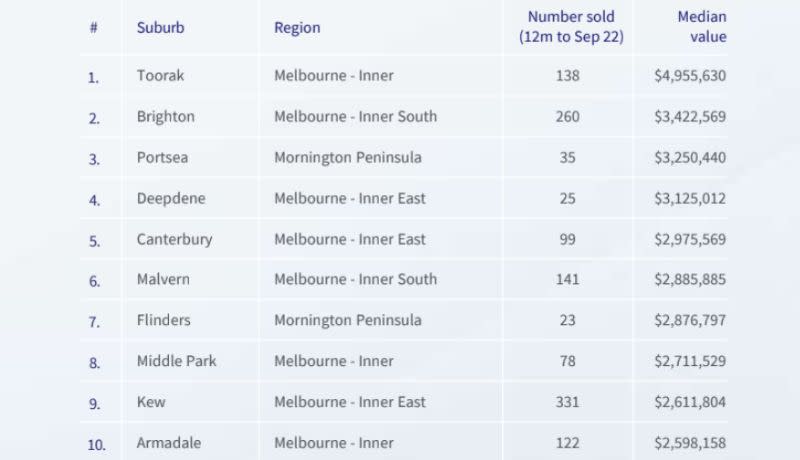

Toorak Keeps Crown as Melbourne’s Priciest Suburb

Toorak—the inner Melbourne suburb long associated with wealth and privilege—has lived up to its reputation with an annual report showing its tree-lined streets continue to have the highest average property values in the capital.

CoreLogic’s Best of the Best Report shows 138 houses were sold in Toorak during the year, with an average property value of $4,955,630.

Portsea, on the Mornington Peninsula, and Deepdene in Melbourne’s inner east were the only other suburbs with average suburban prices above $3 million.

In fact, three of the top five most expensive house sales in Melbourne were in Toorak.

Top of the list was a five-bedroom, four-bathroom house with three parking spaces on 1995sq m, sold in February this year by Deague Group chief executive William Deague for $38.5 million.

But at that price, the property at 802 Orrong Road, in Toorak was only the fourth most expensive house sold in Australia. The top three were all in Sydney, with the most expensive—a Vaucluse trophy home with seven bedrooms, three kitchens, two internal lifts and a 20-car garage—selling for a whopping $63 million.

Vaucluse remains the most expensive neighbourhood in the country with an average selling price of $7.94 million, closely followed by Bellevue Hill, Rose Bay and Dover Heights. Nine of the 10 most expensive suburbs are in Sydney.

Best of the best 2022: Victoria

^ Source: Corelogic

Corelogic says successive interest rate rises, surging inflation, low consumer sentiment and deteriorating affordability drove a shift in Australia’s housing market throughout the year.

CoreLogic head of research Eliza Owen pointed to two distinct capital growth trends in 2022. The first, she said, was that not all housing markets were uniformly impacted by market headwinds.

“More expensive markets tended to see sharper declines, while the more affordable segment of the market where buyers typically do not have to extend themselves as much to buy into, saw greater resilience to increases in interest rates,” she said.

“The second trend is the pace of decline has been slowing on a broad basis since September. While this may be seen as a positive by some, there is still risk of the decline re-accelerating in the year ahead.”

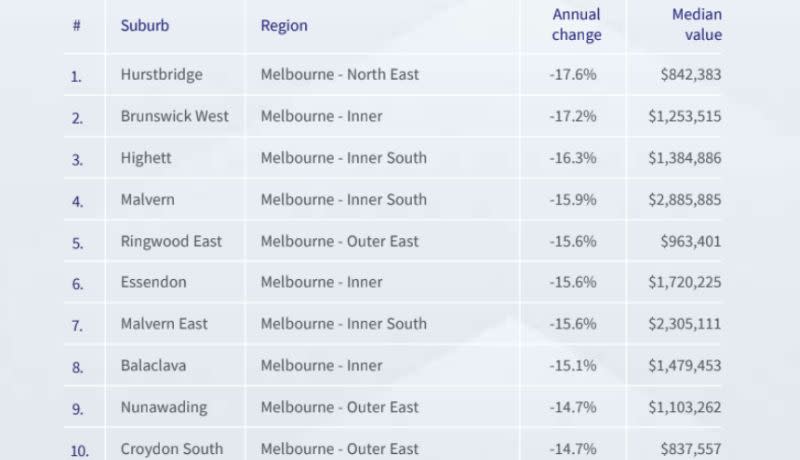

Most affordable suburbs 2022: Victoria

^ Source: Corelogic

Over the year to November, national housing values fell 3.2 per cent, driven by an annual decline in capital city dwelling values of 5.2 per cent, while regional dwelling values rose by 3.3 per cent over the same period.

The estimated total value of residential real estate decreased from $9.6 trillion in December 2021 to $9.4 trillion in November 2022. Estimated annual sales declined 13.3 per cent compared to the year to November 2021, with about 535,000 homes sold nationally.

Greater Melbourne’s strongest growth in housing values was in Melton, which rose by 4.1 per cent, followed by Darley (up 3.6 per cent), Brookfield (also up 3.6 per cent) and Melton South (up 3.2 per cent). Based on average sales prices, Melton is also the most affordable suburb.

The biggest decline in housing prices was in Hurstbridge in Melbourne’s north-east.

In regional Victoria, the most expensive towns are along the Great Ocean Road, and include Lorne, Anglesea, Jan Juc and Torquay.

Elsewhere, and across the country, the cheapest place to buy a house is Kambalda East in Western Australia. The biggest growth in a housing market was in Bingara, NSW, which recorded a 36.2 per cent jump. The biggest drop was Narrabeen in Sydney, falling 26.8 per cent.

“Although declines have been slowing, suggesting we may have moved past the peak home value declines, further rate rises are anticipated in the early months of 2023, which could cause the rate of decline to pick up speed once more,” Owen said.

“With expectations that the bulk of the rate tightening cycle occurred in 2022, housing value declines could find a floor in the new year.

“However, the extent of the floor in values could be further weighed down by mortgage serviceability risks, particularly for those rolling out of record-low fixed mortgage rates through the second half of year.”