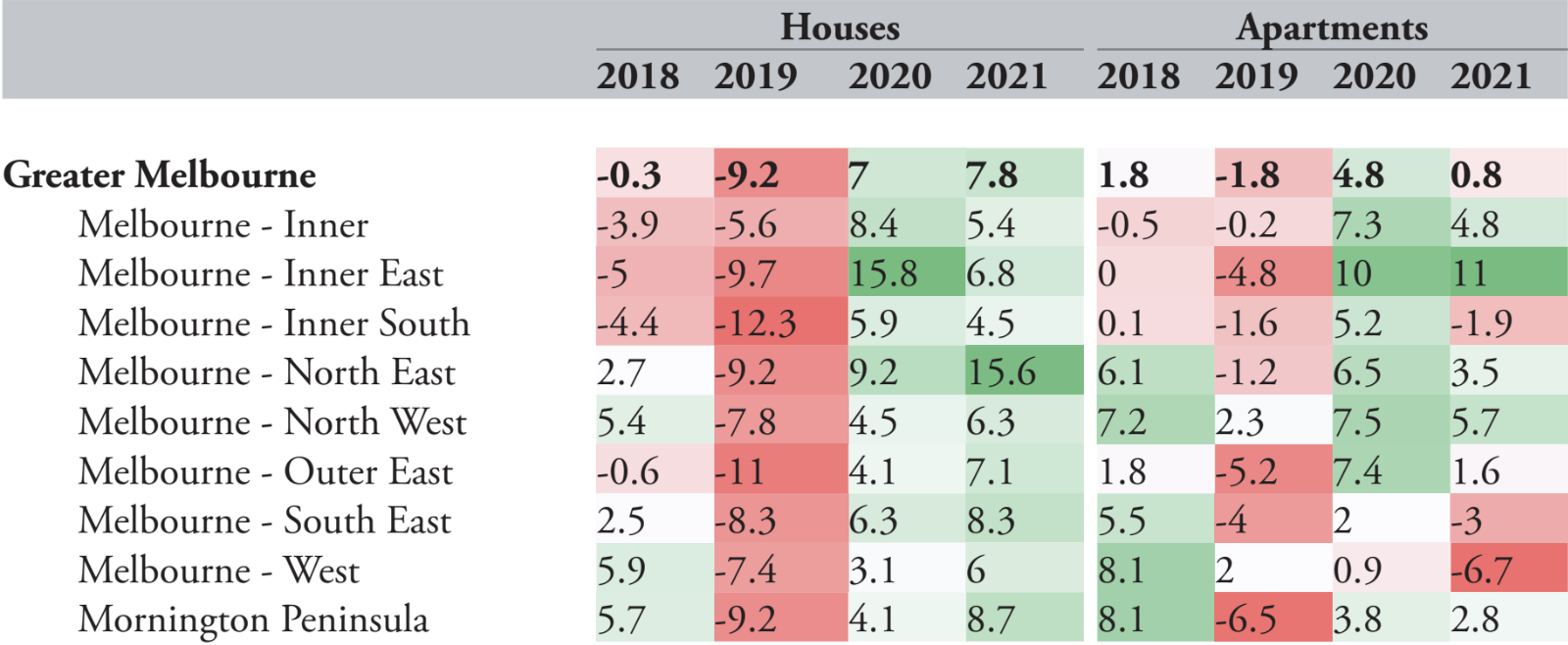

Melbourne home prices set to pick up 7pc in 2020

The fall in house values has been most acute in Melbourne’s inner suburbs, particularly the inner south where prices have fallen by as much as -19 per cent from their peak.

Ell says the recovery in the greater Melbourne area is broad-based but led by a notable uptick in the inner east.

After a 9.2 per cent decline in house values in 2019, the report forecasts 7 per cent growth in 2020 followed by a 7.8 per cent increase in 2021.

Apartments are predicted to decline more modestly by -1.8 per cent across 2019 with a 4.8 per cent increase in 2020 and a slight 0.8 per cent uptick in 2021.

