Tech Firms Lead Fringe Office Market Crunch

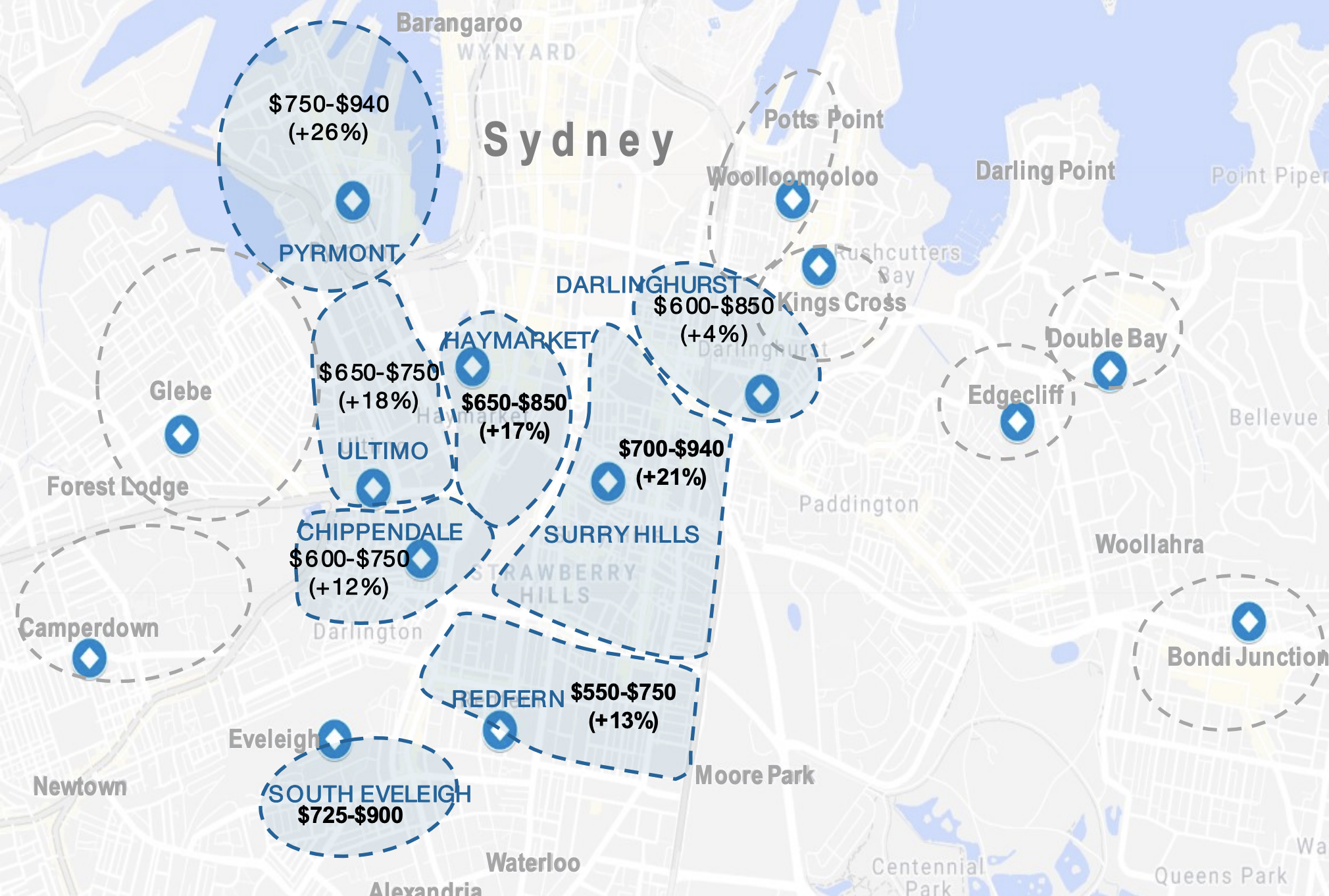

Demand for office space outside of Sydney’s CBD has pushed vacancies to below 3 per cent, with Pyrmont experiencing 26 per cent rental growth as it styles itself as Sydney’s own Silicon-Valley.

The trend toward fringe office markets has been driven by above-trend population and employment growth, primarily in the information, media and technology sector.

The once-industrial, fringe office market attracting tech firms and edgy start-ups narrative is not new — Melbourne’s Cremorne has also claimed the “Australia’s Silicon Valley” mantle, while Brisbane’s Fortitude Valley has consolidated itself as Brisbane’s start-up capital.

Knight Frank associate research director Katy Dean says that growing demand from creative and knowledge-intensive industries on the back of widespread technological adoption has created a transformation in the office market from central to Everleigh.

Knight Frank’s latest Sydney city fringe office market report revealed that overall vacancy in the fringe office markets had compressed to well below the 4.1 per cent in the CBD.

“Pyrmont, Ultimo and Surry Hills have been central to this transformation, mainly due to their proximity to the CBD, and remain the largest office markets in the southern fringe,” Dean said.

Ultimo and Surry Hills had both recorded large annual rental growth numbers — at 18 per cent and 21 per cent respectively — while Pyrmont’s rents sit at between $750/sq m to $940/sq m.

“On a net effective basis, since 2016 rents have double in Surry Hills to $610 per square metre.”

Related: Pyrmont to Rise to the Heights of Sydney CBD: Images

Recent major sales activity: Sydney fringe office market

| Address | Price $ | $/sq m NLA | Vendor | Buyer |

|---|---|---|---|---|

| 19 Foster Street, Surry Hills | $39.5m | $12,524 | Security Invest. Aust | Marks Henderston |

| 19-37 Glebe Street, Glebe | $43m | $12,286sq m | Private | Private |

| 100 Broadway, Chippendale | $77.1m | $14,154sq m | Frasers/IIG | MTAA Super |

| 111-117 Devonshire Street, Surry Hills | $21.5m | $10,312 | Private | Private |

| 19 Harris Street | $143m | $11,378sq m | Kuehne Real Estate | AEW Capital |

| 38-42 Pirrama, Pyrmont | $150m | $9,192sq m | Aqualand | |

| 29-43 Balfour Street, Chippendale | $30m | $12,000sq m | Private | Marks Henderson |

Tech giants commit

In February, Atlassian signed up as anchor tenant at Sydney’s new innovation and technology precinct, while Australian fintech company Quantium has committed to anchor Mirvac’s Locomotive workshops in South Everleigh.

Quantium will join CSIRO, the Seven Network and various technology start-ups in the area.

Mirvac was given approval in 2016 to develop the South Everleigh precinct — formerly known as the Australian Technology Park — given the mandate to bolster Sydney’s status as a global technology and innovation hub.

The ASX-listed developer secured sensitive heritage approvals earlier this year to redevelop the century-old Locomotive Workshops in its bid to restyle them as a technology hub.