What Are the Driving Forces Behind the Industrial Real Estate Boom?

Industrial real estate is currently the most common type of commercial transaction across Australia.

According to a large sample of transaction data from CoreLogic, the industrial sector represented 41 per cent of commercial sales in the year to April 2018.

The construction of new industrial real estate, with the exception of Amazon’s “fulfilment centre” in Dandenong South, is largely overshadowed by news of large scale transport infrastructure, major dwelling projects and towering office buildings.

With industrial real estate in such high demand, it is worth noting what kind of industrial real estate is being built, where it is located, and some of the driving forces behind these constructions.

Using CoreLogic project data, it is estimated that as of the end of April, there are 9,077 projects under construction. Of these, approximately 7 per cent are industrial builds.

For the purpose of identifying trends in retail builds that mirror industrial real estate, this data snapshot also includes showrooms and bulky goods stores in industrial real estate – e.g., home improvement stores, furniture stores and car showrooms.

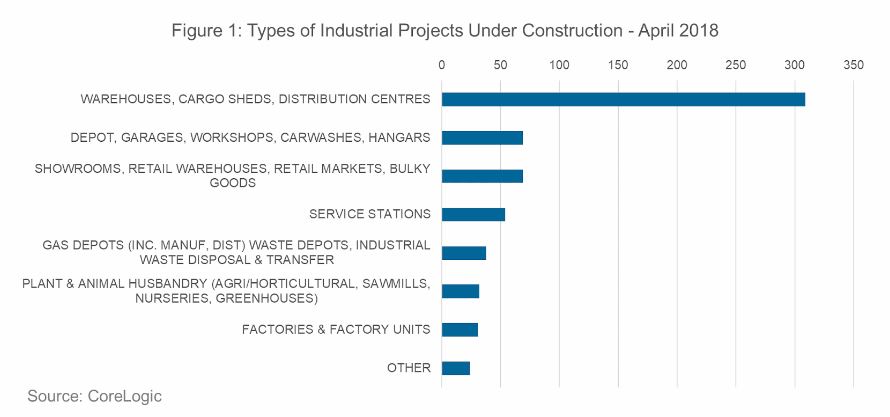

Types of industrial projects under construction

By far the most common types of industrial builds currently under way are warehouses, to be used for the storage and distribution of goods.

