What Is Proptech?

The catch-all term, “Proptech”, is often more confusing than clarifying. You would be forgiven for thinking of a wave of trendy tech innovations such as drones, robots and gadgets.

Proptech, a portmanteau from “property technology”, is used to describe any technology for the real estate space.

These days, it is a common phrase recognised by real estate professionals to define property-specific innovation.

Proptech addresses fundamental questions of how users experience and extract value from real estate.

Whether it’s planning or construction, renting or buying, management or selling, the Proptech ecosystem is increasingly comprehensive—and competitive.

What is Proptech?

Proptech is reshaping Australia's $7.8 trillion real estate market—the largest asset class in the country—by ironing out an industry riddled with inefficiencies.

Technology companies identifying inefficiencies are now delivering tech-bound solutions—digitalising real estate in order to improve the work-life integration of its users by improving productivity and efficiency.

These advancements streamline age-old processes within the research, planning and construction phases, later stages of renting or purchasing real estate and the on-going managing and maintaining buildings, cutting out middle-parties where it makes sense to.

In essence, Proptech encompasses all building processes, removing onerous tasks, and supplements them with automated solutions.

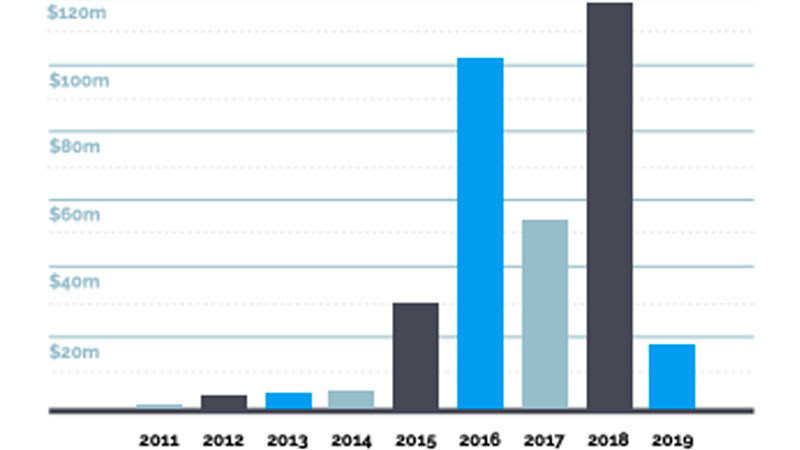

Australian Proptech Funding 2011-2019

The property revolution

As increasing sums of money are deployed into this every more mature space, investors are becoming ever more astute in their allocations, looking for the startups that will make a real difference to the industry and therefore, ultimately, their portfolios.

Real estate accounts for 13 per cent of global GDP, however, productivity and technological growth has been relatively slow compared to other industries with companies initially struggling to mobilise its technology strategy quickly enough to manage change.

Over recent years, a rapid rise in accelerators, incubators or innovation labs has seen Australia's Proptech community grow to more than 270 companies—a 428 per cent increase since 2013, according to the global proptech tracker Unissu.

According to a Deloitte, in the first six months of 2019, $20 billion was poured into real-estate tech startups by venture capitalists and private equity globally, which surpassed the $19 billion record for all of 2017.

According to Bob Courteau, chief executive of real estate software giant Altus Group, technology is set to continue to rapidly shape any given specialism within the real estate sector.

“The combination of new market entrants, new technologies and changing demographics have created disruptive models within real estate.”

“This presents new opportunities for organisations which rapidly embrace innovation and Proptech.”

Australia's Rent-Buy-Lease-Manage PropTech ecosystem

Big data and deep tech

It is estimated that the world will generate about 90 zettabytes of data over 2020—more than all data produced since the advent of computers.

Big data, which describes the large volume of both structured and unstructured data floating round the digital space, is being used in several ways to automate the onerous property industry processes.

Big data encompasses everything from blockchain, to machine learning, deep learning, the internet of things, social media and artificial intelligence.

With big data comes enhanced predictive analytics, or the capacity to use sophisticated computer algorithms that can predict market fluctuations.

However, access to data is probably still the single biggest struggle many technology providers in the Proptech space face, and data sharing principles are sorely needed especially in areas where the private and public realm intersect.

AI and machine learning

While these huge pools of real estate data are already being used by artificial intelligence programs to improve the customer experience through personalisation and predictive home evaluation over time, AI can further change the real estate game.

The ongoing adoption of AI and automation technologies has transformed the way people work and has rapidly distributed many industries, particularly real estate, finance and banking.

AI can help accurately predict which locations will be the most beneficial for developers to invest in, optimising market-level profitability and revenue and revenue as well as helping to identify optimised spatial layouts of new developments.

AI can also predict customer needs, target users and itemise results, navigate and drive CRM databases.

Cloud computing

Cloud computing has become the invisible backbone supporting much of our daily lives.

Cloud computing is the delivery of computing services—including servers, storage, databases, networking, software, analytics and intelligence—over the Internet.

The rising popularity of the cloud has gone hand-in-hand with that of 4G, and the soon-to-be-rolled-out 5G, broadband technology and of smartphones.

In order to drive better business relationships and collaborations, cloud technology has enabled a historically rigid industry to become mobile and flexible.

Thanks to cloud computing, stakeholders are able to access extensive databases on the go while through a streamlined user experience.

Robotics

Machines have been around for a long time, but they are rapidly becoming more sophisticated and able to undertake increasingly complex tasks.

Construction has now become a key focus for robotics investments in recent years, with names like Built, Toggle and Dusty beginning to roll out game-changing solutions.

Even Boston Dynamics, best known for its robot BigDog, is developing construction solutions, mounting sensors to the top of its Spot robots, with is listed as one of the primary use case for the commercialised version of the robot.

Perth-based technology company Fastbrick Robotics has been at the forefront of technological advancement and automation in the construction industry.

Last year, its Hadrian X robot built a three bedroom, two-bathroom home.

Virtual and augmented reality

Virtual reality, or subversive computer-generated environments, is rapidly changing the way users interact with the digital world.

The boundaries between virtual and physical reality are quickly fading through these new digital experiences, with technology providers able to showcase designs and property with stimulated “walk throughs”.

Augmented reality, which has been traditionally linked to the gaming and entertainment industry, has also become particularly beneficial for off-plan developments.

Unlike virtual reality, which requires an advanced headset, most AR applications work on mobile devices such as smartphones and tablets, with smart glasses and other hands-free devices increasingly becoming more prevalent.