The Interrupted Upswing in Perth

The start of the Perth dwelling market recovery comes at an unfortunate time. In early 2020, the Perth dwelling market had four consecutive months of dwelling value increases, which is the longest stretch of capital growth since 2014.

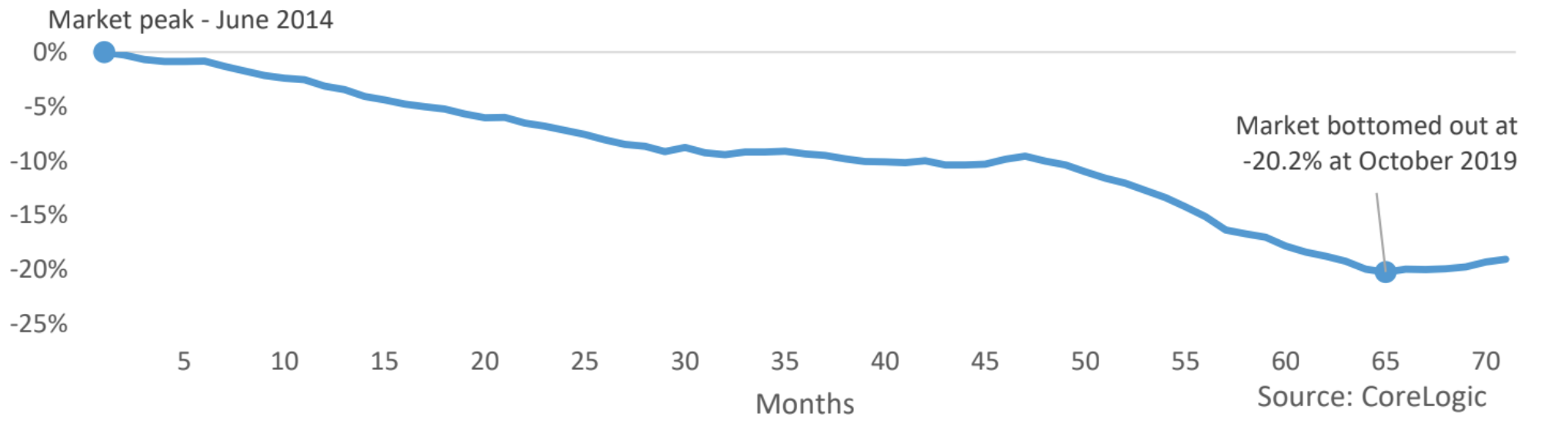

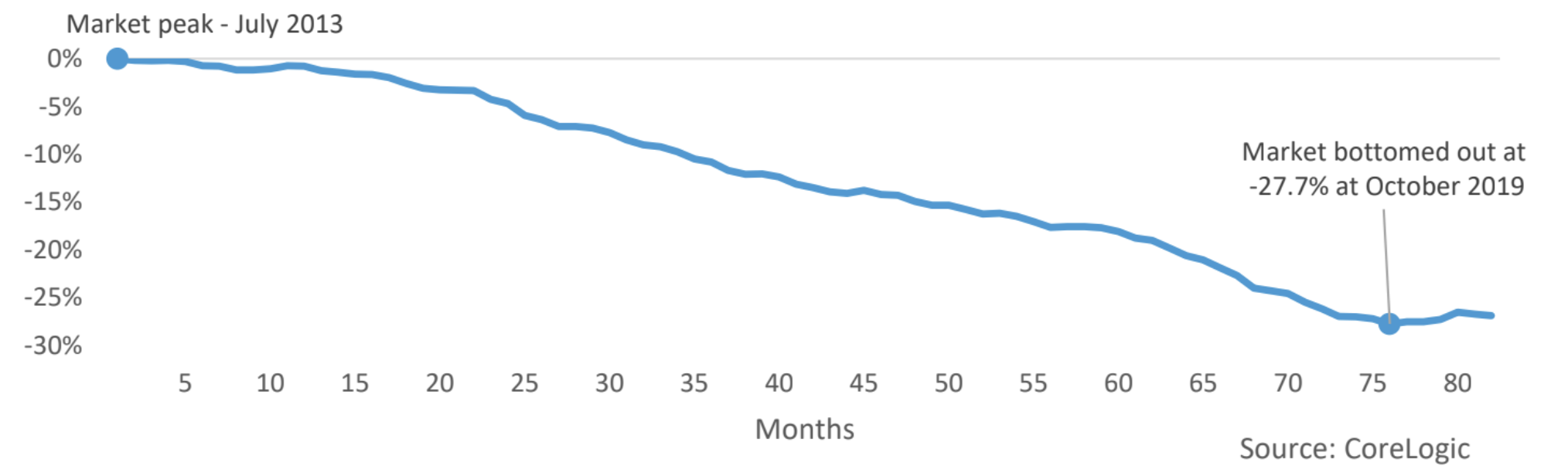

The Perth dwelling market has a long road to recovery. By the end of April, the house market in Perth was -19.1 per cent below its peak value at June 2014. Unit values have taken a larger hit, down -26.9 per cent below the record high at July 2013.

Prior to Covid-19, most indicators for Western Australia were moving into an upswing.

Unemployment had fallen from 6.9 per cent to 5.2 per cent, jobs growth was trending higher, population growth had bounced back to the highest level since 2014, housing supply was contained, and state final demand crept above the decade average.

Perth house market - value change relative to peak

Perth unit market - value change relative to peak

But instead of momentum continuing from the trend seen at the start of the year, the onset of Covid-19 places it at the cusp of another downswing.

