The Reality of Build to Rent in Australia

The build-to-rent property model is increasingly garnering interest from property developers across the country.

Developers such as Grocon, Lendlease and Mirvac are all looking at implementing the model in Australia.

Prooperty finance experts Development Finance Partners have investigated the build-to-rent model in the context of Australia’s financial systems and taxations structures.

The build-to-rent model is increasingly gaining popularity in the US and elsewhere internationally, however in Australia developers are faced with some unique hurdles to implement the model In Australia successfully.

There are some key challenges that the Australian market faces when it comes to successful build to rent development.

There are significant differences when it comes to international markets and Australia

Build-to-rent's financial success in the US is made possible partly because of the financial system in the US, particularly the banking and debt systems.

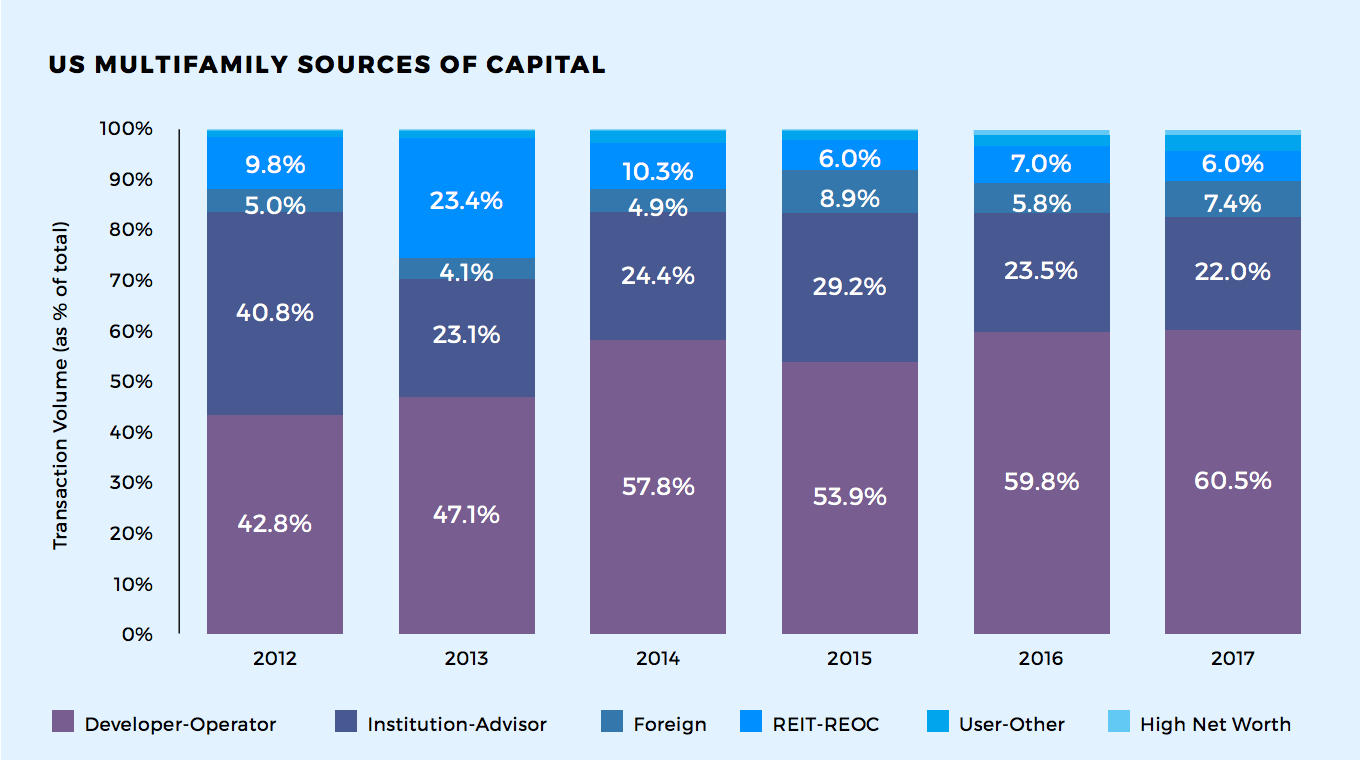

The market in the US is primarily driven by private capital.