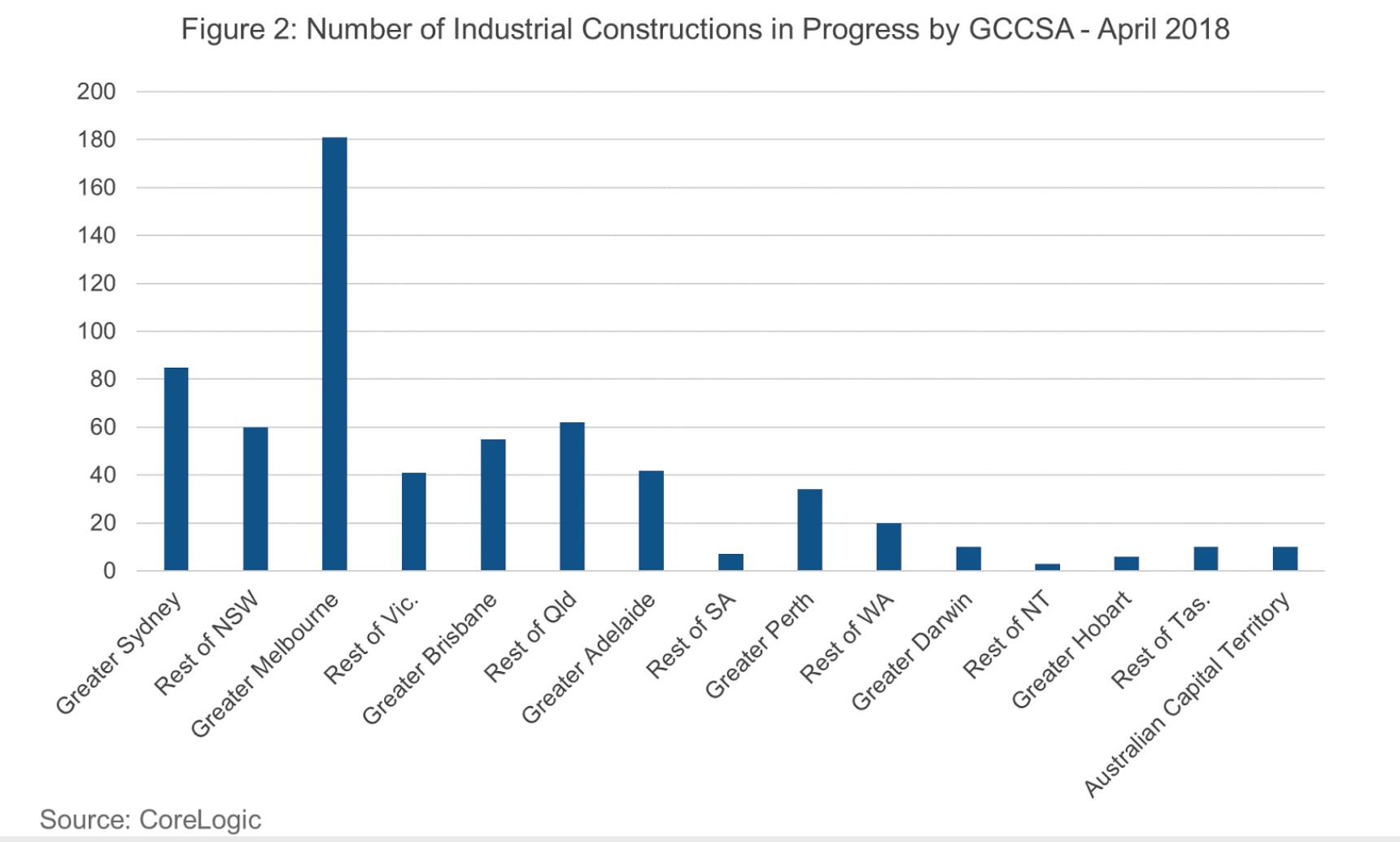

Location of industrial projects currently under construction

The highest concentration of industrial developments is occurring across greater Melbourne – which has historically been the case. The Greater Capital City Statistical Area (GCCSA) region contains 28.9 per cent of the industrial builds across Australia (181 projects), 75 per cent of which were warehouses or distribution centres.

Within Melbourne, the highest frequency location of industrial development was in greater Dandenong, where 15 projects are estimated to be taking place. The well-established industrial area is endowed with proximity to arterial roads, the South Gippsland Highway, the Monash Freeway and Eastlink.

Related reading: Motorway Access Dictates Value of Industrial Assets

Is increased household consumption spurring growth in industrial real estate?