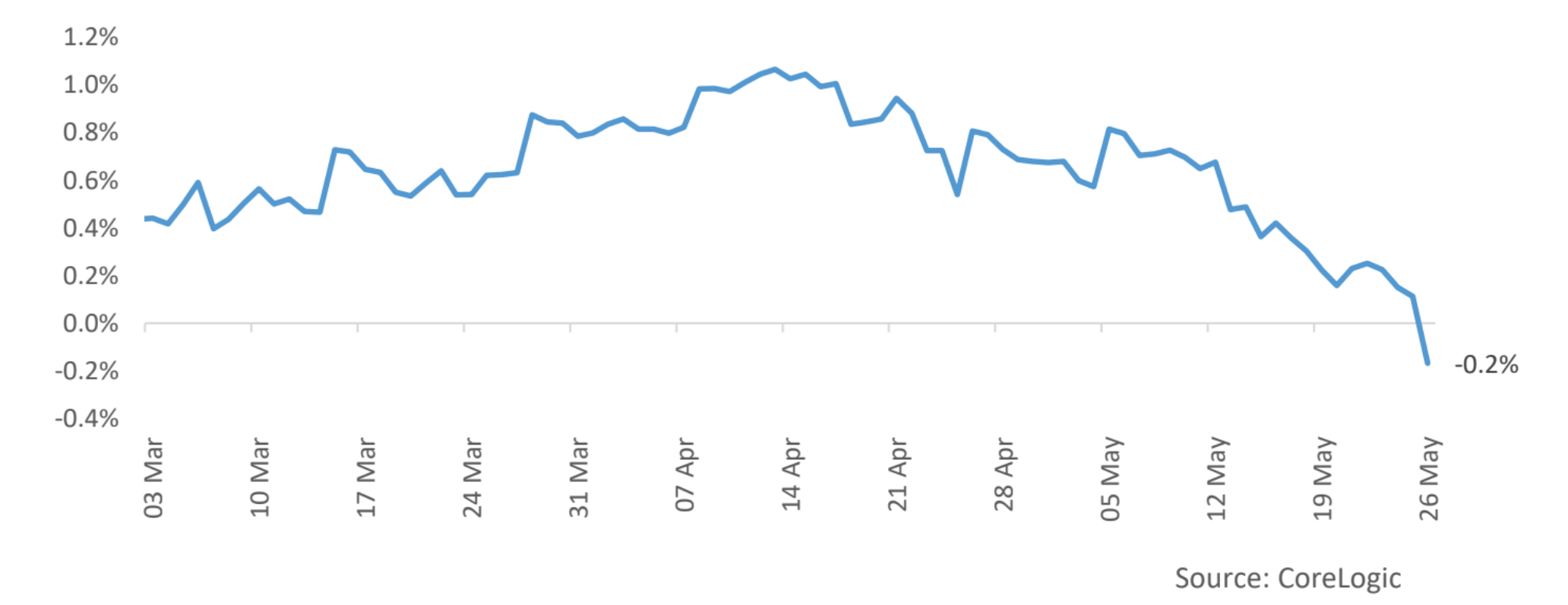

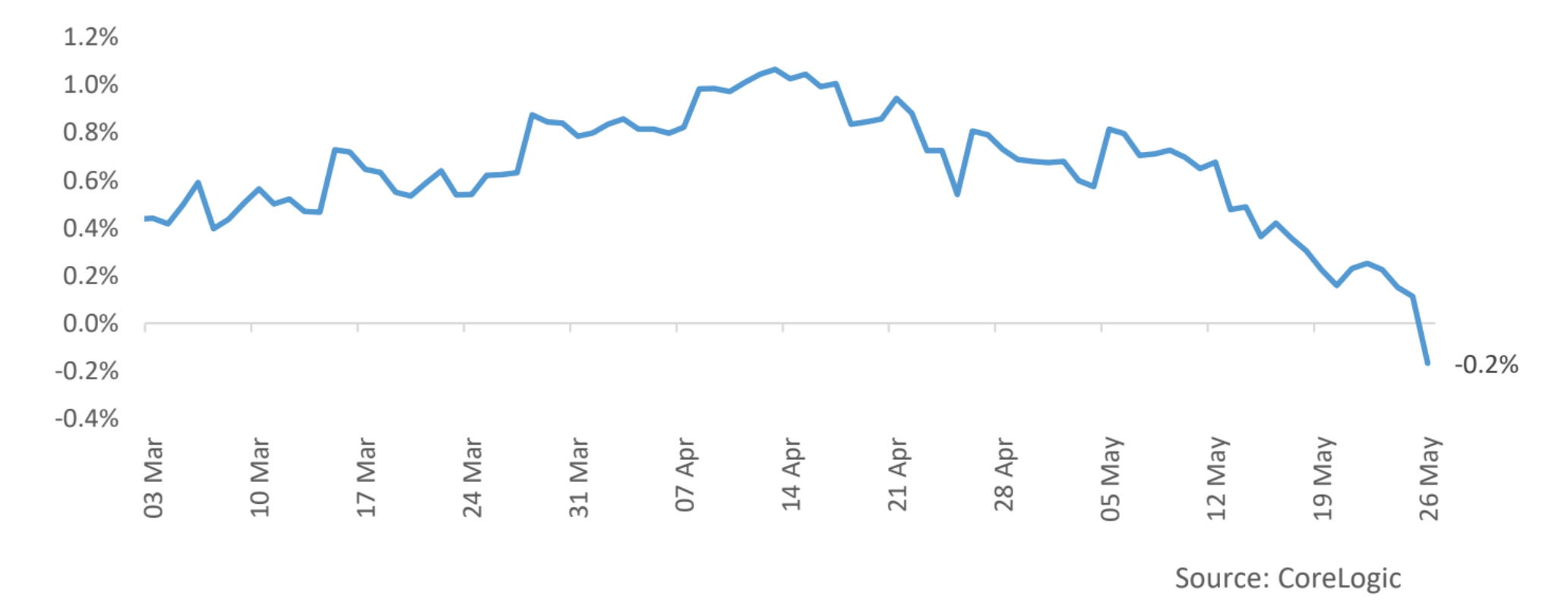

According to the 28-day rolling change in the daily hedonic index, Perth dwelling values have started to fall again.