“Like Sydney, the correction has largely passed,” Ell said.

“In 2020, a strong recovery is predicted for most suburbs, though values in the west and south east suburbs are likely to grow at a relatively weaker pace.”

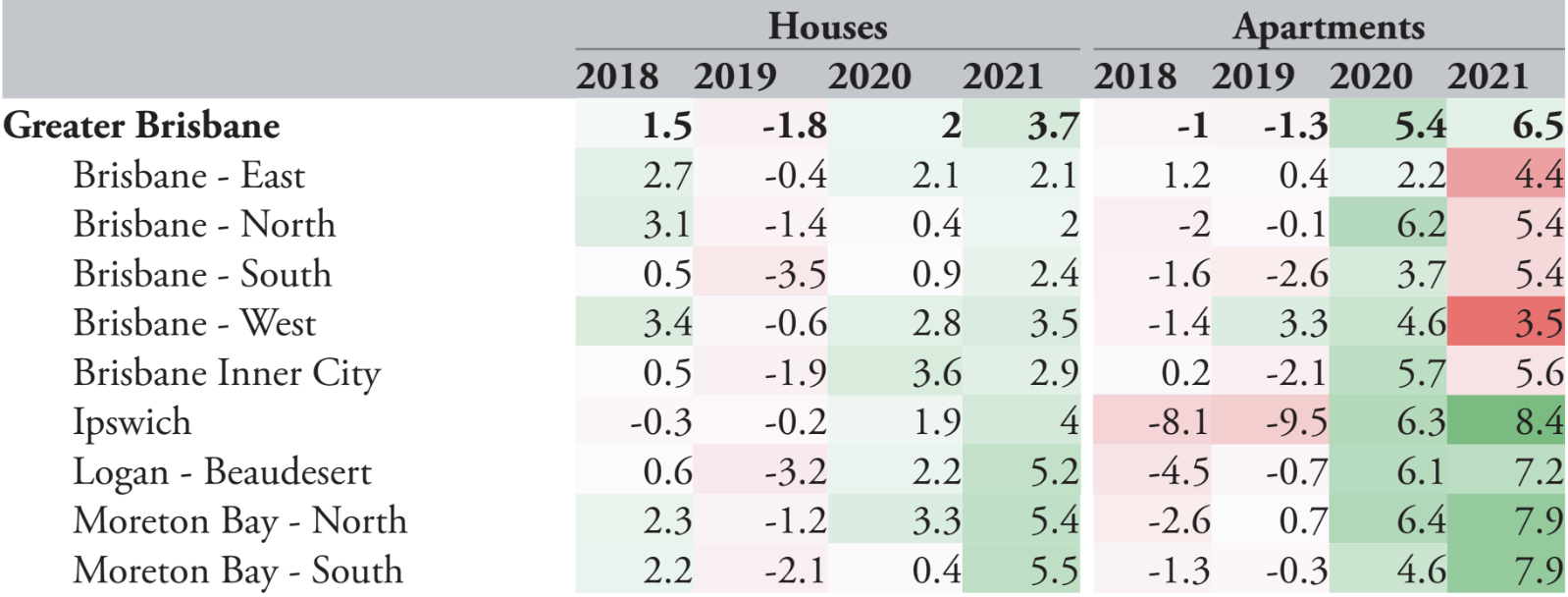

Brisbane apartment market set to pick up 5pc in 2020

Despite faring better than most states over 2019, Brisbane is still not immune to the nationwide downturn and is experiencing a moderate -1.8 per cent correction.

Higher supply in the Brisbane apartment market crippled growth, with apartment approvals in Brisbane during the apartment-supply glut—from 2013 to 2016—outnumbering housing approvals by an average 3 to 1.

“Recently, approvals between the two building types have converged, which should lead to a broad-based recovery in apartment values from 2020 onwards,” Ell said.

As a result, apartment prices are expected to perform better than house prices at least in the medium term.