Sydney House Prices Fall 2.1% as Investors Return

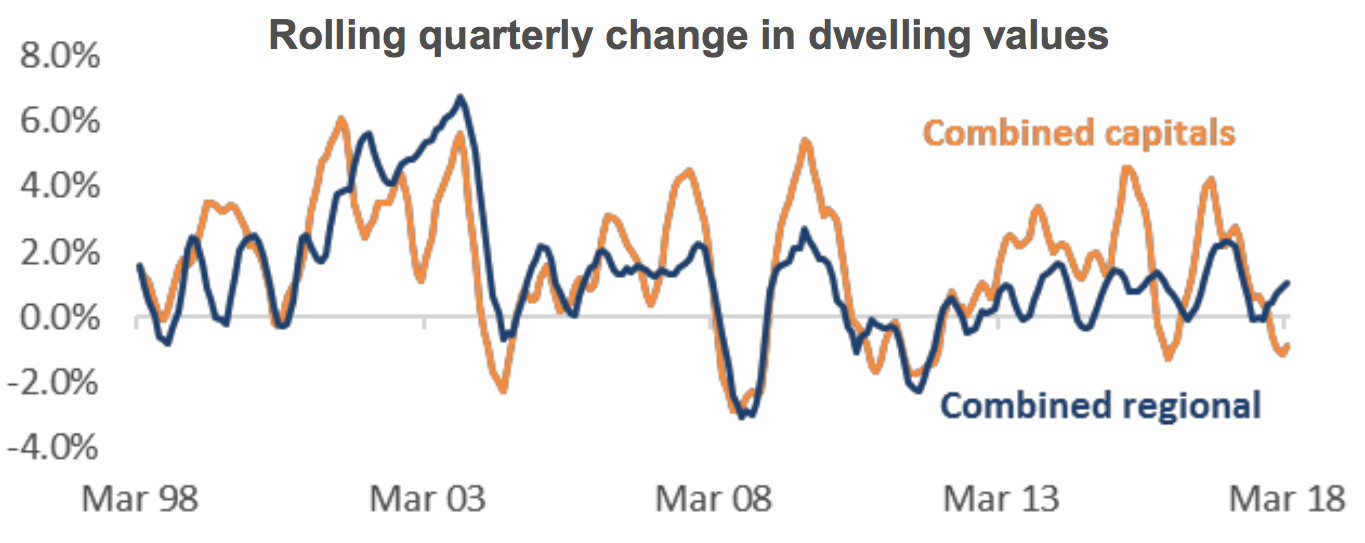

Australia’s residential market is moving through a soft landing, with the pace of decline in home values easing in March.

Australian home values have held firm, with strength in regional areas offsetting falls across capital cities, according to Corelogic’s latest Hedonic Home Value Index.

Sydney’s market recorded the sharpest fall, with an annual 2.1 per cent decline in the house prices in the year to March. Month-on-month Sydney and Melbourne dropped only 0.3 per cent in March, with Brisbane (+0.1 per cent), Perth (+0.3 per cent) and Darwin (+1.0 per cent) recording increases after falls during February.

Corelogic head of research Tim Lawless said that softening in the Australian housing market in March was largely due to weaker conditions in Sydney.

Related reading: Cost of Residential Land in Australia Hits Record High

“However, most other capitals are also recording subtle falls. Dwelling values were steady over the quarter in Brisbane and have continued their strong run of growth across Hobart, up +3.4 per cent,” Lawless said.

Prices in regional areas rose 0.4 per cent last month where prices across the nation’s capitals fell 0.2 per cent overall.

The unit sector across Sydney and Melbourne has shown strong conditions relative to detached housing.

The fall in home values was slighter than expected, with the Australian housing marketing showing every sign of recording a “soft landing” after prices peaked in September 2017.

Related reading: Battle of the States: Which Australian City Will be on Top in 2018?

Return of investors?

Lawless said that lenders have overshot APRA macroprudential benchmarks, with the banks looking to regain some of their lost market share.

“One factor supporting this deceleration in value declines could be an improvement in credit availability for investors and interest only borrowers

“Credit aggregates from the Reserve Bank show growth in credit for investment housing increased at an annualised pace of just 2.3 per cent over the three months to February; well below the APRA benchmark speed limit of 10 per cent.”

Despite the potential improvement in credit availability for investors, rental yields remain low and credit policy is likely to be firmly under the spotlight following the banking Royal Commission.

“Even though the housing market is close to finding a floor, the prospects for a rebound in capital gains are unlikely.”