However, value falls have been mild at -0.2 per cent.

So far, Melbourne has seen the largest decline in property values in the wake of Covid-19, but even in Melbourne the change is less than 1 per cent.

Rolling 28-day growth rate - Perth dwellings

Total listings count, 28 days to May 24 - Perth

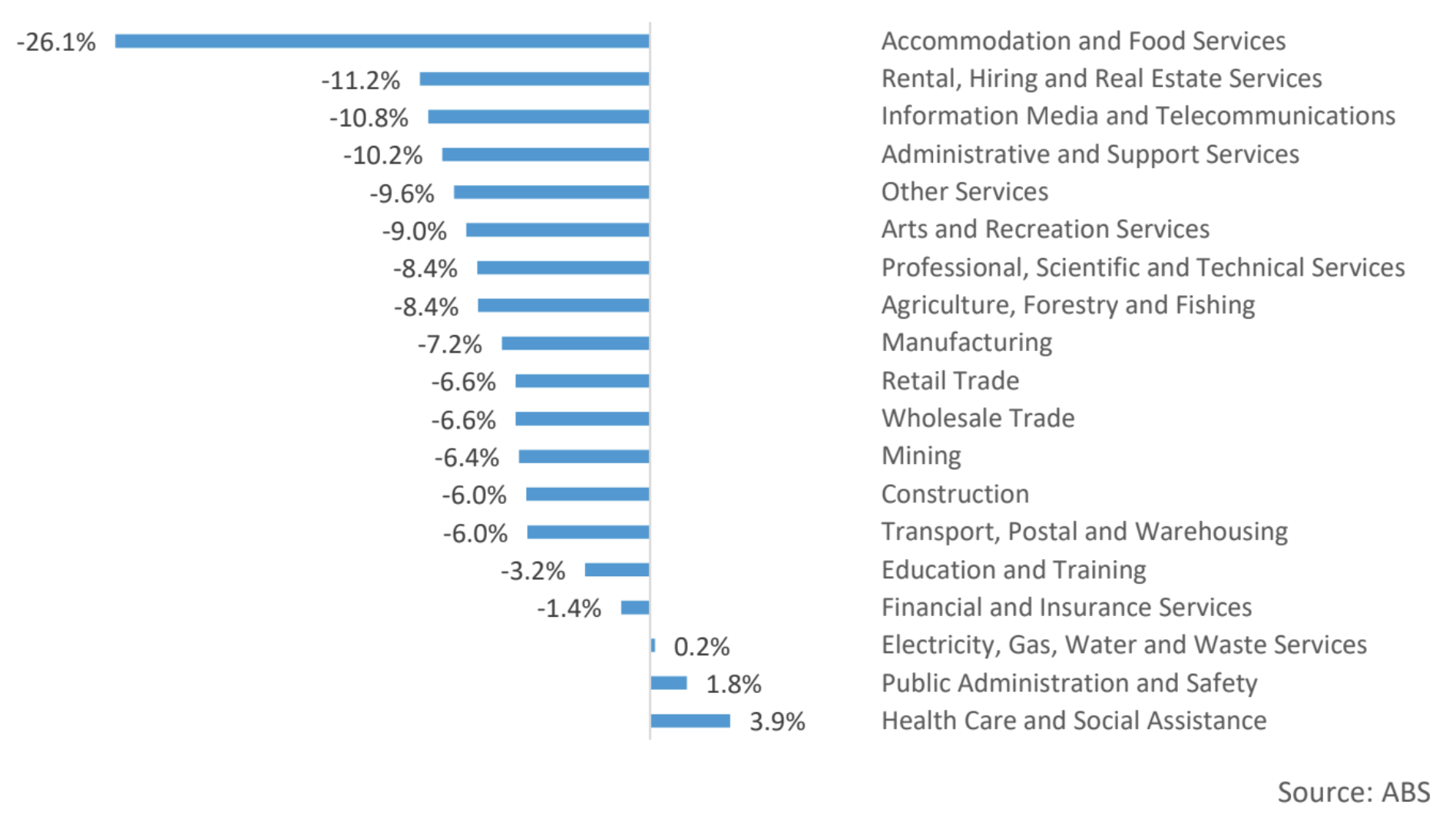

Weekly payroll data from the ABS, which provides an early preview of labour force conditions, shows job losses across WA have been slightly less severe than that across the rest of the country.

The decline in payroll jobs across the state was 5.8 per cent between the 14th of March and 2nd of May, as opposed to 7.3 per cent Australia wide.

Perth has less exposure to industry sectors that have been heavily impacted by Covid-19, with 8.6 per cent of the local workforce employed with the accommodation and food services and arts and recreation services sectors, compared with 9.1 per cent nationally.

Despite heightened economic uncertainty, consumer sentiment levels have been improving.

This is in line with a flattening of the curve and relaxation in social distancing policies, especially those specific to housing, new listing numbers are trending higher from their record lows.

Importantly, total listing numbers haven’t trended higher and are at the lowest level in ten years for this time of the year.

The trend towards a rise in new listings and consistently low total listings implies newly listed stock is being absorbed quickly by the market.

As of late May, total listings were down 34.7 per cent on where they were at the equivalent period in 2019.

Total listings across Perth counted in the 28 days to May 24th were just 13,962.

Though this is a continued headwind to the real estate sector, it may be preserving stability in dwelling values.

Change in payroll jobs between 14 March and 2 May - Western Australia

What was once a drag on property could be a source of market stability

The strong link between mining and prosperity across WA created boom and bust conditions between 2011 and 2019.

This extended to the property market. As mining investment declined significantly following a steel glut in China, job losses and resident departures across the state have left values in a downswing for years.

