Sydney House Prices Record Largest Drop in Decade

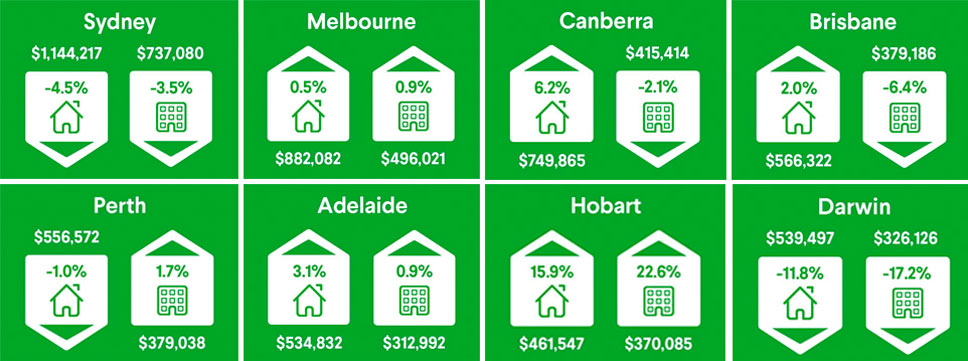

Sydney house prices dropped 4.5 per cent in the year to June, the largest annual fall in house prices for the harbour city in 10 years.

The Domain 2018 House Price Report for the June quarter reveals a 1.4 per cent drop for Sydney, hitting a median house price of $1,144,217, marking the second consecutive quarter of house price falls for the nation’s largest housing market.

Tighter lending conditions and reduced investor activity are key factors weakening the property market’s performance.

Domain data scientist Dr Nicola Powell says capital cities Sydney and Melbourne are being the hardest hit.

“In Sydney and Melbourne, an increase in first home buyers and affordability factors have meant units outperformed houses, while in every other capital city, houses outperformed units,” Powell said.

Across the country, Domain data reveal the national median house price fell one per cent for the June quarter and annually, to $802,077, marking the first annual national drop since mid-2012.

The national unit median price also declined, 0.4 per cent for the quarter and 2.2 per cent for the year to $554,504, marking the first time national unit prices have declined annually since December 2011.

Related: A Welcomed Sigh of Relief for Home Buyers

Sydney

Sydney’s unit prices dropped to $737,080 for the June quarter, a 0.5 per cent quarterly decline, and a 3.5 per cent annual drop. Domain data reveals this annual fall is the steepest drop in unit prices since 2006.

Decreasing clearance rates, heavier vendor discounting and longer days on market are indicators pointing to a slowing market favouring buyers, according to Powell.

“House and unit prices are now back to values seen at the end of 2016,” Powell said.

“However these softening conditions are not uncommon when the median is high comparative to income and particularly when lenders are scrutinising loan-to-income ratios and overall living expenses, which is the case in Sydney,” Powell said.

Related: Infrastructure, Migration and the ‘Mini-credit’ Crunch: Deloitte

Melbourne

The Victorian capital’s median continued to grow annually, a modest 0.5 per cent increase, reflecting the slowest annual growth since 2012. Melbourne’s median house price decreased 1.8 per cent for the June quarter to $882,082.

In the unit market, Melbourne recorded 0.9 per cent annual growth.

“Despite units outperforming houses, Melbourne experienced the lowest growth rate in both house and unit prices since 2012,” Powell said.

Brisbane

Despite a minor quarterly decline of 0.1 per cent over the June quarter, Brisbane’s annual house prices recorded two per cent growth.

Brisbane unit prices continued to decline, 1.2 per cent over the June quarter to $$379,186, reflecting a fall of 6.4 per cent year-on-year, and are now back to prices seen in early 2014

While house prices have risen for five consecutive years, Powell says the rate of growth has been modest compared to the rest of the east coast, making Brisbane comparatively affordable in turn attracting investors and residents from other capital cities.

“Hobart and Canberra were standout markets over the June quarter for house prices, both recording significant growth. Hobart and Perth were the best performers for unit prices, and were the only capital cities to experience a stronger overall performance relative to the previous year,” Powell said.