The US build-to-rent market has also delivered projects aimed at capturing tenants across all income levels.

In the UK, build-to-rent has also started to thrive. Taxation laws have been adjusted which has actively incentivised the market.

These tax changes are shaping the market and preparing it for growth. The build-to-rent sector is proving instrumental in providing affordable housing options in the UK.

Comparatively, in Australia, the current market conditions mean that a large-scale build-to-rent model will only work if it caters primarily to high-level rentals.

Our conservative, stringent and regulated banking sector also does not have the evidence of the model working yet in Australia to support funding this type of asset.

Additionally, Australia doesn't have the low rental supply that has driven success in other International markets.

The taxation landscape for build-to-rent assets is also currently unfavourable to institutional investors that are looking at investing in this asset class, creating a lack of patient, low-cost capital for developers.

Recent announcements now classify build-to-rent assets as Management Investment Trust Assets

Prior to 2017, build-to-rent assets could be accessed through a Managed Investment Trust (MIT), where institutional investors would be taxed at 15 per cent of profits – allowing institutional capital to compete on a local level.

However, the Australian Taxation Office has recently suggested that build-to-rent assets (and residential property in general) are no longer allowable within a MIT structure.

According to JLL research, this decision was based off the fact that a build-to-rent investment is not primarily for the income generated, but instead it is reliant on capital growth.

The only exception to this ruling is affordable housing, which is still allowable within a MIT structure.

Up until very recently this meant that institutional investors investing in build-to-rent assets would be taxed at the company rate between 27.5 per cent and 30 per cent instead of being taxed at 15 per cent under an MIT ownership structure.

On 26 July this year Scott Morrison announced long awaited reforms to the legislative framework that govern how build to rent projects are treated by the Federal Government from a Managed Investment Trust “MIT” perspective.

The new rules will provide certainty to local and international institutional investors who wish to invest in both the development and long-term hold of build to rent assets.

The new rules will also allow MIT’s to staple together active asset investments (development assets) with the completed passive build to rent assets under the one ownership structure with each part of the business taxed appropriately.

This move has been welcomed by the property industry as it provides even greater certainty to MIT investors which will help encourage the growth of this embryonic asset class in Australia.

Purpose Built Student Accommodation as an example

Purpose Built Student Accommodation (PBSA) has begun to thrive in the past 5-10 years in Australia. The model is very similar to build-to-rent; however, there’s fundamental similarities and differences between the two asset classes that both investors and developers need to understand.

While the PBSA and student accommodation, in general, is the closest comparison to build-to-rent in Australia, investors can’t overlook the clear differences between providing accommodation for students and creating long-term rentals for the Australian population in general.

Both rely on different market factors, including population growth, rental demand and investment yields.

The future of the sector

Despite the challenges the Australian market presents, the asset class could still grow organically over the next 5-10 years.

Some developers are using build-to-rent as a means to bring their projects online in current market conditions (as a way to hold onto stock as pre-sales become increasingly difficult).

This could create a flow-on effect of slow and organic growth for build-to-rent. However, it is unlikely that it will ever reach the heights it has in international markets until market conditions become more favourable in Australia.

An alternative to build-to-rent

There are alternatives to the build-to-rent model that developers should still be looking at.

Specifically developments based on a build-to-sell model while retaining some stock within a development specifically for a build-to-rent purpose.

Developers can then sell down debt with pre-sales while holding their profit in a balance of stock.

Want to know more? Download the comprehensive whitepaper

This article is a summary of an in-depth 18-page whitepaper for download at the Development Finance Partners website.

Access the whitepaper for an in-depth analysis on the differences between Australian and international markets, how student accommodation compares, current case studies the feasibility of build-to-rent as well as detailed funding tables and models.

Click here to download the whitepaper.

The Urban Developer is proud to partner with Development Finance Partners to deliver this article to you. In doing so, we can continue to publish our free daily news, information, insights and opinion to you, our valued readers.