According to industry reporting, 2020 was the year mining investment would move through a trough, creating more jobs, and subsequent housing demand across WA.

In fact, we were already seeing improving labour market and demographic trends through late 2019 and early 2020.

The past few weeks have seen an increasingly optimistic outlook for the mining sector because of a recovery in the Chinese economy.

Some high frequency indicators such as coal consumption, traffic congestion and home sales suggest economic activity across China is at 90 per cent of where it was pre-Covid-19.

Unlike recent tensions over trade in beef and barley, China is actually working to reduce barriers to iron ore imports, which is a major source of revenue for WA mining.

The reason for rising iron ore demand is that Chinese steel producers expect a rise in government stimulus and infrastructure to spur production (which uses iron ore as an input).

This has contributed to a relatively strong rise in the value of iron ore and plans from some of Australia’s largest miners to boost production.

Even without the relatively strong position of mining export commodities, work on mine sites may have been buoyed by long-term contracts and the relatively high liquidity of mining companies.

The mining sector has not been completely untouched by Covid-19.

Some operations have been suspended, or capacity has been reduced in an effort to reduce the threat of infection at work sites.

This is reflected in mining sector payroll job losses across WA, of 6.4 per cent between the 14th of March and the 2nd of May.

However, mining companies remain optimistic. BHP signalled steel production over 2020 may even be slightly higher than in 2019 if a second outbreak of Covid-19 could be avoided.

Renewed vitality in the mining sector, and the subsequent boost to economic activity, is likely to provide some insulation in demand for the Perth property market.

This would make the impending downturn less severe than it may otherwise have been.

Another key factor that should support housing demand across Perth is the sheer affordability of housing.

At the end of April 2020, the median value of a house was recorded at just over $465,000 which was the lowest of any capital city.

The blend of affordable housing options and the expectation for more resilient economic conditions is a good recipe for Perth’s housing market to outperform.