RBA cash rate steady

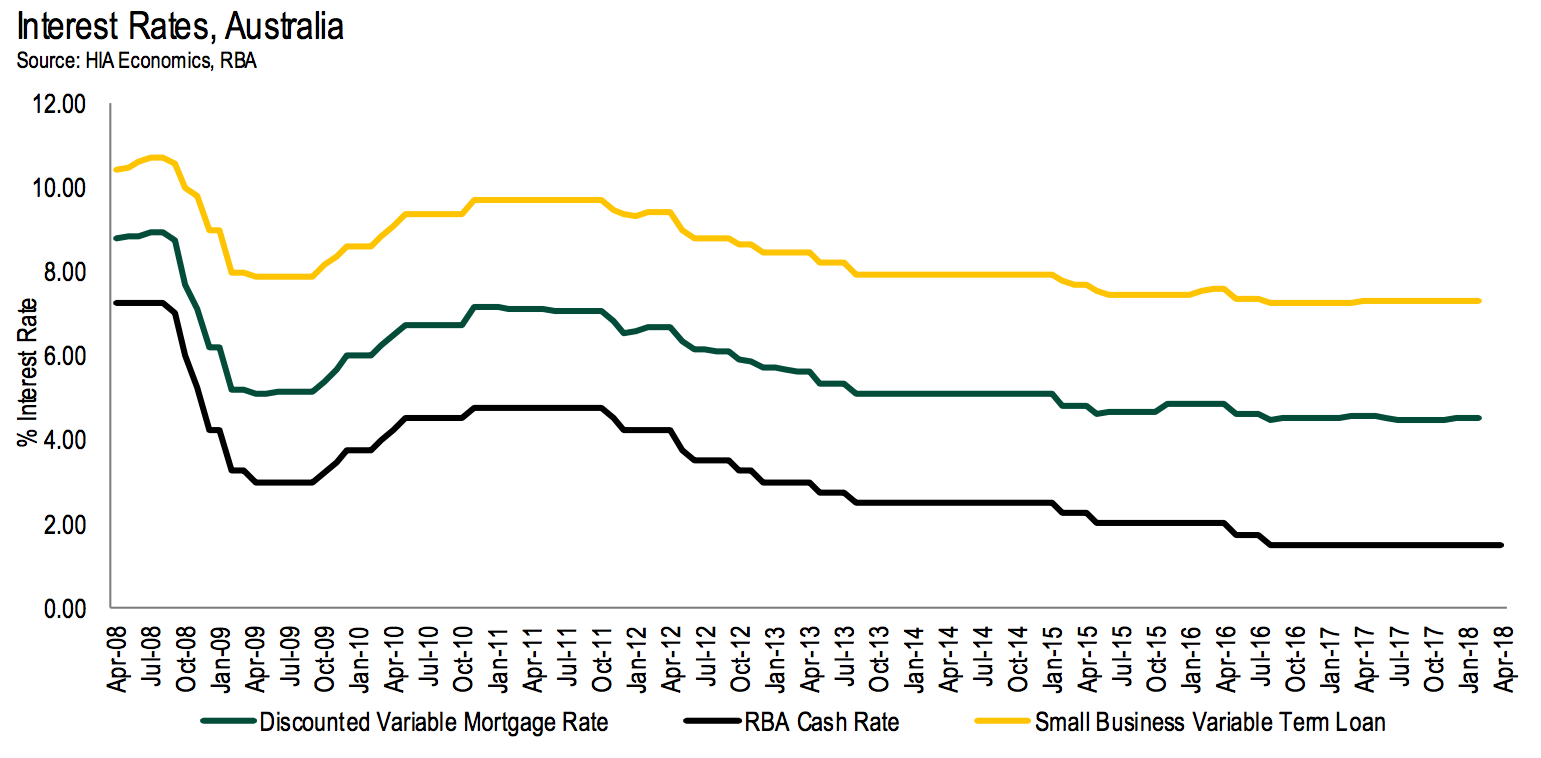

The Reserve Bank has maintained the cash rate at 1.5 per cent for the 19th consecutive month. The decision at Tuesday’s RBA board meeting was widely expected by economists.

RBA Governor Philip Lowe said that the low level of interest rates is continuing to support the Australian economy.

Lawless said that the housing market conditions are likely moving further down the RBA’s list of priorities.

“The controlled slowdown in the housing sector is likely to be a welcome outcome from the RBA, who are more likely to be focussing on labour markets, where the rate of unemployment, although lower than a year ago, crept higher, from 5.4 per cent to 5.5 per cent in February.

“Despite the hold decision from the RBA, mortgage rates remain close to historic lows, particularly for owner occupiers who are paying down both their interest and principal.”

While the RBA has flagged the next move in interest rates will be a rise, it remains likely that any hike to the cash rate is well in the future.