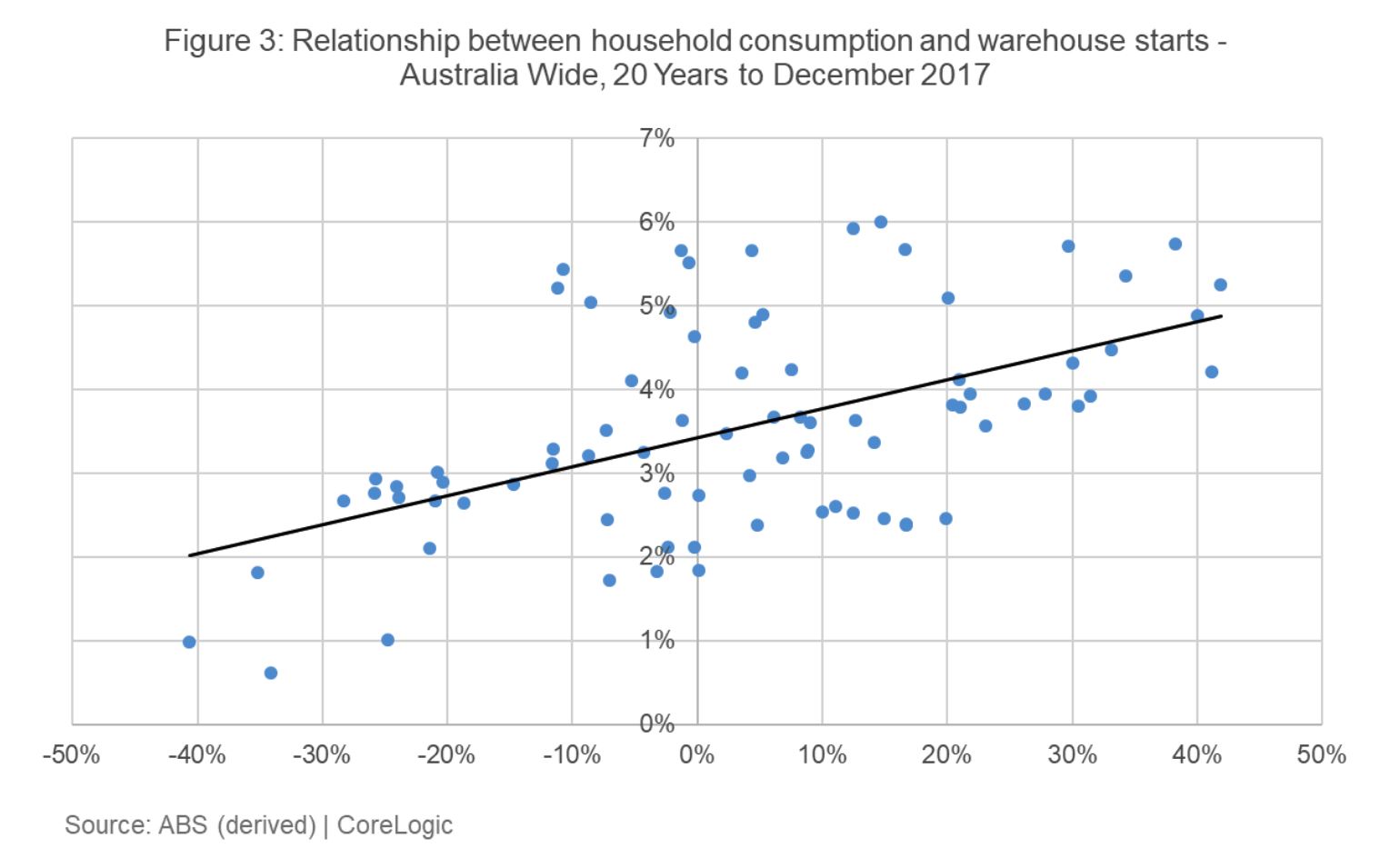

Given the nature of industrial builds as hosting the storage and distribution of goods, rather than a growth in manufacturing, it is quite possible that the rise of industrial real estate may be indicated by increased household consumption, particularly through online channels.

When comparing annual growth in household consumption to annual growth in starts of warehousing (Figure 3), there is indeed a moderately positive relationship between the two variables (0.53).

The correlation becomes stronger when a quarter of lag is taken out of taken out of the data (0.57).

Admittedly, the correlation may be due to other forces increasing household consumption, such as increased migration or exporting, which would also place demand on commercial real estate.

Gaining a more detailed view of the type of construction under way provides a better chance of identifying leading indicators in construction.

Related reading: Federal Budget 2018: Infrastructure, Investment and Build to Rent

Household consumption experienced a relatively subdued period of growth following the end of the mining boom in 2012.

However, some indicators suggest household consumption growth may strengthen, provided there are no major demand shocks to the Australian economy.

Full time employment growth was 3.1 per cent in the year to March 2018, well above the historical average of 1.9 per cent. Growth in the wage price index has also recovered from a historic low of 1.9 per cent at the June 2017 quarter, to 2.1 per cent at the December quarter.

This could further support growth in retail trade, and the growth of East Melbourne as a distribution hub, despite the disruption to traditional brick and mortar outlets across Australia.

The public sector also has a role to play in the development of new industrial real estate.

Interestingly, 85 of the industrial projects currently under construction (13.6%) are owned by various levels of government. These builds were largely transport depots, representing a spill over from infrastructure investment, and waste management facilities.